Cisco 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 59

Notes to Consolidated Financial Statements

Acquisition of Variable Interest Entities

In fiscal 2005, the Company completed acquisitions of companies which had been consolidated prior to acquisition because the Company

was deemed to be the primary beneficiary under FIN 46(R). The total purchase price of these acquisitions was an aggregate of $76 million.

The purchase consideration consisted of cash, stock, and fully vested stock options assumed. There were no significant acquisitions of

variable interest entities in fiscal 2007 or 2006.

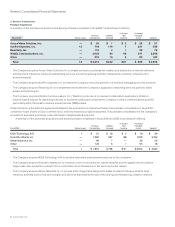

Compensation Expense Related to Acquisitions and Investments

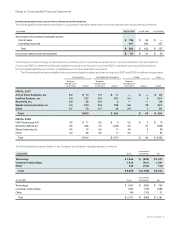

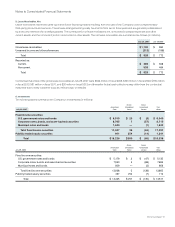

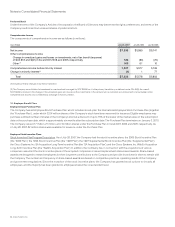

The following table presents the compensation expense related to acquisitions and investments (in millions):

Years Ended July 28, 2007 July 29, 2006 July 30, 2005

Share-based compensation expense $ 34 $ 87 $ 154

Cash compensation expense 59 36 11

Total $ 93 $ 123 $ 165

Share-Based Compensation Expense Beginning in fiscal 2006, share-based compensation related to acquisitions and investments

is measured under SFAS 123(R) and included deferred share-based compensation relating to acquisitions completed prior to fiscal 2006.

As of July 28, 2007, the remaining balance of share-based compensation related to acquisitions and investments to be recognized over

the vesting periods was approximately $309 million.

Prior to fiscal 2006, a portion of the purchase consideration for purchase acquisitions was recorded as deferred share-based

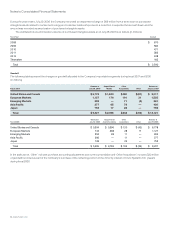

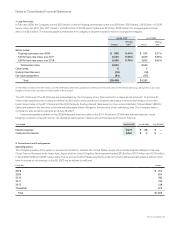

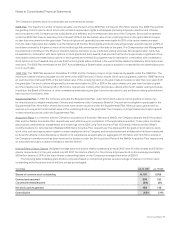

compensation and reflected as a reduction to additional paid-in capital. The following table presents the activity of deferred share-based

compensation for the fiscal year ended July 30, 2005 (in millions):

Amount

Balance at July 31, 2004 $ 153

Purchase acquisitions 128

Amortization (140)

Canceled unvested options (4)

Balance at July 30, 2005 $ 137

Cash Compensation Expense In connection with the Company’s purchase acquisitions, asset purchases, and acquisitions of variable

interest entities, the Company has agreed to pay certain additional amounts in cash contingent upon achieving certain agreed-upon

technology, development, product, or other milestones; or continued employment of certain employees with the Company. In each

case, any additional amounts paid will be recorded as compensation expense. As of July 28, 2007, the Company had remaining potential

payments of up to $209 million pursuant to these agreements.