DIRECTV 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

could result in a write-down of goodwill or intangible assets with indefinite lives in advertising, marketing and customer call center expenses associated with the

a future period which could be material to our consolidated financial statements. acquisition of new subscribers. Set-top receivers leased to new subscribers are

capitalized in ‘‘Property and equipment, net’’ in the Consolidated Balance Sheets

ACCOUNTING CHANGES AND NEW ACCOUNTING and depreciated over their useful lives. In certain countries in Latin America, where

PRONOUNCEMENTS our customer agreements provide for the lease of the entire DIRECTV or SKY

System, we also capitalize the costs of the other customer premises equipment and

For a discussion of accounting changes and new accounting pronouncements related installation costs. The amount of set-top receivers capitalized each period for

see Note 3 of the Notes to the Consolidated Financial Statements in Part II, Item 8 subscriber acquisitions is included in ‘‘Cash paid for property and equipment’’ in

of this Annual Report, which we incorporate herein by reference. the Consolidated Statements of Cash Flows.

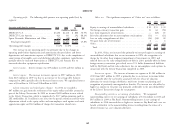

KEY TERMINOLOGY Upgrade and Retention Costs. Upgrade and retention costs are associated with

upgrade efforts for existing subscribers that we believe will result in higher average

Revenues. We earn revenues mostly from monthly fees we charge subscribers monthly revenue per subscriber, or ARPU, and lower churn. Our upgrade efforts

for subscriptions to basic and premium channel programming, HD programming include subscriber equipment upgrade programs for DVR, HD and HD DVR

and access fees, pay-per-view programming, and seasonal and live sporting events. receivers and local channels, our multiple set-top receiver offers and similar

We also earn revenues from monthly fees that we charge subscribers with multiple initiatives. Retention costs also include the costs of installing and providing

non-leased set-top receivers (which we refer to as mirroring fees), monthly fees we hardware under our movers program for subscribers relocating to a new residence.

charge subscribers for leased set-top receivers, monthly fees we charge subscribers Set-top receivers leased to existing subscribers under upgrade and retention

for DVR service, hardware revenues from subscribers who lease or purchase set-top programs are capitalized in ‘‘Property and equipment, net’’ in the Consolidated

receivers from us, warranty service fees and advertising services. Revenues are Balance Sheets and depreciated over their useful lives. The amount of set-top

reported net of customer credits and discounted promotions. receivers capitalized each period for upgrade and retention programs is included in

Broadcast Programming and Other. These costs primarily include license fees ‘‘Cash paid for property and equipment’’ in the Consolidated Statements of Cash

for subscription service programming, pay-per-view programming, live sports and Flows.

other events. Other costs include continuing service fees paid to third parties for General and Administrative Expenses. General and administrative expenses

active subscribers and warranty service costs. include departmental costs for legal, administrative services, finance, marketing and

Subscriber Service Expenses. Subscriber service expenses include the costs of information technology. These costs also include expenses for bad debt and other

customer call centers, billing, remittance processing and certain home services operating expenses, such as legal settlements, and gains or losses from the sale or

expenses, such as in-home repair costs. disposal of fixed assets.

Broadcast Operations Expenses. These expenses include broadcast center Average Monthly Revenue Per Subscriber. We calculate ARPU by dividing

operating costs, signal transmission expenses (including costs of collecting signals for average monthly revenues for the period (total revenues during the period divided

our local channel offerings), and costs of monitoring, maintaining and insuring our by the number of months in the period) by average subscribers for the period. We

satellites. Also included are engineering expenses associated with deterring theft of calculate average subscribers for the period by adding the number of subscribers as

our signal. of the beginning of the period and for each quarter end in the current year or

period and dividing by the sum of the number of quarters in the period plus one.

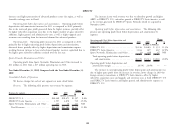

Subscriber Acquisition Costs. These costs include the cost of set-top receivers

and other equipment, commissions we pay to national retailers, independent Average Monthly Subscriber Churn. Average monthly subscriber churn

satellite television retailers, dealers and telcos, and the cost of installation, represents the number of subscribers whose service is disconnected, expressed as a

53