Cisco 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 Cisco Systems, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

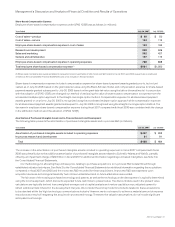

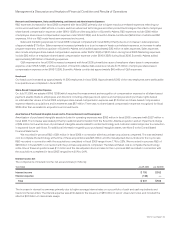

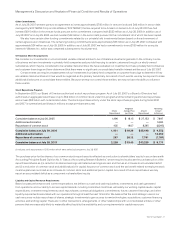

Other Income, Net

The components of other income, net, are as follows (in millions):

Years Ended July 29, 2006 July 30, 2005

Net gains on investments in fixed income and publicly traded equity securities $ 53 $ 88

Impairment charges on publicly traded equity securities — (5)

Net gains on investments in privately held companies 86 51

Impairment charges on investments in privately held companies (15) (39)

Net gains and impairment charges on investments 124 95

Other (94) (27)

Total $ 30 $ 68

The other expenses of $94 million for fiscal 2006 consisted primarily of contributions of publicly traded equity securities and products to

charitable organizations.

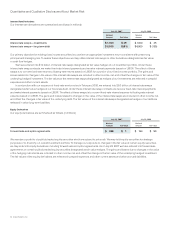

Provision for Income Taxes

The effective tax rate was 26.9% for fiscal 2006 and 28.6% for fiscal 2005. The effective tax rate differed from the statutory rate primarily due

to acquisition-related costs, stock-based compensation expense, research and experimentation tax credits, state taxes, and the tax impact

of foreign operations. In addition, the tax provision rate for fiscal 2006 included a benefit of approximately $124 million from the favorable

settlement of a tax audit in a foreign jurisdiction. On October 22, 2004, the American Jobs Creation Act of 2004 (the “Jobs Creation Act”)

was signed into law. The Jobs Creation Act created a temporary incentive for U.S. corporations to repatriate accumulated income earned

abroad by providing an 85 percent dividends received deduction for certain dividends from controlled foreign corporations. In fiscal

2006, we distributed cash from our foreign subsidiaries and reported an extraordinary dividend (as defined in the Jobs Creation Act) of

$1.2 billion and a related tax liability of approximately $63 million in our fiscal 2006 federal income tax return. This amount was previously

provided for in the provision for income taxes and is included in income taxes payable.

Recent Accounting Pronouncements

FIN 48 In July 2006, the FASB issued Financial Interpretation No. 48, “Accounting for Uncertainty in Income Taxes-an interpretation of FASB

Statement No. 109” (“FIN 48”), which is a change in accounting for income taxes. FIN 48 specifies how tax benefits for uncertain tax positions

are to be recognized, measured, and derecognized in financial statements; requires certain disclosures of uncertain tax positions; specifies

how reserves for uncertain tax positions should be classified on the balance sheet; and provides transition and interim-period guidance,

among other provisions. FIN 48 is effective for fiscal years beginning after December 15, 2006 and as a result, is effective for us in the first

quarter of fiscal 2008. Based on a preliminary analysis, we estimate that the cumulative effect of applying this interpretation will be recorded

as a $150 million to $250 million increase to retained earnings. The final analysis will be completed in the first quarter of fiscal 2008.

SAB 108 In September 2006, the U.S. Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin No. 108, “Considering

the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements” (“SAB 108”). SAB 108

provides interpretative guidance on the process of quantifying financial statement misstatements and is effective for fiscal years ending

after November 15, 2006. We applied the provisions of SAB 108 beginning in the first quarter of fiscal 2007 and there was no impact to

the Consolidated Financial Statements.

SFAS 157 In September 2006, the FASB issued Statement of Financial Accounting Standards (SFAS) No. 157, “Fair Value Measurements”

(“SFAS 157”). SFAS 157 defines fair value, establishes a framework and gives guidance regarding the methods used for measuring fair value,

and expands disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for fiscal years beginning

after November 15, 2007, and interim periods within those fiscal years. We are currently assessing the impact that SFAS 157 may have on

our results of operations and financial position.