Cisco 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 31

Management’s Discussion and Analysis of Financial Condition and Results of Operations

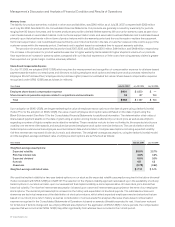

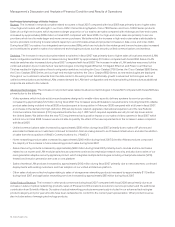

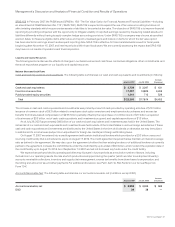

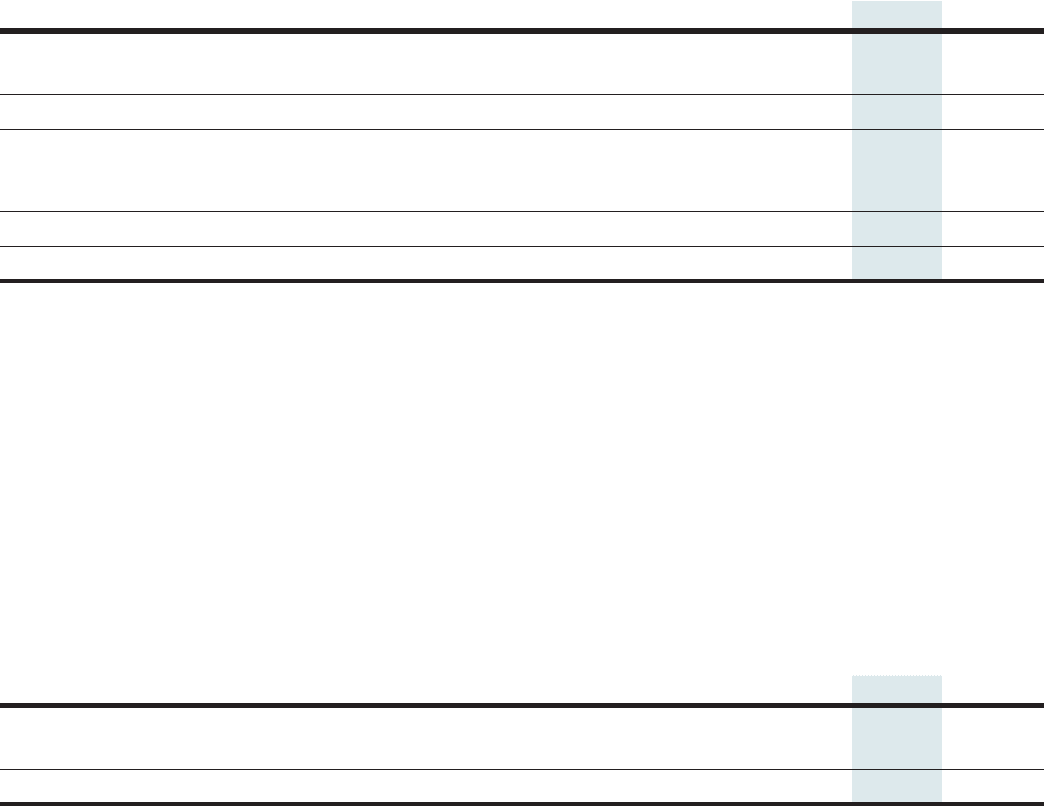

Share-Based Compensation Expense

Employee share-based compensation expense under SFAS 123(R) was as follows (in millions):

Years Ended July 28, 2007 July 29, 2006

Cost of sales—product $ 39 $ 50

Cost of sales—service 104 112

Employee share-based compensation expense in cost of sales 143 162

Research and development 289 346

Sales and marketing 392 427

General and administrative 107 115

Employee share-based compensation expense in operating expenses 788 888

Total employee share-based compensation expense(1) $ 931 $ 1,050

(1) Share-based compensation expense related to acquisitions and investments of $34 million and $87 million for fiscal 2007 and 2006, respectively, is disclosed

in Note 3 to the Consolidated Financial Statements and is not included in the above table.

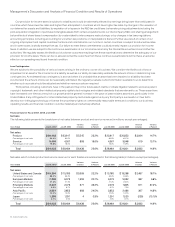

Share-based compensation expense included compensation expense for share-based payment awards granted prior to, but not yet

vested, as of July 30, 2005 based on the grant date fair value using the Black-Scholes model, and compensation expense for share-based

payment awards granted subsequent to July 30, 2005 based on the grant date fair value using the lattice-binomial model. In conjunction

with the adoption of SFAS 123(R), we changed our method of attributing the value of share-based compensation to expense from the

accelerated multiple-option approach to the straight-line single-option method. Compensation expense for all share-based payment

awards granted on or prior to July 30, 2005 is recognized using the accelerated multiple-option approach while compensation expense

for all share-based payment awards granted subsequent to July 30, 2005 is recognized using the straight-line single-option method. The

decrease in employee share-based compensation expense during fiscal 2007 compared with fiscal 2006 was consistent with the change

in the attribution method upon the adoption of SFAS 123(R).

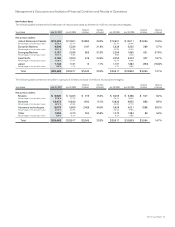

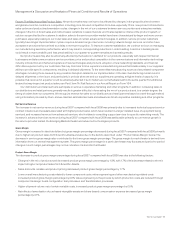

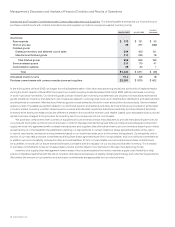

Amortization of Purchased Intangible Assets and In-Process Research and Development

The following table presents the amortization of purchased intangible assets and in-process R&D (in millions):

Years Ended July 28, 2007 July 29, 2006

Amortization of purchased intangible assets included in operating expenses $ 407 $ 393

In-process research and development 81 91

Total $ 488 $ 484

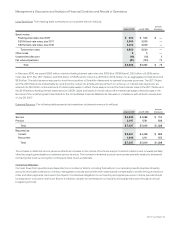

The increase in the amortization of purchased intangible assets included in operating expenses in fiscal 2007 compared with fiscal

2006 was primarily due to the additional amortization of purchased intangible assets related to Scientific-Atlanta and WebEx, partially

offset by an impairment charge of $69 million in fiscal 2006. For additional information regarding purchased intangibles, see Note 3 to

the Consolidated Financial Statements.

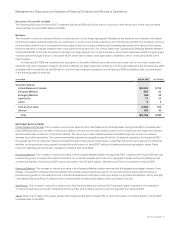

Our methodology for allocating the purchase price, relating to purchase acquisitions, to in-process R&D is determined through

established valuation techniques. See Note 3 to the Consolidated Financial Statements for additional information regarding the acquisitions

completed in fiscal 2007 and 2006 and the in-process R&D recorded for these acquisitions. In-process R&D was expensed upon

acquisition because technological feasibility had not been established and no future alternative uses existed.

The fair value of the existing purchased technology and patents, as well as the technology under development, is typically determined

using the income approach, which discounts expected future cash flows to present value. The discount rates used in the present value

calculations are typically derived from a weighted-average cost of capital analysis and venture capital surveys, adjusted upward to

reflect additional risks inherent in the development lifecycle. We consider the pricing model for products related to these acquisitions

to be standard within the high-technology communications industry. However, we do not expect to achieve a material amount of expense

reductions as a result of integrating the acquired in-process technology. Therefore, the valuation assumptions do not include significant

anticipated cost savings.