DIRECTV 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

resolution of examinations with tax authorities. We do not expect a significant judicial deposit in Brazil for the ECAD matter discussed in Part I, Item 3 of this

payment related to these obligations within the next twelve months. Annual Report and insurance deductibles.

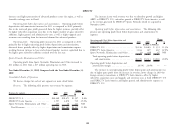

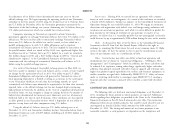

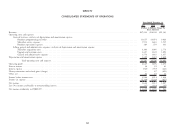

Payments Due By Period CONTINGENCIES

Less than More than

Contractual Obligations Total 1 year 1-3 years 3-5 years 5 years For a discussion of ‘‘Contingencies’’, see Note 20 of the Notes to the

(Dollars in Millions) Consolidated Financial Statements in Part II, Item 8 of this Annual Report, which

Long-term debt obligations (Note 10) (a) . $21,781 $ 704 $2,408 $6,100 $12,569 we incorporate herein by reference.

Purchase obligations (Note 20) (b) ..... 8,258 2,409 3,509 1,154 1,186

Operating lease obligations (Note 20) (c) . 846 73 143 137 493 CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

Capital lease obligations (Notes 12

and 20) (d) .................. 1,551 95 182 254 1,020 For a discussion of ‘‘Certain Relationships and Related-Party Transactions,’’ see

Note 18 of the Notes to the Consolidated Financial Statements in Part II, Item 8

Total ........................ $32,436 $3,281 $6,242 $7,645 $15,268

of this Annual Report, which we incorporate herein by reference.

(a) Long-term debt obligations include interest calculated based on the rates in effect at CRITICAL ACCOUNTING ESTIMATES

December 31, 2011, however, the obligations do not reflect potential prepayments

required under indentures. The preparation of the consolidated financial statements in conformity with

accounting principles generally accepted in the United States requires management

(b) Purchase obligations consist primarily of broadcast programming commitments, regional to make estimates, judgments and assumptions that affect amounts reported.

professional team rights agreements, service contract commitments and satellite

Management bases its estimates, judgments and assumptions on historical

construction and launch contracts. Broadcast programming commitments include

guaranteed minimum contractual commitments that are typically based on a flat fee or experience and on various other factors that are believed to be reasonable under the

a minimum number of required subscribers subscribing to the related programming. circumstances. Due to the inherent uncertainty involved in making estimates, actual

Actual payments may exceed the minimum payment requirements if the actual number results reported for future periods may be affected by changes in those estimates.

of subscribers subscribing to the related programming exceeds the minimum amounts. The following represents what we believe are the critical accounting policies that

Service contract commitments include minimum commitments for the purchase of may involve a higher degree of estimation, judgment and complexity. Management

services that have been outsourced to third parties, such as billing services, telemetry, has discussed the development and selection of these critical accounting estimates

tracking and control services and broadcast center services. In most cases, actual with the Audit Committee of our Board of Directors, and the Audit Committee

payments, which are typically based on volume, usually exceed these minimum has reviewed our disclosures relating to them, which are presented below. For a

amounts. summary of our significant accounting policies, including those discussed below, see

(c) Certain of the operating leases contain variable escalation clauses and renewal or Note 2 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of

purchase options, which we do not consider in the amounts disclosed. this Annual Report.

(d) Capital lease obligations includes obligations related to the ISDLA-1 and ISDLA-2 Income Taxes. We must make certain estimates and judgments in determining

satellites discussed in Note 20 of the Notes to the Consolidated Financial Statements in provisions for income taxes. These estimates and judgments occur in the calculation

Part II, Item 8 of this Annual Report. of tax credits, tax benefits and deductions, and in the calculation of certain tax

assets and liabilities, which arise from differences in the timing of recognition of

OFF-BALANCE SHEET ARRANGEMENTS revenue and expense for tax and financial statement purposes.

As of December 31, 2011, we were contingently liable under standby letters of

credit and bonds in the aggregate amount of $136 million, primarily related to a

51