Cisco 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 55

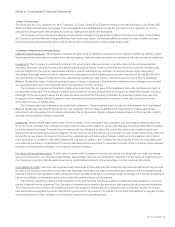

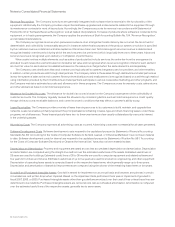

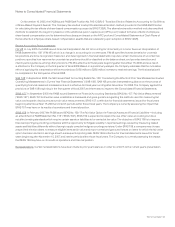

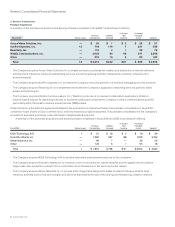

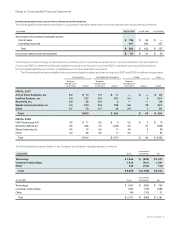

Notes to Consolidated Financial Statements

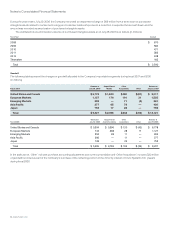

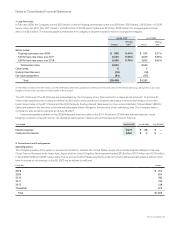

Shares Issued

Purchase

Consideration

Liabilities

Assumed

In-Process

R&D

Expense

Purchased

Intangible

Assets GoodwillFiscal 2005

Actona Technologies, Inc. — $ 90 $ 4 $ 4 $ 21 $ 66

Airespace, Inc. 2 3 447 11 3 95 337

NetSolve, Incorporated — 146 6 — 31 78

P–Cube Inc. — 213 17 6 56 150

Procket Networks, Inc. — 92 10 — 26 76

Topspin Communications, Inc. — 253 23 4 67 164

Other — 350 41 9 155 196

Total 2 3 $ 1,591 $ 112 $ 26 $ 451 $ 1,067

• The Company acquired Actona Technologies, Inc. to expand the functionality of its branch-office access routers with intelligent network

services that are designed to allow users at remote sites to access and transfer files as quickly and easily as users at headquarters sites.

The acquired technology is also designed to allow enterprises to centralize file servers and storage and better protect and manage their

remote office data.

• The Company acquired Airespace, Inc. to add to its portfolio of wireless local-area networking (WLAN) solutions and to add advanced

features and capabilities to the Company’s existing WLAN product portfolio.

• The Company acquired NetSolve, Incorporated to add remote network-management services, including real-time monitoring of IP

communications networks, network security software, and network devices, to the Company’s solutions offered to specialized resellers.

• The Company acquired P–Cube Inc. to provide additional control and management capabilities for advanced IP services, such as

identifying subscribers, classifying applications, and accurately billing for content-based services, to service providers.

• The Company acquired the intellectual property and selected other assets of, and hired a majority of the engineering team from, Procket

Networks, Inc. to add to the Company’s portfolio of intellectual property and to add a team of silicon and software architects.

• The Company acquired Topspin Communications, Inc. to add server fabric switches, a new class of server networking equipment that

is designed to help improve resource utilization and reduce equipment and management costs, to the Company’s switching product

portfolio consisting of network and storage switches.

The Consolidated Financial Statements include the operating results of each business from the date of acquisition. Pro forma results of

operations for the acquisitions, with the exception of Scientific-Atlanta, have not been presented because the effects of the acquisitions,

individually or in the aggregate, were not material to the Company’s financial results.

Acquisition of Scientific-Atlanta, Inc.

On February 24, 2006, Cisco completed the acquisition of Scientific-Atlanta, Inc., a provider of set-top boxes, end-to-end video distribution

networks, and video integration systems. Cisco believes video is emerging as the key strategic application in the service provider “triple

play” bundle of consumer entertainment, communications, and online services. Cisco believes the combined entity creates an end-to-end

solution for carrier networks and the digital home and delivers large-scale video systems to extend Cisco’s commitment to and leadership

in the service provider market.

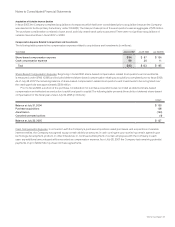

Purchase Price Allocation Pursuant to the terms of the merger agreement, the Company paid a cash amount of $43.00 per share in

exchange for each outstanding share of Scientific-Atlanta common stock and assumed each Scientific-Atlanta stock option which was

outstanding immediately prior to the effective time of the merger. Each unvested Scientific-Atlanta stock option became fully vested

immediately prior to the completion of the merger. The Scientific-Atlanta stock options assumed were converted into options to purchase

an aggregate of approximately 32.1 million shares of Cisco common stock. The total purchase price was as follows (in millions):

Amount

Cash $ 6,907

Fair value of fully vested stock options assumed 163

Acquisition-related costs 17

Total $ 7,087