DIRECTV 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

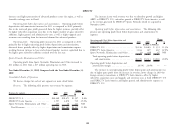

to a benefit recorded for previously unrecognized foreign tax credits and a benefit DIRECTV U.S. Segment

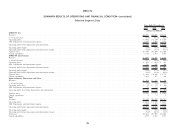

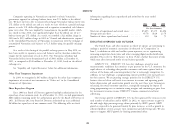

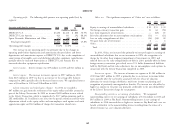

recorded for domestic production activities deduction in 2011. The following table provides operating results and a summary of key

subscriber data for the DIRECTV U.S. segment:

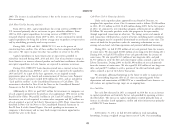

Noncontrolling interests in net earnings of subsidiaries. We recognized

noncontrolling interests in net earnings of subsidiaries of $27 million in 2011 and Change

$114 million in 2010 at Sky Brazil. Noncontrolling interests in net earnings of 2011 2010 $ %

subsidiaries in 2011 decreased due to the Globo Transaction in the fourth quarter (Dollars in Millions, Except Per

of 2010 which increased our ownership percentage in Sky Brazil and a net tax Subscriber Amounts)

benefit attributable to the noncontrolling interest resulting from the release of a Revenues ............................ $21,872 $20,268 $1,604 7.9%

Operating costs and expenses

deferred income tax asset valuation allowance in 2010. Costs of revenues, exclusive of depreciation and

amortization expense

Earnings Per Share. Class A common stock earnings per share and weighted Broadcast programming and other .......... 9,799 8,699 1,100 12.6%

shares outstanding were as follows for the years ended December 31: Subscriber service expenses . . . ............ 1,435 1,340 95 7.1%

Broadcast operations expenses ............. 300 273 27 9.9%

Selling, general and administrative expenses, exclusive

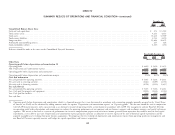

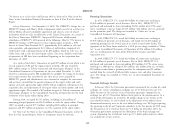

2011 2010

of depreciation and amortization expense

(Shares in Subscriber acquisition costs . . . ............ 2,794 2,631 163 6.2%

Millions) Upgrade and retention costs .............. 1,209 1,106 103 9.3%

Basic earnings attributable to DIRECTV Class A common General and administrative expenses ......... 1,046 1,003 43 4.3%

stockholders per common share ...................... $3.49 $2.31 Depreciation and amortization expense ........... 1,587 1,926 (339) (17.6)%

Diluted earnings attributable to DIRECTV Class A common Total operating costs and expenses ......... 18,170 16,978 1,192 7.0%

stockholders per common share ...................... 3.47 2.30 Operating profit ........................ $3,702 $ 3,290 $ 412 12.5%

Weighted average number of Class A common shares outstanding Operating profit margin ................... 16.9% 16.2% — —

Basic ......................................... 747 870 Other data:

Operating profit before depreciation and amortization . . $ 5,289 $ 5,216 $ 73 1.4%

Diluted ....................................... 752 876 Operating profit before depreciation and amortization

margin ............................ 24.2% 25.7% — —

The increases in basic and diluted earnings per share for Class A common Total number of subscribers (in thousands) ........ 19,885 19,223 662 3.4%

stock were due to higher net income attributable to DIRECTV, a reduction in ARPU .............................. $93.27 $ 89.71 $ 3.56 4.0%

weighted average shares outstanding resulting from our share repurchase program, Average monthly subscriber churn % ............ 1.56% 1.53% — 2.0%

Gross subscriber additions (in thousands) ......... 4,316 4,124 192 4.7%

and the $0.19 reduction to basic and $0.18 reduction to diluted earnings per Subscriber disconnections (in thousands) .......... 3,654 3,461 193 5.6%

Class A common share resulting from the Malone Transaction in 2010. Net subscriber additions (in thousands) .......... 662 663 (1) (0.2)%

Average subscriber acquisition costs—per subscriber

(SAC)............................. $ 813 $ 796 $ 17 2.1%

Capitalized subscriber leased equipment:

Subscriber leased equipment—subscriber acquisitions . . $ 713 $ 651 $ 62 9.5%

Subscriber leased equipment—upgrade and retention . . 315 316 (1) (0.3)%

Total subscriber leased equipment capitalized ....... $1,028 $ 967 $ 616.3%

Depreciation expense—subscriber leased equipment . . . $ 903 $ 1,145 $ (242) (21.1)%

Subscribers. In 2011, net subscriber additions were relatively unchanged as

higher gross additions mainly resulting from improved customer offers were offset

41