DIRECTV 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

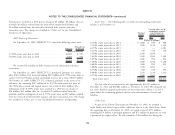

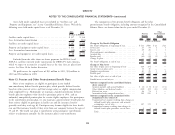

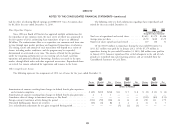

had the effect of reducing diluted earnings per DIRECTV Class A common share The following table sets forth information regarding shares repurchased and

by $0.18 for the year ended December 31, 2010. retired for the years ended December 31:

2011 2010 2009

Share Repurchase Program (Amounts in Millions,

Except Per Share Amounts)

Since 2006 our Board of Directors has approved multiple authorizations for

Total cost of repurchased and retired shares ....... $5,455 $5,179 $1,696

the repurchase of our common stock, the most recent of which was announced in

Average price per share ..................... 45.78 38.20 23.79

the first quarter of 2012, authorizing share repurchases of up to an additional

Number of shares repurchased and retired ........ 119 136 71

$6 billion. The authorizations allow us to repurchase our common stock from time

to time through open market purchases and negotiated transactions, or otherwise. Of the $5,455 million in repurchases during the year ended December 31,

The timing, nature and amount of such transactions will depend on a variety of 2011, $27 million were paid for in January 2012. Of the $5,179 million in

factors, including market conditions, and the program may be suspended, repurchases during the year ended December 31, 2010, $68 million were paid for

discontinued or accelerated at any time. The sources of funds for the purchases in January 2011. Amounts repurchased but settled subsequent to the end of such

under the remaining authorizations are our existing cash on hand, cash from periods are considered non-cash financing activities and are excluded from the

operations and potential additional borrowings. Purchases are made in the open Consolidated Statements of Cash Flows.

market, through block trades and other negotiated transactions. Repurchased shares

are retired, but remain authorized for registration and issuance in the future.

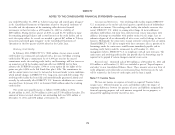

Other Comprehensive Income

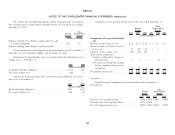

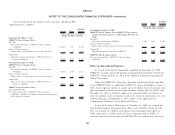

The following represents the components of OCI, net of taxes, for the years ended December 31:

2011 2010 2009

Tax Ta x Tax

Pre-tax (Benefit) Net Pre-tax (Benefit) Net Pre-tax (Benefit) Net

Amount Expense Amount Amount Expense Amount Amount Expense Amount

(Dollars in Millions)

Amortization of amounts resulting from changes in defined benefit plan experience

and actuarial assumptions ...................................... $ (49) $(19) $(30) $13 $ 5 $ 8 $ (3) $ (1) $ (2)

Amortization of amounts resulting from changes in defined benefit plan provisions . . 2 1 1 — — — — — —

Cumulative effect of change in functional currency at Sky Brazil .............. — — — — — — (181) (69) (112)

Foreign currency translation activity during the period .................... (153) (59) (94) 32 12 20 290 111 179

Unrealized holding gains (losses) on securities .......................... (10) (4) (6) 6 2 4 11 4 7

Less: reclassification adjustment for net gains recognized during period .......... — — — (5) (2) (3) — — —

88