DIRECTV 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

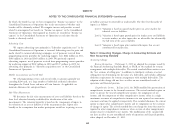

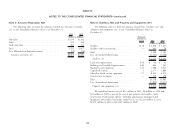

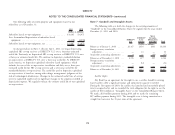

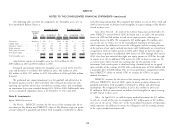

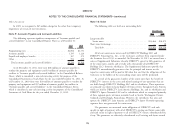

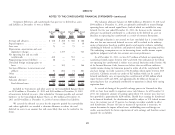

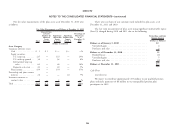

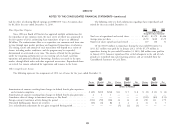

Term Loan C resulted in a 2010 pre-tax charge of $9 million, $6 million after tax, Senior Notes. The following table sets forth our outstanding senior notes

of which $6 million resulted from the write-off of unamortized discount and balance as of December 31:

$3 million resulted from the write-off of deferred debt issuance and other Carrying value, net of

transaction costs. The charge was recorded in ‘‘Other, net’’ in our Consolidated unamortized original

Statements of Operations. Principal issue discounts or

amount including premiums

2011 2011 2010

2009 Financing Transactions (Dollars in Millions)

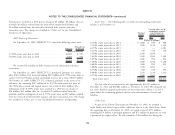

On September 22, 2009, DIRECTV U.S. issued the following senior notes: 4.750% senior notes due in 2014 .......... $ 1,000 $ 999 $ 998

3.550% senior notes due in 2015 .......... 1,200 1,199 1,199

Proceeds, net 6.375% senior notes due in 2015 .......... — — 1,002

Principal of discount

3.125% senior notes due in 2016 .......... 750 750 750

(Dollars in Millions)

3.500% senior notes due in 2016 .......... 1,500 1,498 —

4.750% senior notes due in 2014 ................. $1,000 $ 997

7.625% senior notes due in 2016 .......... 1,500 1,500 1,500

5.875% senior notes due in 2019 ................. 1,000 993

5.875% senior notes due in 2019 .......... 1,000 994 994

$2,000 $1,990 5.200% senior notes due in 2020 .......... 1,300 1,298 1,298

4.600% senior notes due in 2021 .......... 1,000 999 999

We incurred $14 million of debt issuance costs in connection with these 5.000% senior notes due in 2021 .......... 1,500 1,494 —

transactions. 6.350% senior notes due in 2040 .......... 500 499 499

On September 22, 2009, DIRECTV U.S. purchased, pursuant to a tender 6.000% senior notes due in 2040 .......... 1,250 1,234 1,233

offer, $583 million of its then outstanding $910 million of 8.375% senior notes at 6.375% senior notes due in 2041 .......... 1,000 1,000 —

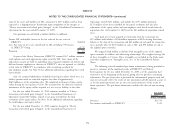

a price of 103.125% plus accrued and unpaid interest, for a total of $603 million. Total senior notes ................... $13,500 $13,464 $10,472

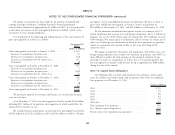

On October 23, 2009, DIRECTV U.S. redeemed, pursuant to the terms of its

indenture, the remaining $327 million of its 8.375% senior notes at a price of The fair value of our senior notes was approximately $14,512 million at

102.792% plus accrued and unpaid interest, for a total of $339 million. The December 31, 2011 and $10,881 million at December 31, 2010. We calculated the

redemption of the 8.375% senior notes resulted in a 2009 pre-tax charge of fair values based on quoted market prices of our senior notes, which is a Level 1

$34 million, $21 million after tax, of which $27 million resulted from the input under the accounting guidance for fair value measurements of assets and

premium paid for redemption of our 8.375% senior notes and $7 million resulted liabilities.

from the write-off of deferred debt issuance and other transaction costs. The charge

was recorded in ‘‘Other, net’’ in our Consolidated Statements of Operations. Collar Loan

As part of the Liberty Transaction on November 19, 2009, we assumed a

credit facility and related equity collars, which we refer to as the Collar Loan. From

the acquisition date to December 31, 2009, we repaid a total of $751 million,

including $676 million in principal payments and $75 million in payments to settle

a portion of the equity collars. We also recorded a $105 million loss during the

78