DIRECTV 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

PART II Information regarding compensation plans under which our equity securities

may be issued is included in Item 12 through incorporation by reference to our

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, Proxy Statement for the Annual Meeting of Stockholders scheduled to be held on

RELATED STOCKHOLDER MATTERS AND ISSUER May 3, 2012.

PURCHASES OF EQUITY SECURITIES

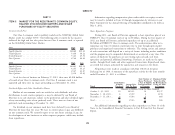

Common Stock Price Share Repurchase Programs

Our Class A common stock is publicly traded on the NASDAQ Global Select During 2011, our Board of Directors approved a share repurchase plan of our

Market under the symbol ‘‘DTV.’’ The following table sets forth for the quarters DIRECTV Class A common stock of up to $6 billion. During the first quarter of

indicated the high and low sales prices for our Class A common stock, as reported 2012, our Board of Directors authorized repurchases of up to an additional

on the NASDAQ Global Select Market. $6 billion of DIRECTV Class A common stock. The authorizations allow us to

repurchase our Class A common stock from time to time through open market

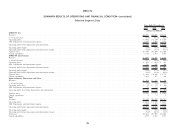

2011 High Low purchases and negotiated transactions or otherwise. The timing, nature and amount

Fourth Quarter .................................. $48.60 $39.82 of such transactions will depend on a variety of factors, including market conditions

Third Quarter ................................... 53.40 40.22 and the program may be suspended, discontinued or accelerated at any time. The

Second Quarter .................................. 51.23 45.52 sources of funds for the purchases are our existing cash on hand, cash from

First Quarter .................................... 47.40 40.20 operations and potential additional borrowings. Purchases are made on the open

market, through block trades and other negotiated transactions. Repurchased shares

2010 High Low

are retired but remain authorized for registration and issuance in the future.

Fourth Quarter .................................. $44.61 $39.12

Third Quarter ................................... 42.61 33.25 All purchases were made in accordance with Rule 10b-18 of Securities

Second Quarter .................................. 39.87 33.87 Exchange Act of 1934. A summary of the repurchase activity for the three months

First Quarter .................................... 35.18 29.83 ended December 31, 2011 is as follows:

As of the close of business on February 17, 2012, there were 69,818 holders Total Number of Maximum Dollar

of record of our Class A common stock. Our Class B common stock is not Shares Purchased Value that May

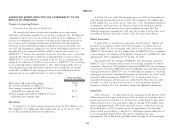

Total Number as Part of Publicly Yet Be Purchased

registered and there were no shares outstanding as of December 31, 2011. of Shares Average Price Announced Plans Under the Plans

Period Purchased Paid Per Share or Programs or Programs

Dividend Rights and Other Stockholder Matters (Amounts in Millions, Except Per Share Amounts)

October 1 - 31, 2011 . . . 10 $45.22 10 $1,517

Holders of our common stock are entitled to such dividends and other November 1 - 30, 2011 . . 8 45.99 8 1,150

distributions in cash, stock or property as may be declared by our Board of December 1 - 31, 2011 . . 6 45.04 6 866

Directors in its sole discretion, subject to the preferential and other dividend rights

Total .............. 24 45.43 24 866

of any outstanding series of our preferred stock. There were no shares of our

preferred stock outstanding at December 31, 2011.

For additional information regarding our share repurchases see Note 14 of the

No dividends on our common stock have been declared by our Board of Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual

Directors for more than five years. We have no current plans to pay any dividends Report.

on our common stock. We currently expect to use our future earnings, if any, for

***

the development of our businesses or other corporate purposes, which may include

share repurchases.

29