Cisco 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

The Company refers to some of its products and technologies as advanced technologies. As of July 28, 2007, the Company had identified

the following advanced technologies for particular focus: application networking services, home networking, hosted small-business systems,

security, storage area networking, unified communications, video systems, and wireless technology. The Company continues to identify

additional advanced technologies for focus and investment in the future, and the Company’s investments in some previously identified

advanced technologies may be curtailed or eliminated depending on market developments. Beginning in the first quarter of fiscal 2007,

sales of optical networking products, which were previously included in the advanced technologies product category, are included in the

other product category, and prior year amounts have been reclassified in order to conform to the current year’s presentation.

The majority of the Company’s assets as of July 28, 2007 and July 29, 2006 were attributable to its U.S. operations. In fiscal 2007,

2006, and 2005, no single customer accounted for 10% or more of the Company’s net sales.

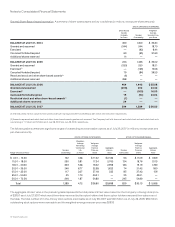

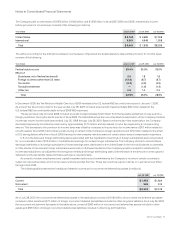

Property and equipment information is based on the physical location of the assets. The following table presents property and

equipment information for geographic areas (in millions):

July 28, 2007 July 29, 2006

Property and equipment, net:

United States $ 3,340 $ 3,082

International 553 358

Total $ 3,893 $ 3,440

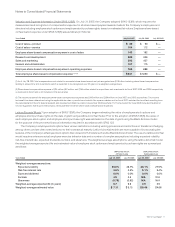

13. Net Income Per Share

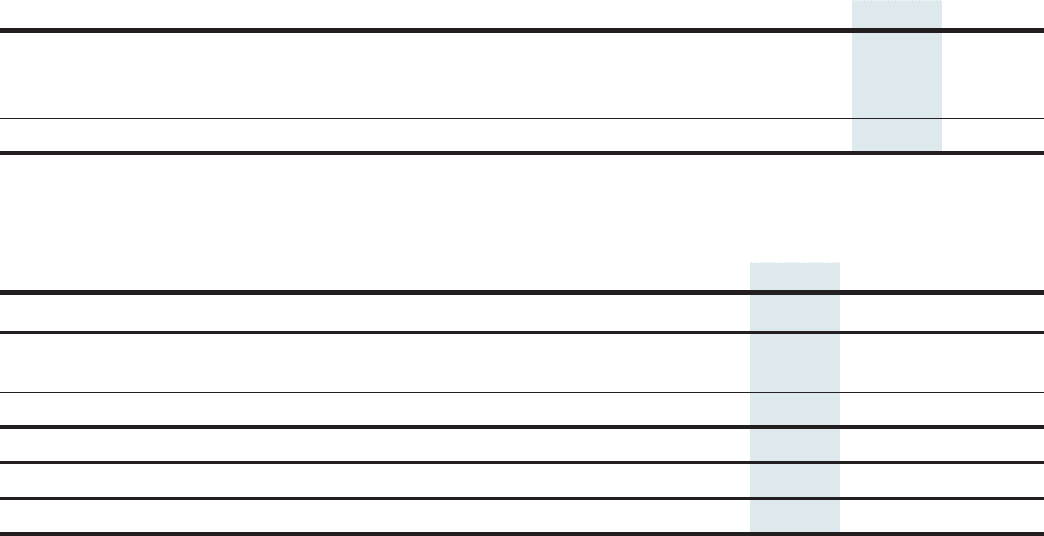

The following table presents the calculation of basic and diluted net income per share (in millions, except per-share amounts):

Years Ended July 28, 2007 July 29, 2006 July 30, 2005

Net income $ 7,333 $ 5,580 $ 5,741

Weighted-average shares—basic 6,055 6,158 6,487

Effect of dilutive potential common shares 210 114 125

Weighted-average shares—diluted 6,265 6,272 6,612

Net income per share—basic $ 1.21 $ 0.91 $ 0.88

Net income per share—diluted $ 1.17 $ 0.89 $ 0.87

Antidilutive employee stock options 533 1,014 847

14. Subsequent Event

On August 17, 2007, the Company entered into a credit agreement with certain institutional lenders which provides for a $3.0 billion

unsecured revolving credit facility that is scheduled to expire on August 17, 2012. Advances under the credit facility will accrue interest at

rates that are equal to either (i) the higher of the Federal Funds rate plus 0.50% or Bank of America’s “prime rate” as announced from time

to time, or (ii) LIBOR plus a margin that is based on the Company’s senior debt credit ratings as published by Standard & Poor’s Ratings

Services and Moody’s Investors Service, Inc. In addition, the credit agreement requires that the Company maintain an interest coverage ratio

as defined in the agreement. The Company may also, upon the agreement of either the then existing lenders or of additional lenders not

currently parties to the agreement, increase the commitments under the credit facility up to a total of $5.0 billion, and/or extend the expiration

date of the credit facility up to August 15, 2014. As of September 14, 2007, the Company had not borrowed any funds under the credit facility.