DIRECTV 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

the adjustment of net bolivars fuerte denominated monetary assets to the new Income taxes. During 2010, we entered into an agreement with a former

official exchange rate. We began reporting the operating results of our Venezuelan owner to settle certain tax contingencies. As a result of this settlement we recorded

subsidiary in the first quarter of 2010 using the devalued rate of 4.3 bolivars fuerte a benefit of $39 million in ‘‘Income tax expense’’ in the Consolidated Statements of

per U.S. dollar. In December 2010, the Venezuelan government announced the Operations during the year ended December 31, 2010. We engage in continuous

elimination of the dual exchange rate system, eliminating the 2.6 bolivars fuerte per discussions and negotiations with federal, state, and foreign taxing authorities and

U.S. dollar preferential rate which was available for certain activities. reevaluate our uncertain tax positions, and, while it is often difficult to predict the

final outcome or the timing of resolution of any particular tax matter or tax

Companies operating in Venezuela are required to obtain Venezuelan position, we believe that it is reasonably possible that our unrecognized tax benefits

government approval to exchange Venezuelan bolivars fuerte into U.S. dollars at the could decrease by up to approximately $180 million during the next twelve months.

official rate. We have not been able to consistently exchange Venezuelan bolivars

fuerte into U.S. dollars at the official rate and as a result, we have relied on a Globo. As discussed in Note 20 of the Notes to the Consolidated Financial

parallel exchange process to settle U.S. dollar obligations and to repatriate Statements in Part II, Item 8 of this Annual Report, Globo has the right to

accumulated cash balances prior to its close. The rates implied by transactions in exchange its remaining Sky Brazil shares for cash or our common shares. If Globo

the parallel market, which was closed in May 2010, were significantly higher than exercises this right, we have the option to elect to pay the consideration in cash,

the official rate (6 to 7 bolivars fuerte per U.S. dollar). As a result, we recorded a shares of our common stock, or a combination of both.

$22 million charge in 2010, and a $213 million charge in 2009 in ‘‘General and

Other. Several factors may affect our ability to fund our operations and

administrative expenses’’ in the Consolidated Statements of Operations in

commitments that we discuss in ‘‘Contractual Obligations’’, ‘‘Off-Balance Sheet

connection with the exchange of accumulated Venezuelan cash balances to U.S.

Arrangements’’ and ‘‘Contingencies’’ below. In addition, our future cash flows may

dollars using the parallel exchange process.

be reduced if we experience, among other things, significantly higher subscriber

As a result of the closing of the parallel exchange process in May 2010, we additions than planned, increased subscriber churn or upgrade and retention costs,

have been unable to repatriate excess cash balances and as a result, we have realized higher than planned capital expenditures for satellites and broadcast equipment, or

no charges for the repatriation of cash in 2011. Our ability to pay U.S. dollar satellite anomalies or signal theft. Additionally, DIRECTV U.S.’ ability to borrow

denominated obligations and repatriate cash generated in Venezuela in excess of under its revolving credit facility is contingent upon DIRECTV U.S. meeting a

local operating requirements is limited, resulting in an increase in the cash balance financial and other covenants associated with its facility as more fully described

at our Venezuelan subsidiary. At such time that exchange controls are eased, above.

accumulated cash balances may ultimately be repatriated at less than their currently

reported value, as the official exchange rate has not changed despite continuing CONTRACTUAL OBLIGATIONS

high inflation in Venezuela. In addition, in the event of a significant devaluation of

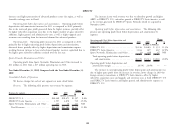

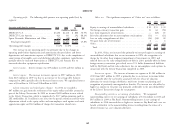

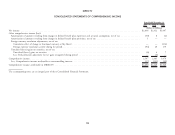

The following table sets forth our contractual obligations as of December 31,

the bolivar fuerte, we may recognize a charge to earnings based on the amount of

2011, including the future periods in which payments are expected. Additional

bolivar fuerte denominated net monetary assets (monetary assets net of monetary

details regarding these obligations are provided in the Notes to the Consolidated

liabilities) held at the time of such devaluation. These conditions are also expected

Financial Statements in Part II, Item 8 referenced in the table. The contractual

to affect growth in our Venezuelan business which is dependent on our ability to

obligations below do not include payments that could be made related to our net

purchase set-top boxes and other components using U.S. dollars.

unrecognized tax benefits liability, which amounted to $394 million as of

Using the official 4.3 bolivars fuerte per U.S. dollar exchange rate as of December 31, 2011. The timing and amount of any future payments is not

December 31, 2011, our Venezuelan subsidiary had net Venezuelan bolivar fuerte reasonably estimable, as such payments are dependent on the completion and

denominated monetary assets of $285 million, including cash of $401 million as of

December 31, 2011.

50