DIRECTV 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

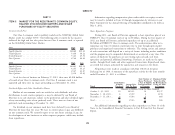

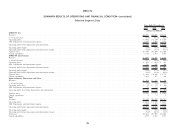

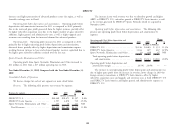

Companies operating in Venezuela are required to obtain Venezuelan information regarding shares repurchased and retired for the years ended

government approval to exchange bolivars fuerte into U.S. dollars at the official December 31:

rate. We have not been able to consistently exchange Venezuelan bolivars fuerte into 2011 2010 2009

U.S. dollars at the official rate and as a result, we have relied on a parallel exchange (Amounts in Millions, Except

process to settle U.S. dollar obligations and to repatriate accumulated cash balances Per Share Amounts)

prior to its close. The rates implied by transactions in the parallel market, which Total cost of repurchased and retired shares ....... $5,455 $5,179 $1,696

was closed in May, 2010, were significantly higher than the official rate (6 to 7 Average price per share ..................... 45.78 38.20 23.79

bolivars fuerte per U.S. dollar). As a result, we recorded a $22 million charge in Number of shares repurchased and retired ........ 119 136 71

2010 and a $213 million charge in 2009 in ‘‘General and administrative expenses’’

in the Consolidated Statements of Operations in connection with the exchange of EXECUTIVE OVERVIEW AND OUTLOOK

accumulated Venezuelan cash balances to U.S. dollars using the parallel exchange

The United States and other countries in which we operate are continuing to

process.

undergo a period of economic uncertainty. As discussed in ‘‘Competition’’ in

As a result of the closing of the parallel exchange process in May 2010, we Item 1, in addition to cable and satellite system operators, we are experiencing

have been unable to repatriate excess cash balances and we therefore realized no increasing competition from telcos and other emerging digital media distribution

charges for the repatriation of cash in 2011. Our Venezuelan subsidiary had providers. Please refer to ‘‘Risk Factors’’ in Item 1A for a further discussion of risks

Venezuelan bolivar fuerte denominated cash of $401 million at December 31, which may affect forecasted results of our business generally.

2011, as compared to $169 million at December 31, 2010, based on the official

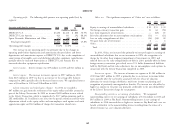

exchange rate. DIRECTV U.S. DIRECTV U.S. faces key challenges related to weak

macroeconomic conditions that continue to put pressure on the U.S. consumer, the

See ‘‘Liquidity and Capital Resources’’ below for additional information. rapid advance of technology that provides consumers with more options both in

and out of the home and a maturing industry that is increasingly competitive. In

Other Than Temporary Impairment addition, we face challenges as programming content providers seek increased rates

In 2009, we recognized a $45 million charge for the other than temporary for their content. We are pursuing strategic priorities for the DIRECTV U.S.

impairment of certain of our investments in ‘‘Other, net’’ in the Consolidated business that we believe will result in an increase in revenue and operating profit

Statements of Operations. before depreciation and amortization growth over the next three years: focusing on

enhancing the overall customer experience, strategically managing the impact of

Share Repurchase Program rising programming costs to maintain strong margins and continuing to grow three

key incremental revenue streams: DIRECTV Cinema, commercial and local

Since 2006 our Board of Directors approved multiple authorizations for the advertising.

repurchase of our common stock. As of December 31, 2011, we had approximately

$866 million remaining under the authorization given by the Board of Directors in Our revenue growth in DIRECTV U.S. has been generated by increases in the

2011. In February 2012 our Board of Directors authorized up to an additional total number of subscribers and in ARPU. In 2012, we expect revenue to grow in

$6 billion for repurchases of our common stock. The following table sets forth the mid-single digit percentage range driven primarily by ARPU growth. ARPU

growth is expected to be generated mainly by price increases, as well as growth in

advanced product services, pay per view, commercial and advertising sales. We also

expect to support ARPU growth by limiting promotional offers.

38