Cisco 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 67

Notes to Consolidated Financial Statements

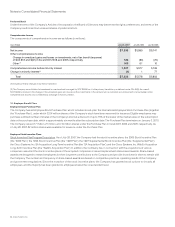

Legal Proceedings

The Company and other defendants were subject to patent claims asserted by QPSX Developments 5 Pty Ltd (now known as Ipernica Ltd)

against the Company and such other defendants on June 21, 2005 in the United States District Court for the Eastern District of Texas. QPSX

alleged that various Cisco switches and routers infringed United States Patent No. 5,689,499 and sought damages and injunctive relief.

On April 10, 2007, prior to trial, the Company and QPSX settled the dispute on terms that are not material to the Company, and the lawsuit

was dismissed with prejudice on May 2, 2007.

The Company and other defendants were subject to claims asserted by Telcordia Technologies, Inc. on July 16, 2004 in the Federal

District Court for the District of Delaware alleging that various Cisco routers, switches and optical products infringed United States Patent

Nos. 4,893,306, 4,835,763 and Re 36,633. Telcordia sought damages and injunctive relief. The Court ruled that, as a matter of law, the

Company does not infringe Patent No. 4,893,306. After conclusion of a trial, on May 10, 2007, a jury found that infringement had occurred

and awarded damages in an amount that is not material to the Company. The Company has asked the Court to reverse the verdict as a

matter of law, and if necessary, the Company intends to appeal the decision. Telcordia has asked the Court to enhance damages and award

it attorneys’ fees and also has the right to appeal. The Company believes that the ultimate outcome of this matter and aggregate potential

damages will not be material.

In September 2005, Scientific-Atlanta, Inc. (which subsequently was acquired by the Company) and another plaintiff filed a

declaratory judgment action against Forgent Networks in the United States District Court for the Eastern District of Texas after Forgent

sued various Scientific-Atlanta customers. In the action, Scientific-Atlanta asserted that its products did not infringe Forgent’s United

States Patent No. 6,285,746 and that the patent was invalid. On October 20, 2005, Forgent responded to the complaint and alleged that

various Scientific-Atlanta digital video recorders infringed the patent and sought damages and injunctive relief. Subsequent to that,

another declaratory judgment plaintiff moved to intervene and the cases were combined. On April 25, 2007, prior to trial, Scientific-Atlanta

and Forgent settled their dispute on terms that are not material to the Company, and the lawsuits were dismissed with prejudice on

April 30, 2007.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business, including

intellectual property litigation. While the outcome of these matters is currently not determinable, the Company does not expect that the

ultimate costs to resolve these matters will have a material adverse effect on its consolidated financial position, results of operations,

or cash flows.

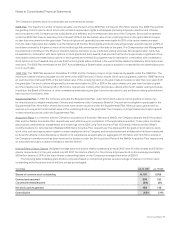

9. Shareholders’ Equity

Stock Repurchase Program

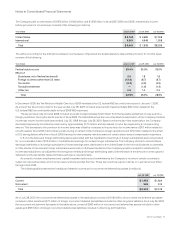

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 28, 2007, the Company’s

Board of Directors had authorized an aggregate repurchase of up to $52 billion of common stock under this program and the remaining

authorized repurchase amount was $8.8 billion with no termination date. The stock repurchase activity under the stock repurchase

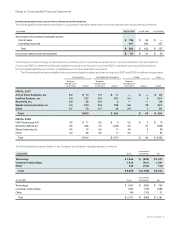

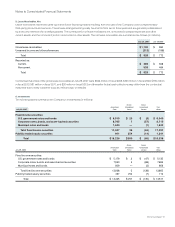

program is summarized as follows (in millions, except per-share amounts):

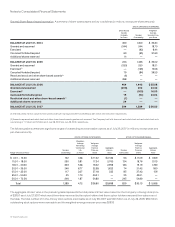

Shares

Repurchased

Weighted-

Average Price

per Share

Amount

Repurchased

Remaining

Amount

Authorized

Cumulative balance at July 30, 2005 1,496 $ 18.15 $ 27,153 $ 7,847

Additional authorization on June 7, 2006 — — — 5,000

Repurchase of common stock 435 19.07 8,295 (8,295)

Cumulative balance at July 29, 2006 1,931 $ 18.36 $ 35,448 $ 4,552

Additional authorization — — — 12,000

Repurchase of common stock(1) 297 26.12 7,781 (7,781)

Cumulative balance at July 28, 2007 2,228 $ 19.40 $ 43,229 $ 8,771

(1) Includes stock repurchases of $100 million which were settled subsequent to July 28, 2007.

The purchase price for the shares of the Company’s stock repurchased is reflected as a reduction to shareholders’ equity. In accordance

with Accounting Principles Board Opinion No. 6, “Status of Accounting Research Bulletins,” the Company is required to allocate the

purchase price of the repurchased shares as (i) a reduction to retained earnings until retained earnings are zero and then as an increase

to accumulated deficit and (ii) a reduction of common stock and additional paid-in capital. Issuance of common stock and the tax benefit

related to employee stock incentive plans are recorded as an increase to common stock and additional paid-in capital.