Cisco 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 39

Management’s Discussion and Analysis of Financial Condition and Results of Operations

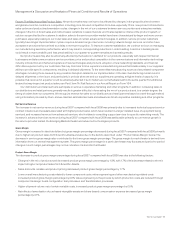

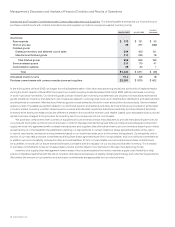

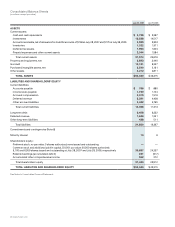

Long-Term Debt The following table summarizes our long-term debt (in millions):

July 29, 2006

Increase

(Decrease)July 28, 2007

Senior notes:

Floating-rate notes, due 2009 $ 500 $ 500 $ —

5.25% fixed-rate notes, due 2011 3,000 3,000 —

5.50% fixed-rate notes, due 2016 3,000 3,000 —

Total senior notes 6,500 6,500 —

Other notes 5 5 —

Unamortized discount (16) (18) 2

Fair value adjustment (81) (155) 74

Total $ 6,408 $ 6,332 $ 76

In February 2006, we issued $500 million of senior floating interest rate notes due 2009 (the “2009 Notes”), $3.0 billion of 5.25% senior

notes due 2011 (the “2011 Notes”), and $3.0 billion of 5.50% senior notes due 2016 (the “2016 Notes”), for an aggregate principal amount of

$6.5 billion. The debt issuance was used to fund the acquisition of Scientific-Atlanta and for general corporate purposes. The 2011 Notes

and the 2016 Notes are redeemable by us at any time, subject to a make-whole premium. To achieve our interest rate objectives, we

entered into $6.0 billion notional amount of interest rate swaps. In effect, these swaps convert the fixed interest rates of the 2011 Notes and

the 2016 Notes to floating interest rates based on LIBOR. Gains and losses in the fair value of the interest rate swaps offset changes in the

fair value of the underlying debt. See Note 8 to the Consolidated Financial Statements. We were in compliance with all debt covenants as

of July 28, 2007.

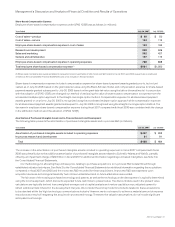

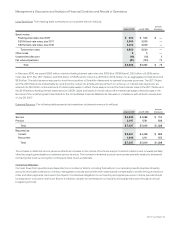

Deferred Revenue The following table presents the breakdown of deferred revenue (in millions):

July 29, 2006

Increase

(Decrease)July 28, 2007

Service $ 4,840 $ 4,088 $ 752

Product 2,197 1,561 636

Total $ 7,037 $ 5,649 $ 1,388

Reported as:

Current $ 5,391 $ 4,408 $ 983

Noncurrent 1,646 1,241 405

Total $ 7,037 $ 5,649 $ 1,388

The increase in deferred service revenue reflects an increase in the volume of technical support contract initiations and renewals partially

offset by ongoing amortization of deferred service revenue. The increase in deferred product revenue was primarily related to shipments

not having met revenue recognition criteria and other revenue deferrals.

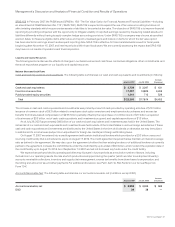

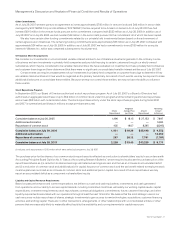

Contractual Obligations

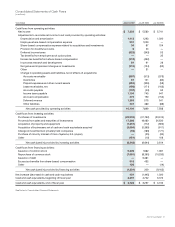

Our cash flows from operations are dependent on a number of factors, including fluctuations in our operating results, shipment linearity,

accounts receivable collections, inventory management, excess tax benefits from share-based compensation, and the timing and amount

of tax and other payments. As a result, the impact of contractual obligations on our liquidity and capital resources in future periods should

be analyzed in conjunction with such factors. In addition, we plan for and measure our liquidity and capital resources through an annual

budgeting process.