DIRECTV 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

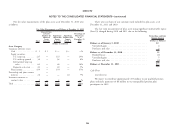

No income tax provision has been made for the portion of undistributed tax expense’’ in the Consolidated Statements of Operations. We have accrued, as

earnings of foreign subsidiaries, excluding Venezuela, deemed permanently part of our liability for unrecognized tax benefits, interest and penalties of

reinvested that amounted to approximately $7 million in 2011. It is not practicable $67 million as of December 31, 2011, and $51 million as of December 31, 2010.

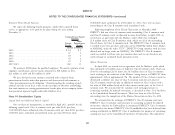

to determine the amount of the unrecognized deferred tax liability related to the We file numerous consolidated and separate income tax returns in the U.S.

investments in these foreign subsidiaries. federal jurisdiction and in many state and foreign jurisdictions. For U.S. federal tax

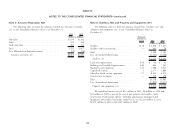

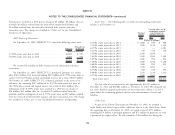

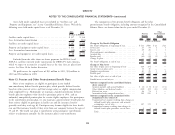

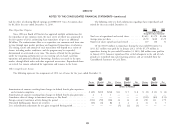

A reconciliation of the beginning and ending balances of the total amounts of purposes, the tax year 2010 remains open for examination. The California tax years

gross unrecognized tax benefits is as follows: 1994 through 2010 remain open to examination and the income tax returns in the

other state and foreign tax jurisdictions in which we have operations are generally

Unrecognized Tax subject to examination for a period of three to five years after filing of the

Benefits respective return.

(Dollars in Millions)

Gross unrecognized tax benefits at January 1, 2009 ........ $363 We engage in continuous discussions and negotiations with federal, state, and

Increases in tax positions for prior years .............. 41 foreign taxing authorities and reevaluate our uncertain tax positions, and, while it is

Decreases in tax positions for prior years .............. (15) often difficult to predict the final outcome or the timing of resolution of any

Increases in tax positions for the current year ........... 147 particular tax matter or tax position, we believe that it is reasonably possible that

Settlements ................................. (9) our unrecognized tax benefits could decrease by up to approximately $180 million

during the next twelve months.

Gross unrecognized tax benefits at December 31, 2009 ...... 527

Increases in tax positions for prior years .............. 7 Note 12: Capital Lease Obligations

Decreases in tax positions for prior years .............. (207)

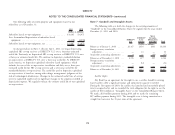

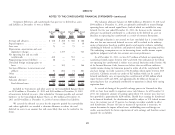

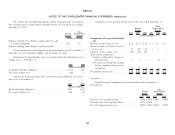

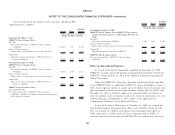

Increases in tax positions for the current year ........... 35 The following table sets forth total minimum lease payments under capital

Gross unrecognized tax benefits at December 31, 2010 ...... 362 leases for satellites and vehicles along with the present value of the net minimum

Increases in tax positions for prior years .............. 17 lease payments as of December 31, 2011:

Decreases in tax positions for prior years .............. (4) (Dollars in Millions)

Increases in tax positions for the current year ........... 15

2012 ....................................... $ 95

Gross unrecognized tax benefits at December 31, 2011 ...... $390 2013 ....................................... 93

2014 ....................................... 89

We previously reported the increases and decreases in tax positions for prior 2015 ....................................... 81

years on a net basis. 2016 ....................................... 75

As of December 31, 2011, our unrecognized tax benefits totaled $390 million, Thereafter .................................... 363

including $327 million of tax positions the recognition of which would affect the Total minimum lease payments ...................... 796

annual effective income tax rate. Less: Amount representing interest ................... 251

We recorded interest and penalties accrued related to unrecognized tax benefits Present value of net minimum lease payments ............ $545

of $16 million in 2011, $21 million in 2010 and $10 million in 2009 in ‘‘Income

82