Cisco 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

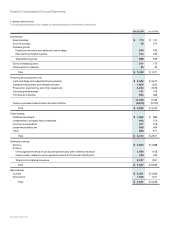

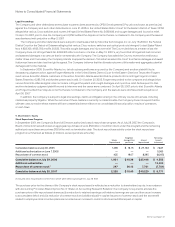

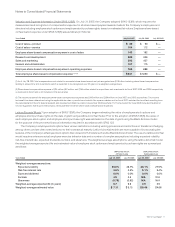

General Share-Based Award Information A summary of share-based award activity is as follows (in millions, except per-share amounts):

STOCK OPTIONS OUTSTANDING

Share-Based

Awards

Available

for Grant

Number

Outstanding

Weighted-

Average

Exercise Price

per Share

BALANCE AT JULY 31, 2004 390 1,350 $ 25.34

Granted and assumed (244) 244 18.70

Exercised — (93) 8.44

Canceled/forfeited/expired 63 (65) 31.63

Additional shares reserved 14 — —

BALANCE AT JULY 30, 2005 223 1,436 $ 25.02

Granted and assumed (230) 230 18.21

Exercised(1) — (136) 10.08

Canceled/forfeited/expired 79 (84) 29.53

Restricted stock and other share-based awards(2) (6) — —

Additional shares reserved 398 — —

BALANCE AT JULY 29, 2006 464 1,446 $ 25.08

Granted and assumed (206) 206 23.32

Exercised(1) — (309) 16.00

Canceled/forfeited/expired 19 (54) 34.04

Restricted stock and other share-based awards(2) (7) — —

Additional shares reserved 24 — —

BALANCE AT JULY 28, 2007 294 1,289 $ 26.60

(1) The total pretax intrinsic value of stock options exercised during fiscal 2007 and 2006 was $3.1 billion and $1.3 billion, respectively.

(2) Amounts represent restricted stock and other share-based awards granted and assumed. The Company had total shares of restricted stock and restricted stock units

outstanding of 11 million and 6 million as of July 28, 2007 and July 29, 2006, respectively.

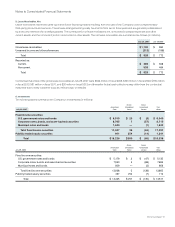

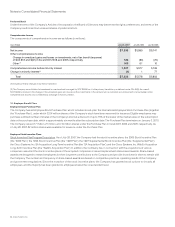

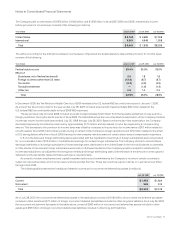

The following table summarizes significant ranges of outstanding and exercisable options as of July 28, 2007 (in millions, except years and

per-share amounts):

STOCK OPTIONS OUTSTANDING STOCK OPTIONS EXERCISABLE

Range of Exercise Prices

Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life

(in Years)

Weighted-

Average

Exercise

Price per

Share

Aggregate

Intrinsic

Value

Number

Exercisable

Weighted-

Average

Exercise

Price per

Share

Aggregate

Intrinsic

Value

$ 0.01 – 15.00 122 4.58 $ 11.02 $ 2,183 93 $ 11.09 $ 1,659

15.01 – 18.00 230 5.81 17.24 2,700 124 16.76 1,513

18.01 – 20.00 303 5.48 19.22 2,958 183 19.19 1,780

20.01 – 25.00 246 6.77 22.38 1,622 74 21.42 560

25.01 – 35.00 117 3.07 27.18 235 85 27.43 156

35.01 – 50.00 25 1.70 40.01 — 25 40.01 —

50.01 – 72.56 246 1.87 54.89 — 245 54.89 —

Total 1,289 4.72 $ 26.60 $ 9,698 829 $ 30.13 $ 5,668

The aggregate intrinsic value in the preceding table represents the total pretax intrinsic value, based on the Company’s closing stock price

of $28.97 as of July 27, 2007, which would have been received by the option holders had those option holders exercised their options as of

that date. The total number of in-the-money stock options exercisable as of July 28, 2007 was 549 million. As of July 29, 2006, 969 million

outstanding stock options were exercisable and the weighted-average exercise price was $28.53.