Cisco 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

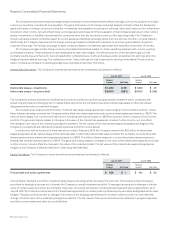

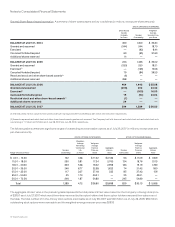

The components of the deferred tax assets and liabilities are as follows (in millions):

July 28, 2007 July 29, 2006

ASSETS

Allowance for doubtful accounts and returns $ 330 $ 290

Sales-type and direct-financing leases 111 104

Inventory write downs and capitalization 222 224

Investment provisions 245 273

In-process R&D, goodwill, and purchased intangible assets 344 473

Deferred revenue 1,056 825

Credits and net operating loss carryforwards 651 526

SFAS 123(R) share-based compensation expense 520 326

Other 766 652

Gross deferred tax assets 4,245 3,693

Valuation allowance (118) (45)

Total deferred tax assets 4,127 3,648

LIABILITIES

Purchased intangible assets (881) (695)

Unremitted earnings of foreign subsidiaries (100) (100)

Unrealized gains on investments (60) (104)

Depreciation (73) (185)

Other (71) (45)

Total deferred tax liabilities (1,185) (1,129)

Total net deferred tax assets $ 2,942 $ 2,519

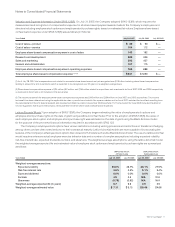

As of July 28, 2007, the Company’s federal, state, and foreign net operating loss carryforwards for income tax purposes were $381 million,

$1.9 billion, and $82 million, respectively. If not utilized, the federal net operating loss carryforwards will begin to expire in fiscal 2019, the

state net operating loss carryforwards will begin to expire in fiscal 2010, and the foreign net operating loss carryforwards will begin to expire

in fiscal 2012. As of July 28, 2007, the Company’s federal and state tax credit carryforwards for income tax purposes were approximately

$13 million and $596 million, respectively. If not utilized, the federal and state tax credit carryforwards will begin to expire in fiscal 2009.

The Company’s income taxes payable for federal, state, and foreign purposes have been reduced by the tax benefits from employee

stock options. The Company receives an income tax benefit calculated as the difference between the fair market value of the stock issued

at the time of exercise and the option price, tax effected. The net tax benefits from employee stock option transactions were $995 million,

$454 million, and $35 million for fiscal 2007, 2006, and 2005, respectively, and are reflected as an increase to additional paid-in capital in the

Consolidated Statements of Shareholders’ Equity. The Company includes only the direct tax effects of employee stock incentive plans in

calculating this increase to additional paid-in capital.

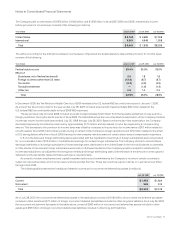

The Company’s federal income tax returns for fiscal years ended July 27, 2002 through July 31, 2004 are under examination and the

Internal Revenue Service has proposed certain adjustments. The Company believes that adequate amounts have been reserved for any

adjustments which may ultimately result from these examinations.

On October 22, 2004, the American Jobs Creation Act of 2004 (the “Jobs Creation Act”) was signed into law. The Jobs Creation Act

created a temporary incentive for U.S. corporations to repatriate accumulated income earned abroad by providing an 85 percent dividends

received deduction for certain dividends from controlled foreign corporations. In fiscal 2006, the Company distributed cash from its

foreign subsidiaries and reported an extraordinary dividend (as defined in the Jobs Creation Act) of $1.2 billion and a related tax liability

of approximately $63 million in its fiscal 2006 federal income tax return. This amount was previously provided for in the provision for

income taxes and is included in income taxes payable. This distribution does not change the Company’s intention to indefinitely reinvest

undistributed earnings of certain of its foreign subsidiaries in operations outside the United States.