DIRECTV 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

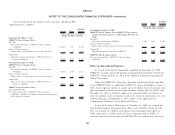

Accumulated Other Comprehensive Loss the period. We exclude common equivalent shares from the computation in loss

periods as their effect would be antidilutive and we exclude common stock options

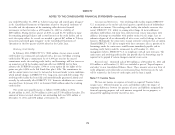

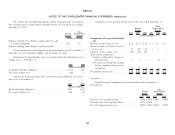

The following represent the components of ‘‘Accumulated other comprehensive from the computation of diluted EPS when their exercise price is greater than the

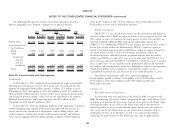

loss’’ in our Consolidated Balance Sheets as of December 31: average market price of our common stock. The following table sets forth the

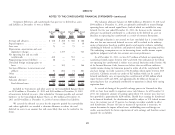

number of common stock options excluded from the computation of diluted EPS

2011 2010

because the options’ exercise prices were greater than the average market price of

(Dollars in Millions)

our common stock during the years presented:

Unamortized net amount resulting from changes in defined

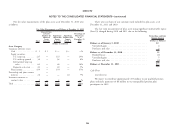

benefit plan experience and actuarial assumptions, net of December 31,

tax ..................................... $(149) $(119) 2011 2010 2009

Unamortized amount resulting from changes in defined (Shares in Millions)

benefit plan provisions, net of tax ................. (2) (3) Common stock options excluded .................... — — 16

Accumulated unrealized gains on securities, net of tax ..... 3 9

Accumulated foreign currency translation adjustments ..... (8) 86 No DIRECTV Class B common stock options have been issued.

Total accumulated other comprehensive loss .......... $(156) $ (27) From November 20, 2009 to June 16, 2010, we allocated ‘‘Net income

attributable to DIRECTV’’ in the Consolidated Statements of Operations to the

DIRECTV Class A and DIRECTV Class B common stockholders based on the

Note 15: Earnings Per Common Share weighted average shares outstanding for each class through the close of the Malone

Earnings per share has been computed using the number of outstanding shares Transaction on June 16, 2010. After the close of the Malone Transaction we

of DIRECTV Group common stock from January 1, 2009 through November 19, allocate all net income attributable to DIRECTV to the DIRECTV Class A

2009, and based on the outstanding shares of DIRECTV Class A common stock stockholders. At the close of the transaction, we exchanged 21.8 million shares of

from November 20, 2009 through December 31, 2011 and Class B common stock DIRECTV Class B common stock, which represented all of the issued and

from November 20, 2009 through June 16, 2010. See Note 4 for additional outstanding DIRECTV Class B common stock, for 26.5 million shares of

information regarding the Liberty Transaction and Note 14 for additional DIRECTV Class A common stock. We determined the number of shares of

information regarding the Malone Transaction. DIRECTV Class A common stock to be exchanged as follows: one share of

DIRECTV Class A common stock for each share of DIRECTV Class B common

We compute basic earnings per common share, or EPS, by dividing net stock held, plus an additional number of DIRECTV Class A shares with a fair

income by the weighted average number of common shares outstanding for the value of $160 million based on the market price of the DIRECTV Class A

period. common stock at the time of the agreement on April 6, 2010. We included the

Diluted EPS considers the effect of common equivalent shares, which consist $160 million in income attributable to DIRECTV Class B common stockholders.

entirely of common stock options and unvested restricted stock units issued to For the years ended December 31, 2011, 2010 and 2009, there were no dilutive

employees. In the computation of diluted EPS under the treasury stock method, securities outstanding for the DIRECTV Class B common stock. See Note 14 of

the amount of assumed proceeds from restricted stock units and common stock the Notes to the Consolidated Financial Statements for a further discussion of the

options includes the amount of compensation cost attributable to future services Malone Transaction.

not yet recognized, proceeds from the exercise of the options and the incremental

income tax benefit or liability as if the awards were exercised or distributed during

89