DIRECTV 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Estimated Future Benefit Payments 50,000,000 shares authorized. As of December 31, 2011, there were no shares

outstanding of the Class B common stock or preferred stock.

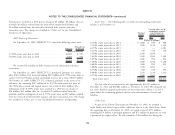

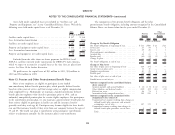

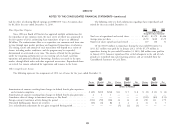

We expect the following benefit payments, which reflect expected future

service, as appropriate, to be paid by the plans during the years ending Following completion of the Liberty Transaction in November 2009,

December 31: DIRECTV had two classes of common stock outstanding: Class A common stock

and Class B common stock. As discussed in more detail below, in April 2010, we

Estimated Future Benefit entered into an agreement with the Malones, under which they exchanged

Payments 21.8 million shares of Class B common stock, which was all of the outstanding

Other

Pension Postretirement Class B shares, for Class A common stock. The DIRECTV Class A common stock

Benefits Benefits is entitled to one vote per share and trades on the NASDAQ Global Select Market,

(Dollars in Millions) or NASDAQ, under the ticker ‘‘DTV’’. DIRECTV Group common stock has been

2012 .................................... $ 44 $ 2 delisted and no longer trades on NASDAQ. The DIRECTV Class B common

2013 .................................... 47 2 stock was entitled to fifteen votes per common share and was not listed on any

2014 .................................... 49 2 stock exchange or automated dealer quotation system.

2015 .................................... 45 2

2016 .................................... 47 2 Malone Transaction

2017-2021 ................................ 260 11

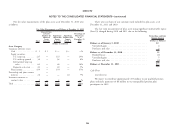

In April 2010, we entered into an agreement with the Malones, under which

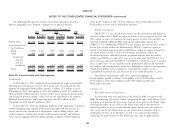

We maintain 401(k) plans for qualified employees. We match a portion of our they exchanged 21.8 million shares of high-vote Class B common stock, which was

employee contributions and our match amounted to $28 million in 2011, all of the outstanding Class B shares, for 26.5 million shares of Class A common

$23 million in 2010 and $16 million in 2009. stock, resulting in the reduction of the Malones’ voting interest in DIRECTV from

approximately 24% to approximately 3%. The number of Class A shares issued was

We have disclosed certain amounts associated with estimated future

determined as follows: one share of Class A common stock for each share of

postretirement benefits other than pensions and characterized such amounts as

Class B common stock held, plus an additional number of Class A shares with a

‘‘other postretirement benefit obligation.’’ Notwithstanding the recording of such

fair value of $160 million based on the then current market price of the Class A

amounts and the use of these terms, we do not admit or otherwise acknowledge

common stock. We accounted for the common stock exchange pursuant to

that such amounts or existing postretirement benefit plans of our company (other

accounting standards for induced conversions, as described in Note 15 of the Notes

than pensions) represent legally enforceable liabilities of us.

to the Consolidated Financial Statements. There have been no Class B shares

outstanding since the completion of the Malone Transaction on June 16, 2010.

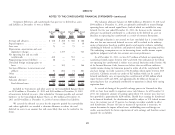

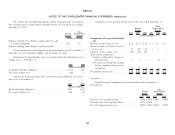

Note 14: Stockholders’ Equity

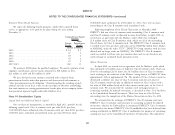

We accounted for the exchange of DIRECTV Class B common stock into

Capital Stock and Additional Paid-In Capital DIRECTV Class A common stock pursuant to accounting standards for induced

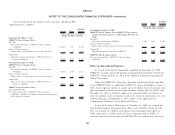

Our certificate of incorporation, as amended in April 2011, provides for the conversions, whereby the $160 million in incremental DIRECTV Class A common

following capital stock: Class A common stock, par value $0.01 per share, stock issued to the former DIRECTV Class B stockholders has been deducted from

3,947,000,000 shares authorized; Class B common stock, par value $0.01 per share, earnings attributable to DIRECTV Class A stockholders for purposes of calculating

3,000,000 shares authorized; and preferred stock, par value $0.01 per share, earnings per share in the Consolidated Statements of Operations. This adjustment

87