Cisco 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report 53

Notes to Consolidated Financial Statements

On November 10, 2005, the FASB issued FASB Staff Position No. FAS 123(R)-3 “Transition Election Related to Accounting for Tax Effects

of Share-Based Payment Awards.” The Company has elected to adopt the alternative transition method provided in the FASB Staff Position

for calculating the tax effects of share-based compensation pursuant to SFAS 123(R). The alternative transition method includes simplified

methods to establish the beginning balance of the additional paid-in capital pool (“APIC pool”) related to the tax effects of employee

share-based compensation, and to determine the subsequent impact on the APIC pool and Consolidated Statements of Cash Flows of

the tax effects of employee share-based compensation awards that are outstanding upon adoption of SFAS 123(R).

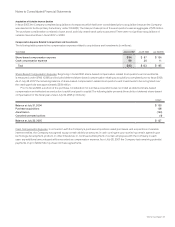

Recent Accounting Pronouncements

FIN 48 In July 2006, the FASB issued Financial Interpretation No. 48, “Accounting for Uncertainty in Income Taxes-an interpretation of

FASB Statement No. 109” (“FIN 48”), which is a change in accounting for income taxes. FIN 48 specifies how tax benefits for uncertain

tax positions are to be recognized, measured, and derecognized in financial statements; requires certain disclosures of uncertain tax

positions; specifies how reserves for uncertain tax positions should be classified on the balance sheet; and provides transition and

interim-period guidance, among other provisions. FIN 48 is effective for fiscal years beginning after December 15, 2006 and as a result,

is effective for the Company in the first quarter of fiscal 2008. Based on a preliminary analysis, the Company estimates that the cumulative

effect of applying this interpretation will be recorded as a $150 million to $250 million increase to retained earnings. The final analysis will

be completed in the first quarter of fiscal 2008.

SAB 108 In September 2006, the SEC issued Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year Misstatements when

Quantifying Misstatements in Current Year Financial Statements” (“SAB 108”). SAB 108 provides interpretative guidance on the process of

quantifying financial statement misstatements and is effective for fiscal years ending after November 15, 2006. The Company applied the

provisions of SAB 108 beginning in the first quarter of fiscal 2007 and there was no impact to the Consolidated Financial Statements.

SFAS 157 In September 2006, the FASB issued Statement of Financial Accounting Standards (SFAS) No. 157, “Fair Value Measurements”

(“SFAS 157”). SFAS 157 defines fair value, establishes a framework and gives guidance regarding the methods used for measuring fair

value, and expands disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for fiscal years

beginning after November 15, 2007, and interim periods within those fiscal years. The Company is currently assessing the impact that

SFAS 157 may have on its results of operations and financial position.

SFAS 159 In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities—Including

an amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 is expected to expand the use of fair value accounting but does

not affect existing standards which require certain assets or liabilities to be carried at fair value. The objective of SFAS 159 is to improve

financial reporting by providing companies with the opportunity to mitigate volatility in reported earnings caused by measuring related

assets and liabilities differently without having to apply complex hedge accounting provisions. Under SFAS 159, a company may choose,

at specified election dates, to measure eligible items at fair value and report unrealized gains and losses on items for which the fair value

option has been elected in earnings at each subsequent reporting date. SFAS 159 is effective for financial statements issued for fiscal

years beginning after November 15, 2007, and interim periods within those fiscal years. The Company is currently assessing the impact

that SFAS 159 may have on its results of operations and financial position.

Reclassifications Certain reclassifications have been made to prior year balances in order to conform to the current year’s presentation.