DIRECTV 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

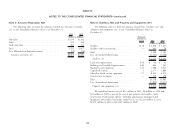

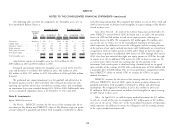

Other Investments Note 10: Debt

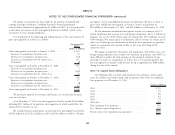

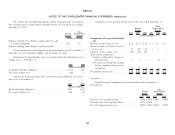

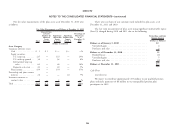

In 2009, we recognized a $45 million charge for the other than temporary The following table sets forth our outstanding debt:

impairment of certain of our investments. December 31,

2011 2010

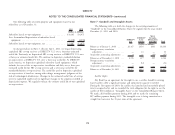

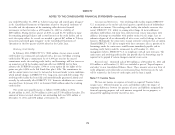

Note 9: Accounts Payable and Accrued Liabilities (Dollars in Millions)

The following represent significant components of ‘‘Accounts payable and Long-term debt

accrued liabilities’’ in our Consolidated Balance Sheets as of December 31: Senior notes ............................... $13,464 $10,472

Short-term borrowings .......................... — 38

2011 2010

Total debt ............................... $13,464 $10,510

(Dollars in Millions)

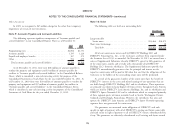

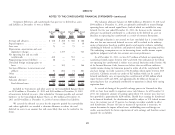

Programming costs ............................ $2,006 $1,751 All of our senior notes were issued by DIRECTV Holdings LLC and

Accounts payable ............................. 1,195 1,224 DIRECTV Financing Co., Inc., or the Co-Issuers, and have been registered under

Payroll and employee benefits ..................... 307 272 the Securities Act of 1933, as amended. On November 14, 2011, we entered into a

Other ..................................... 702 679 series of Supplemental Indentures whereby DIRECTV agreed to fully guarantee all

Total accounts payable and accrued liabilities ......... $4,210 $3,926 of the senior notes, jointly and severally with substantially all of DIRECTV

Holdings LLC’s domestic subsidiaries. The Supplemental Indentures provide that

As of December 31, 2011, there were $68 million of amounts payable to DIRECTV unconditionally guarantees that the principal and interest on the

vendors for property and equipment and $3 million of amounts payable for respective senior notes will be paid in full when due and that the obligations of the

satellites in ‘‘Accounts payable and accrued liabilities’’ in the Consolidated Balance Co-Issuers to the holders of the outstanding senior notes will be performed.

Sheets, which is considered a non-cash investing activity for purposes of the

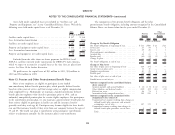

Consolidated Statements of Cash Flows for the year ended December 31, 2011. As As a result of the guarantees, holders of the senior notes have the benefit of

of December 31, 2010 there were $30 million of amounts payable to vendors for DIRECTV’s interests in the assets and related earnings of our operations that are

property and equipment and $17 million of amounts payable for satellites in not held through DIRECTV Holdings LLC and its subsidiaries. Those operations

‘‘Accounts payable and accrued liabilities’’ in the Consolidated Balance Sheets, are primarily our direct-to-home digital television services throughout Latin America

which is considered a non-cash investing activity for purposes of the Consolidated which are held by DIRECTV Latin America Holdings, Inc. and its subsidiaries and

Statements of Cash Flows for the year ended December 31, 2010. DIRECTV Sports Networks LLC and its subsidiaries which are comprised primarily

of three regional sports television networks based in Seattle, Washington; Denver,

Colorado and Pittsburgh, Pennsylvania. However, the subsidiaries that own and

operate the DIRECTV Latin America and DIRECTV Sports Networks operating

segments have not guaranteed the senior notes.

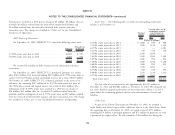

The guarantees are unsecured senior obligations of DIRECTV and rank

equally in right of payment with all of DIRECTV’s existing and future senior debt

and rank senior in right of payment to all of DIRECTV’s future subordinated debt,

if any. The guarantees are effectively subordinated to all existing and future secured

76