DIRECTV 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

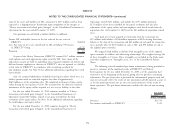

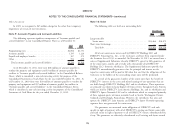

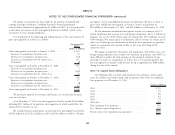

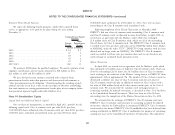

Our income tax expense consisted of the following for the years ended Our income tax expense was different than the amount computed using the

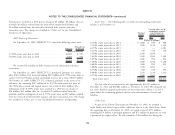

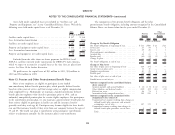

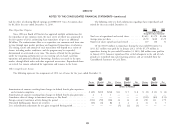

December 31: U.S. federal statutory income tax rate for the reasons set forth in the following

table for the years ended December 31:

2011 2010 2009

(Dollars in Millions) 2011 2010 2009

Current tax expense: (Dollars in Millions)

U.S. federal ............................ $ 631 $ 391 $308 Expected expense at U.S. federal statutory income tax

Foreign ............................... 253 227 97 rate ................................. $1,394 $1,230 $642

State and local .......................... 107 20 63 U.S. state and local income tax expense, net of federal

benefit ............................... 75 106 77

Total ............................... 991 638 468 Liberty Transaction charges not recoverable ......... 1 4 127

Deferred tax expense (benefit): Change in unrecognized tax benefits ............. 40 (40) 21

U.S. federal ............................ 284 596 309 Noncontrolling interests in partnership earnings and

Foreign ............................... 59 (118) (1) taxes................................. 2 (44) (30)

State and local .......................... 14 86 51 Foreign taxes, net of federal tax benefits ........... (82) 9 (31)

Total ............................... 357 564 359 Change in valuation allowance ................. (40) (32) 33

Multistate tax planning ...................... — (20) —

Total income tax expense ................. $1,348 $1,202 $827 Tax credits .............................. (47) (7) (3)

Other ................................. 5 (4) (9)

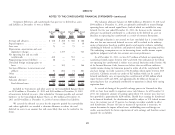

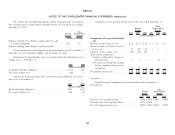

‘‘Income before income taxes’’ in the Consolidated Statements of Operations

included the following components for the years ended December 31: Total income tax expense ................... $1,348 $1,202 $827

2011 2010 2009

(Dollars in Millions)

U.S. income ............................ $3,044 $2,809 $1,446

Foreign income .......................... 940 705 388

Total ............................... $3,984 $3,514 $1,834

80