DIRECTV 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

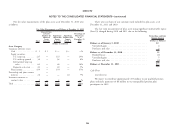

The following table presents revenues earned from subscribers located in 2012, $1,957 million in 2013, $1,552 million in 2014, $916 million in 2015,

different geographic areas. Property is grouped by its physical location. $238 million in 2016 and $1,186 million thereafter.

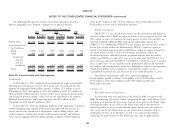

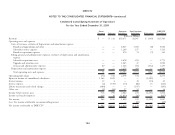

Years Ended and As of December 31, Satellite Commitments

2011 2010 2009 DIRECTV U.S. has entered into contracts for the construction and launch of

Net Property Net Property Net Property

Revenues & Satellites Revenues & Satellites Revenues & Satellites two new satellites: D14, which we expect to launch in the first quarter of 2014 and

(Dollars in Millions) D15, which we expect to launch in the fourth quarter of 2014. D14 and D15 are

United States .... $22,310 $5,267 $20,684 $4,987 $18,844 $5,247 expected to provide additional HD, replacement, and backup capacity for

DIRECTV U.S. Additionally, DIRECTV Latin America has entered into a contract

Latin America and for the lease of two satellites for PanAmericana: ISDLA-1, which we expect to

the Caribbean launch in the fourth quarter of 2014 and ISDLA-2, which we expect to launch in

Brazil ........ 3,020 1,423 2,013 1,060 1,416 742 the fourth quarter of 2015. ISDLA-1 will become the primary satellite for

Other ....... 1,896 748 1,405 632 1,305 487 PanAmericana with a substantial increase in channel capacity from the current

Total Latin satellite, and ISDLA-2 is expected to serve as an in-orbit spare for ISDLA-1. As a

America part of the lease agreement for ISDLA-1 and ISDLA-2, which we expect to account

and the for as a capital lease, we are required to make prepayments prior to the launch of

Caribbean . 4,916 2,171 3,418 1,692 2,721 1,229 the satellites and commencement of the lease. Prepayments related to this agreement

Total ........ $27,226 $7,438 $24,102 $6,679 $21,565 $6,476 totaled $104 million and are included as ‘‘Cash paid for satellites’’ in the

Consolidated Statements of Cash Flows for the year ended December 31, 2011.

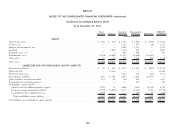

Note 20: Commitments and Contingencies Total future cash payments under these agreements aggregate to

$1,646 million, payable as follows: $340 million in 2012, $308 million in 2013,

Commitments $174 million in 2014, $116 million in 2015, $50 million in 2016 and

At December 31, 2011, minimum future commitments under noncancelable $658 million thereafter.

operating leases having lease terms in excess of one year were primarily for real

property and aggregated $846 million, payable as follows: $73 million in 2012, Contingencies

$78 million in 2013, $65 million in 2014, $67 million in 2015, $70 million in Redeemable Noncontrolling Interest

2016 and $493 million thereafter. Certain of these leases contain escalation clauses

In connection with our acquisition of Sky Brazil in 2006, our partner who

and renewal or purchase options, which we have not considered in the amounts

holds the remaining 7% interest, Globo, was granted the right, until January 2014,

disclosed. Rental expenses under operating leases were $99 million in 2011,

to require us to purchase all, but not less than all, of its shares in Sky Brazil. Upon

$78 million in 2010 and $72 million in 2009.

exercising this right, the fair value of Sky Brazil shares will be determined by

At December 31, 2011, our minimum payments under agreements to purchase mutual agreement or by an outside valuation expert, and we have the option to

broadcast programming, regional professional team rights and the purchase of elect to pay for the Sky Brazil shares in cash, shares of our common stock or a

services that we have outsourced to third parties, such as billing services, and combination of both. As of December 31, 2011, we estimated that Globo’s

satellite telemetry, tracking and control, satellite launch contracts and broadcast remaining 7% equity interest in Sky Brazil had a fair value of approximately

center services aggregated $8,258 million, payable as follows: $2,409 million in

96