Cisco 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Cisco Systems, Inc.

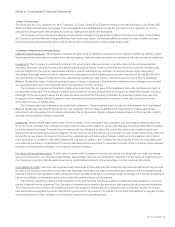

Notes to Consolidated Financial Statements

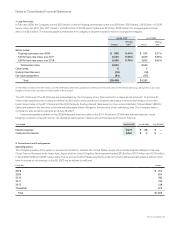

The fair value of Scientific-Atlanta stock options assumed was determined using a lattice-binomial model. The use of the lattice-binomial

model and method of determining the variables is consistent with the Company’s valuation of stock options in accordance with SFAS 123(R).

See Note 10 to the Consolidated Financial Statements.

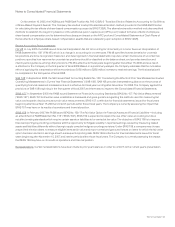

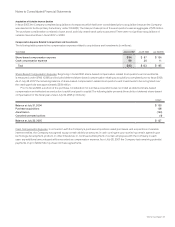

Under the purchase method of accounting, the total purchase price as shown in the table above is allocated to the tangible and

identifiable intangible assets acquired and liabilities assumed based on their estimated fair values. The excess of the purchase price over

the aggregate fair values was recorded as goodwill. The fair value assigned to identifiable intangible assets acquired is determined using

the income approach, which discounts expected future cash flows to present value using estimates and assumptions determined by

management. The acquired goodwill was assigned to each of the reportable segments. The purchase price allocation as of July 29, 2006

was as follows (in millions):

Amount

Cash and cash equivalents $ 1,747

Investments 137

Goodwill 3,762

Purchased intangible assets 1,949

Other tangible assets 746

Deferred tax liabilities, net (645)

Liabilities assumed (697)

In-process research and development 88

Total $ 7,087

The purchase price allocation in the table above does not reflect certain immaterial adjustments to the purchase price allocation prior to

the finalization of the purchase price allocation in fiscal 2007. None of the goodwill recorded as part of the Scientific-Atlanta acquisition

will be deductible for U.S. federal income tax purposes. Amortization of goodwill will be deductible for state income tax purposes in those

states in which the Company elected to step up its basis in the acquired assets.

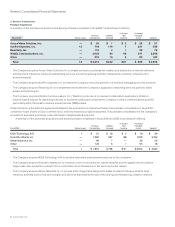

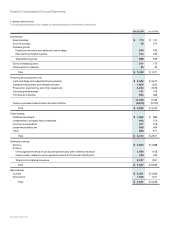

Intangible assets consist primarily of customer relationships, technology and other intangibles. The intangible assets attributable

to customer relationships relate to Scientific-Atlanta’s ability to sell existing, in-process, and future versions of its products to its existing

customers. Technology intangibles include a combination of patented and unpatented technology, trade secrets, and computer software

that represent the foundation for current and planned new products.

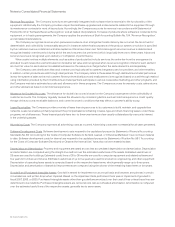

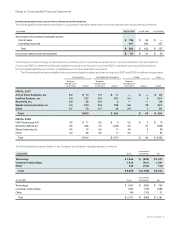

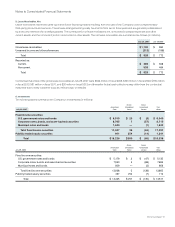

Unaudited Pro Forma Financial Information The financial information in the table below summarizes the combined results of operations

of Cisco and Scientific-Atlanta, on a pro forma basis, as though the companies had been combined as of the beginning of each of the

fiscal years presented. The unaudited pro forma financial information for fiscal 2006 combines the historical results of operations of Cisco

for fiscal 2006, which include the results of operations of Scientific-Atlanta subsequent to February 24, 2006, and the historical results of

operations of Scientific-Atlanta for the six months ended December 30, 2005 and the month ended February 24, 2006. The unaudited

pro forma financial information for fiscal 2005 combines the historical results of operations of Cisco for fiscal 2005 with the historical results

of operations of Scientific-Atlanta for its fiscal year ended July 1, 2005.

This information is presented for informational purposes only and is not indicative of the results of operations that would have been

achieved if the acquisition of Scientific-Atlanta and issuance of $6.5 billion of debt (see Note 7) had taken place at the beginning of each

of the fiscal years presented. The debt was issued to finance the acquisition of Scientific-Atlanta as well as for general corporate purposes.

For the purposes of this pro forma financial information, the interest expense on the entire debt, including the effects of hedging, were

included in the pro forma financial adjustments. The pro forma financial information for fiscal 2006 also included incremental share-based

compensation expense due to the acceleration of Scientific-Atlanta employee stock options prior to the acquisition date, investment

banking fees, and other acquisition-related costs, recorded in Scientific-Atlanta’s historical results of operations during February 2006.

In addition, the pro forma financial information for each fiscal year presented also included the purchase accounting adjustments on

historical Scientific-Atlanta inventory, adjustments to depreciation on acquired property and equipment, a charge for in-process research

and development, amortization charges from acquired intangible assets, adjustments to interest income, and related tax effects.

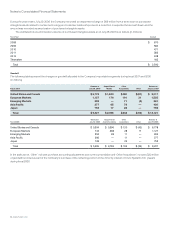

The following table summarizes the pro forma financial information (in millions, except per-share amounts):

Years Ended July 29, 2006 July 30, 2005

Net sales $ 29,632 $ 26,712

Net income $ 5,366 $ 5,406

Net income per share—basic $ 0.87 $ 0.83

Net income per share—diluted $ 0.86 $ 0.82