DIRECTV 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

regional telco partners as a result of a more challenging competitive environment. DIRECTV Latin America Segment

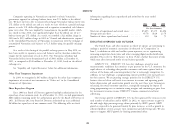

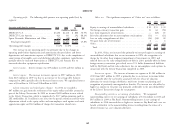

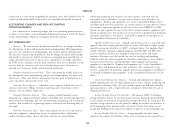

Net subscriber additions decreased from 2009 due to the decrease in gross additions The following table provides operating results and a summary of key

and higher subscriber disconnections associated with the larger subscriber base. subscriber data for the DIRECTV Latin America segment:

Average monthly subscriber churn remained unchanged from 1.53% in 2009.

Change

Revenues. Our revenues increased as a result of higher ARPU and the larger 2010 2009 $ %

subscriber base. The increase in ARPU resulted primarily from price increases on (Dollars in Millions, Except Per

programming packages, higher HD and DVR service fees. Subscriber Amounts)

Revenues .......................... $3,597 $2,878 $ 719 25.0%

Operating profit before depreciation and amortization. The improvement of Operating profit before depreciation and

operating profit before depreciation and amortization was primarily due to the gross amortization ....................... 1,164 697 467 67.0%

profit generated from the higher revenues, partially offset by higher subscriber Operating profit before depreciation and

acquisition and upgrade and retention costs and higher general and administrative amortization margin ................. 32.4% 24.2% — —

expenses. Operating profit ...................... 623 331 292 88.2%

Broadcast programming and other costs increased due to the larger number of Operating profit margin ................ 17.3% 11.5% — —

subscribers in 2010 and annual program supplier rate increases. Subscriber service Other data:

expenses increased primarily due to a larger subscriber base in 2010 and costs ARPU ............................ $57.95 $57.12 $ 0.83 1.5%

associated with service quality improvement initiatives. Average monthly total subscriber churn % .... 1.77% 1.75% — 1.1%

Average monthly post paid subscriber churn % . 1.47% 1.55% — (5.2)%

Subscriber acquisition costs increased from 2009 primarily due to higher Total number of subscribers (in thousands) (1) . 5,808 4,588 1,220 26.6%

subscriber demand for advanced products as well as increased dealer commissions. Gross subscriber additions (in thousands) ..... 2,318 1,575 743 47.2%

SAC per subscriber, which includes the cost of capitalized set-top receivers, Net subscriber additions (in thousands) ...... 1,220 692 528 76.3%

increased primarily due to higher subscriber demand for advanced products and

increased dealer commissions compared to 2009. (1) DIRECTV Latin America subscriber data exclude subscribers of the Sky

Upgrade and retention costs increased in 2010 due to increased marketing Mexico platform. Net subscriber additions and churn exclude the effect of the

costs and costs related to advanced product upgrades. The decrease in the migration of approximately 3,000 subscribers to Sky Mexico and the migration

capitalized amount of set-top receivers is due to a decrease in the cost of advanced of approximately 16,000 subscribers from a local pay television service provider

products. to Sky Brazil in 2009.

General and administrative expenses increased in 2010 primarily due to Gross subscriber additions increased in 2010 principally due to continued

increased labor and benefit costs related to higher incentive compensation and strong demand for advanced products and prepaid services, the effect of the FIFA

increased headcount as well as higher bad debt expense associated with higher World Cup soccer tournament as well as targeted customer promotions aimed at

revenue. the middle-market segments. The increase in net subscriber additions was due to

higher gross subscriber additions primarily in Brazil, Argentina, Colombia, Ecuador

Operating profit. The increase in operating profit was primarily due to higher and Chile.

operating profit before depreciation and amortization and lower depreciation and

Revenues increased in 2010 primarily due to strong subscriber growth. ARPU

amortization expense in 2010 as a result of decreased subscriber equipment

increased mainly due to price increases and higher fees for HD and DVR services,

capitalization and completion of the amortization of subscriber related and orbital

slot intangible assets.

46