Cisco 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 Cisco Systems, Inc.

Notes to Consolidated Financial Statements

Defined Benefit Plans Assumed from Scientific-Atlanta

Upon completion of the acquisition of Scientific-Atlanta, the Company assumed certain defined benefit plans related to employee pensions.

Scientific-Atlanta had a defined benefit pension plan covering substantially all of its domestic employees, defined benefit pension plans

covering certain international employees, a restoration retirement plan for certain domestic employees, and supplemental executive

retirement plans for certain key officers, (collectively, the “Pension Plans”).

The fair value of the liabilities of these plans was determined at the July 28, 2007 and July 29, 2006 measurement dates. The fair value

determination of the liabilities reflects the Company’s intent to integrate the Scientific-Atlanta employee benefit programs with those of the

Company. As a result, no additional benefits will be accrued under the Pension Plans after February 2008.

On July 28, 2007, the Company adopted SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement

Plans, an amendment of FASB Statements No. 87, 88, 106 and 132(R).” The adoption of this statement did not have a material impact on the

Company’s Consolidated Financial Statements.

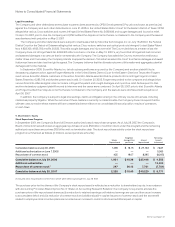

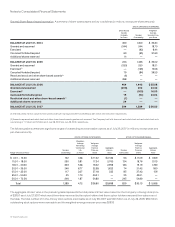

The following table sets forth projected benefit obligations, plan assets, and amounts recorded in current and long-term liabilities

under the Pension Plans (in millions):

July 28, 2007 July 29, 2006

Projected benefit obligations $ 234 $ 214

Fair value of plan assets (125) (95)

Accrued benefit liability $ 109 $ 119

The accumulated benefit obligations under the Pension Plans were $225 million and $199 million as of July 28, 2007 and July 29, 2006,

respectively.

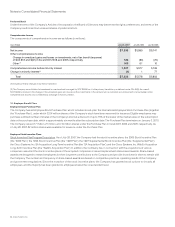

11. Income Taxes

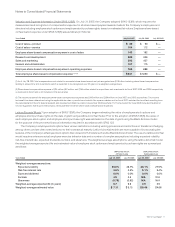

The provision for income taxes consists of the following (in millions):

Years Ended July 28, 2007 July 29, 2006 July 30, 2005

Federal:

Current $ 1,979 $ 1,877 $ 1,340

Deferred (554) (292) 497

1,425 1,585 1,837

State:

Current 344 215 496

Deferred (68) (20) (292)

276 195 204

Foreign:

Current 427 304 404

Deferred — (31) (150)

427 273 254

Total $ 2,128 $ 2,053 $ 2,295