Cisco 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 2007 Annual Report 21

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Contracts, Internet commerce agreements, and customer purchase orders are generally used to determine the existence of an

arrangement. Shipping documents and customer acceptance, when applicable, are used to verify delivery. We assess whether the fee

is fixed or determinable based on the payment terms associated with the transaction and whether the sales price is subject to refund or

adjustment. We assess collectibility based primarily on the creditworthiness of the customer as determined by credit checks and analysis,

as well as the customer’s payment history. When a sale involves multiple elements, such as sales of products that include services, the

entire fee from the arrangement is allocated to each respective element based on its relative fair value and recognized when revenue

recognition criteria for each element are met. The amount of product and service revenue recognized is impacted by our judgment as to

whether an arrangement includes multiple elements and, if so, whether vendor-specific objective evidence of fair value exists. Changes

to the elements in an arrangement and our ability to establish vendor-specific objective evidence for those elements could affect the

timing of the revenue recognition. Our total deferred revenue for products was $2.2 billion and $1.6 billion as of July 28, 2007 and July 29,

2006, respectively. Technical support services revenue is deferred and recognized ratably over the period during which the services are

to be performed, which is typically from one to three years. Advanced services revenue is recognized upon delivery or completion of

performance. Our total deferred revenue for services was $4.8 billion and $4.1 billion as of July 28, 2007 and July 29, 2006, respectively.

We make sales to distributors and retail partners and recognize revenue based on a sell-through method using information provided

by them. Our distributors and retail partners participate in various cooperative marketing and other programs, and we maintain estimated

accruals and allowances for these programs. If actual credits received by our distributors and retail partners for these programs were to

deviate significantly from our estimates, which are based on historical experience, our revenue could be adversely affected.

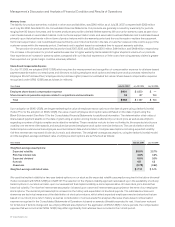

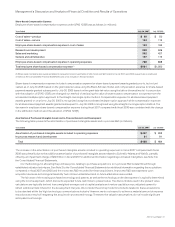

Allowance for Doubtful Accounts and Sales Returns

Our accounts receivable balance, net of allowance for doubtful accounts, was $4.0 billion and $3.3 billion as of July 28, 2007 and July 29,

2006, respectively. The allowance for doubtful accounts was $166 million, or 4.0% of the gross accounts receivable balance, as of July 28,

2007, and $175 million, or 5.0% of the gross accounts receivable balance, as of July 29, 2006. The allowance is based on our assessment

of the collectibility of customer accounts. We regularly review the allowance by considering factors such as historical experience, credit

quality, age of the accounts receivable balances, and current economic conditions that may affect a customer’s ability to pay.

Our provision for doubtful accounts was $6 million and $24 million for fiscal 2007 and 2006, respectively. We had no provision for

doubtful accounts in fiscal 2005. If a major customer’s creditworthiness deteriorates, or if actual defaults are higher than our historical

experience, or if other circumstances arise, our estimates of the recoverability of amounts due to us could be overstated, and additional

allowances could be required, which could have an adverse impact on our revenue.

A reserve for future sales returns is established based on historical trends in product return rates. The reserve for future sales returns

as of July 28, 2007 and July 29, 2006 was $74 million and $80 million, respectively, and was recorded as a reduction of our accounts

receivable. If the actual future returns were to deviate from the historical data on which the reserve had been established, our revenue

could be adversely affected.

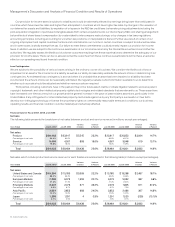

Inventory Valuation and Liability for Purchase Commitments with Contract Manufacturers and Suppliers

Our inventory balance was $1.3 billion and $1.4 billion as of July 28, 2007 and July 29, 2006, respectively. Inventory is written down based

on excess and obsolete inventories determined primarily by future demand forecasts. Inventory write downs are measured as the

difference between the cost of the inventory and market based upon assumptions about future demand, and are charged to the provision

for inventory, which is a component of our cost of sales. At the point of the loss recognition, a new, lower cost basis for that inventory is

established, and subsequent changes in facts and circumstances do not result in the restoration or increase in that newly established

cost basis.

In addition, we record a liability for firm, noncancelable, and unconditional purchase commitments with contract manufacturers and

suppliers for quantities in excess of our future demand forecasts consistent with the valuation of our excess and obsolete inventory. As of

July 28, 2007, the liability for these purchase commitments was $168 million, compared with $148 million as of July 29, 2006, and was

included in other accrued liabilities. In the third quarter of fiscal 2006, we began the initial implementation of the lean manufacturing model.

Lean manufacturing is an industry-standard model that seeks to drive efficiency and flexibility in manufacturing processes and in the

broader supply chain. We fully implemented the lean manufacturing model in the fourth quarter of fiscal 2007.

Our total provision for inventory was $214 million, $162 million, and $221 million for fiscal 2007, 2006, and 2005, respectively. The amount

recorded to cost of sales related to the liability for purchase commitments with contract manufacturers and suppliers was $34 million,

$61 million, and $12 million in fiscal 2007, 2006, and 2005, respectively. If there were to be a sudden and significant decrease in demand

for our products, or if there were a higher incidence of inventory obsolescence because of rapidly changing technology and customer

requirements, we could be required to increase our inventory write downs and our liability for purchase commitments with contract

manufacturers and suppliers, and our gross margin could be adversely affected. Inventory and supply chain management remain areas of

focus as we balance the need to maintain supply chain flexibility to help ensure competitive lead times with the risk of inventory obsolescence.