DIRECTV 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

In 2012, we expect operating profit before depreciation and amortization to At the consolidated DIRECTV level, we anticipate free cash flow, or cash

grow in the mid-single digit percent range. We intend to manage the impact to our provided by operating activities less capital expenditures, to be relatively flat

margins from higher programming costs by productivity improvements from recent compared to 2011 as the anticipated growth in operating profit before depreciation

capital projects and by closely managing other costs across the organization, and amortization is expected to be offset by higher cash paid for taxes and interest.

including subscriber services, broadcast operations costs and general and We believe that cash paid for taxes will be higher in 2012 as a result of an increase

administrative expenses. We also expect aggregate subscriber acquisition costs to be in earnings before taxes coupled with an increase in our cash tax rate in the 30%

lower in 2012 as a result of lower anticipated gross subscriber additions in 2012 as range as a result of the reversal of accelerated depreciation benefits associated with

compared to 2011. the prior year economic stimulus programs.

We expect capital expenditures in 2012 to be relatively flat with 2011 levels as RESULTS OF OPERATIONS

the lower capital expenditures associated with anticipated lower gross additions is

expected to be offset by increased capital expenditures for DIRECTV U.S.’ Year Ended December 31, 2011 Compared with the Year Ended December 31,

satellites, D14 and D15. 2010

Consolidated Results of Operations

DIRECTV Latin America. In Latin America, pay TV penetration and

relatively favorable macroeconomic and demographic trends continue to provide a We discuss changes for each of our segments in more detail below.

substantial opportunity for growth. In 2012, we intend to profitably increase

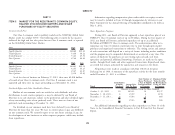

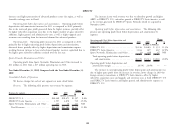

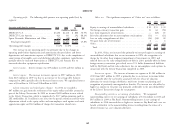

market share in the region. In particular, we will continue to strengthen our Revenues. The following table presents our revenues by segment:

leadership position in the higher end markets with a focus on our superior HD and Change

DVR products. In addition, we plan to further penetrate the rapidly growing Revenues by segment: 2011 2010 $ %

middle market by continuing to offer attractive lower priced post-paid packages and (Dollars in Millions)

pre-paid services throughout the region. DIRECTV U.S. .................. $21,872 $20,268 $1,604 7.9%

In 2012, we expect subscriber and revenue growth of approximately 20% and DIRECTV Latin America ............ 5,096 3,597 1,499 41.7%

operating profit before amortization and depreciation percentage growth in the mid Sports Networks, Eliminations and Other . . 258 237 21 8.9%

to upper teens. We also expect capital expenditures to increase approximately 10% Total Revenues .................. $27,226 $24,102 $3,124 13.0%

driven by subscriber growth, investments in upgrading DIRECTV Latin America’s

infrastructure, including satellites, as well as strategic initiatives. The increase in our total revenues was due to subscriber growth and higher

ARPU at our DIRECTV Latin America and DIRECTV U.S businesses.

DIRECTV Consolidated. We expect diluted earnings per common share to

grow well over $4 per share in 2012 resulting from higher operating profit before

depreciation and amortization coupled with a continued decline in weighted average

common shares outstanding resulting from our share repurchase program, partially

offset by increased interest and income tax expenses.

39