Cisco 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 63

Notes to Consolidated Financial Statements

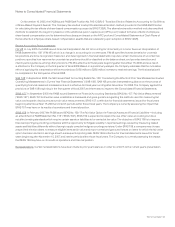

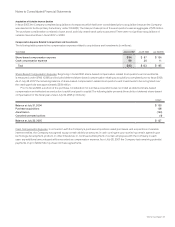

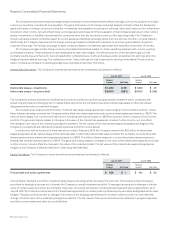

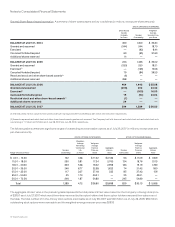

7. Long-Term Debt

In February 2006, the Company issued $500 million of senior floating interest rate notes due 2009 (the “2009 Notes”), $3.0 billion of 5.25%

senior notes due 2011 (the “2011 Notes”), and $3.0 billion of 5.50% senior notes due 2016 (the “2016 Notes”), for an aggregate principal

amount of $6.5 billion. The following table summarizes the Company’s long-term debt (in millions, except percentages):

July 28, 2007 July 29, 2006

Amount

Effective

Rate(1) Amount

Effective

Rate(1)

Senior notes:

Floating-rate notes, due 2009 $ 500 5.44% $ 500 5.27%

5.25% fixed-rate notes, due 2011 3,000 5.56% 3,000 5.39%

5.50% fixed-rate notes, due 2016 3,000 5.79% 3,000 5.62%

Total senior notes 6,500 6,500

Other notes 5 5

Unamortized discount (16) (18)

Fair value adjustment (81) (155)

Total $ 6,408 $ 6,332

(1) The effective rates for the 2011 Notes and the 2016 Notes reflect the variable rate in effect as of the period end on the interest rate swaps designated as fair value

hedges of those notes, including the amortization of the discount.

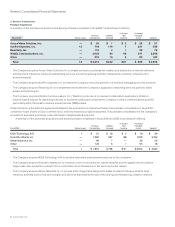

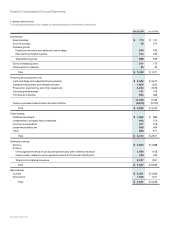

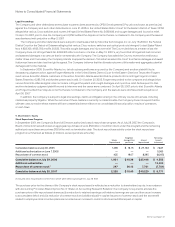

The 2011 Notes and the 2016 Notes are redeemable by the Company at any time, subject to a make-whole premium. To achieve its

interest rate objectives, the Company entered into $6.0 billion notional amount of interest rate swaps. In effect, these swaps convert the

fixed interest rates of the 2011 Notes and the 2016 Notes to floating interest rates based on the London Interbank Offered Rate (“LIBOR”).

Gains and losses in the fair value of the interest rate swaps offset changes in the fair value of the underlying debt. The Company was in

compliance with all debt covenants as of July 28, 2007.

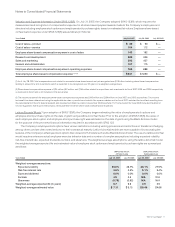

Interest is payable quarterly on the 2009 Notes and semi-annually on the 2011 Notes and 2016 Notes. Interest expense, net of

hedging, included in interest income, net, as well as cash paid for interest, are summarized as follows (in millions):

Years Ended July 28, 2007 July 29, 2006 July 30, 2005

Interest expense $ 377 $ 148 $ —

Cash paid for interest $ 361 $ 6 $ —

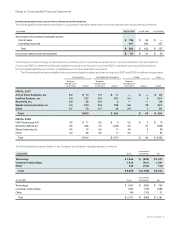

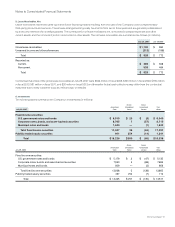

8. Commitments and Contingencies

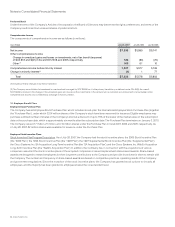

Operating Leases

The Company leases office space in several U.S. locations. Outside the United States, larger sites include Australia, Belgium, Canada,

China, France, Germany, India, Israel, Italy, Japan, and the United Kingdom. Rent expense totaled $219 million, $181 million, and $179 million

in fiscal 2007, 2006, and 2005, respectively. Future annual minimum lease payments under all noncancelable operating leases with an initial

term in excess of one year as of July 28, 2007 are as follows (in millions):

Fiscal Year Amount

2008 $ 252

2009 204

2010 180

2011 156

2012 138

Thereafter 673

Total $ 1,603