Cisco 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20 Cisco Systems, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

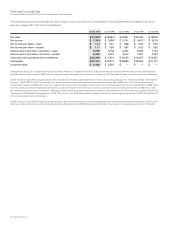

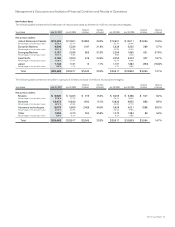

Operating Margin

In fiscal 2007, our gross margin increased in absolute dollars compared with fiscal 2006. However, our gross margin percentage decreased

compared with fiscal 2006 primarily due to increased net sales from Scientific-Atlanta, whose business model has a lower gross margin

percentage than other Cisco products. In addition, the decrease in our gross margin percentage was also due to higher sales discounts,

rebates and product pricing partially offset by higher shipment volume and lower manufacturing costs. Operating expenses in fiscal 2007

increased in absolute dollars compared with fiscal 2006, primarily due to increased investments in headcount, but decreased as a

percentage of revenue.

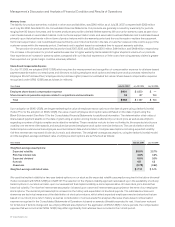

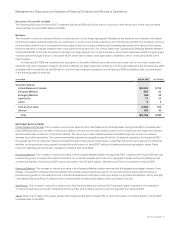

Other Financial Highlights

During fiscal 2007, we generated cash flows from operations of $10.1 billion. Our cash and cash equivalents, and investments were

$22.3 billion at the end of fiscal 2007, compared with $17.8 billion at the end of fiscal 2006. We repurchased 297 million shares of our

common stock during fiscal 2007 for $7.8 billion, and we used $3.3 billion for acquisitions, net of cash, cash equivalents, and investments

acquired. Days sales outstanding in accounts receivable (DSO) at the end of both fiscal 2007 and 2006 was 38 days. Our inventory

balance was $1.3 billion at the end of fiscal 2007, compared with $1.4 billion at the end of fiscal 2006. Annualized inventory turns were

10.3 in the fourth quarter of fiscal 2007 as compared with 8.5 in the fourth quarter of fiscal 2006. Our purchase commitments with

contract manufacturers and suppliers were $2.6 billion at the end of fiscal 2007, compared with $2.0 billion at the end of fiscal 2006.

Focus Areas

We have continued to focus particular attention on the commercial market; additional sales coverage; growing and expanding our

advanced technologies; evolving our support model; and expanding our presence in the Emerging Markets theater. We have also

continued to focus on developing a new wave of technologies, which we refer to as emerging technologies, including such products

as digital media, TelePresence, and physical security, among others. In addition to these areas, we expect to continue to focus on

next-generation service provider network build-outs, strengthening our product offerings in the consumer market, and providing more

comprehensive solutions to our customers as they employ Internet solutions.

We believe our growth was attributable to the continued deployment by customers of our end-to-end architecture and the convergence

of data, voice, video and mobility into IP networks, together with our differentiated strategy and execution. In addition, our balance across

product areas, customer markets and geographic segments contributed to our growth and strong financial position.

The investments we have made and our architectural approach are based on the belief that collaboration and “Web 2.0,” the

technologies that enable user collaboration, including such technologies as unified communications and TelePresence, and the increased

use of the network as the platform for all forms of communications and information technology will create new market opportunities for us.

As part of the second major phase of the Internet, we believe the industry is evolving as both personal and business process collaboration

and Web 2.0 help to increase innovation and productivity.

Critical Accounting Estimates

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the

United States requires us to make judgments, assumptions, and estimates that affect the amounts reported in the Consolidated Financial

Statements and accompanying notes. Note 2 to the Consolidated Financial Statements describes the significant accounting policies

and methods used in the preparation of the Consolidated Financial Statements. The accounting policies described below are significantly

affected by critical accounting estimates. Such accounting policies require significant judgments, assumptions, and estimates used in

the preparation of the Consolidated Financial Statements, and actual results could differ materially from the amounts reported based

on these policies.

Revenue Recognition

Our products are generally integrated with software that is essential to the functionality of the equipment. Additionally, we provide

unspecified software upgrades and enhancements related to the equipment through our maintenance contracts for most of our products.

Accordingly, we account for revenue in accordance with Statement of Position No. 97-2, “Software Revenue Recognition,” and all related

interpretations. For sales of products where software is incidental to the equipment, or in hosting arrangements, we apply the provisions of

Staff Accounting Bulletin No. 104, “Revenue Recognition,” and all related interpretations. Revenue is recognized when persuasive evidence

of an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectibility is reasonably assured. In instances

where final acceptance of the product, system, or solution is specified by the customer, revenue is deferred until all acceptance criteria

have been met.