Cisco 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Welcome to the Human Network at Work Cisco Systems, Inc. 2007 Annual Report

Table of contents

-

Page 1

Welcome to the Human Network at Work Cisco Systems, Inc. 2007 Annual Report -

Page 2

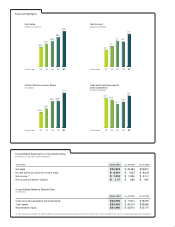

... 0.62 0.50 Fiscal Year '03 '04 '05 '06 '07 Fiscal Year '03 '04 '05 '06 '07 Consolidated Statements of Operations Data (in millions, except per-share amounts) Years Ended July 28, 2007 July 29, 2006 July 30, 2005 Net sales Income before provision for income taxes Net income (1) Net... -

Page 3

... Welcome to the network at work. Welcome to the Human Network. CONTENTS Introduction 1 Letter to Shareholders 12 Reports of Management 16 Report of Independent Registered Public Accounting Firm 17 Selected Financial Data 18 Management's Discussion and Analysis of Financial Condition and Results of... -

Page 4

... options, and wellness tips. And all the information remains highly secure and private-even while it's instantly available for sharing. In the data-rich world of modern medicine, the network is adding the power of collaboration to the caregiver's healing touch. VIDEO VIRTUAL Cisco® TelePresence... -

Page 5

... features to your set-top box. And your home network becomes your link to the connected life. INFORMATION The virtual network: making a parent/teacher conference more convenient. When one person can tap the creative energy of the entire planet. Music, video, and photos anytime, anywhere. Nations... -

Page 6

... save the environment. Cisco 7200 Series Routers are 20 times more power-efficient than previous models. Source: Cisco Corporate Citizenship Report 2006 By investing in Cisco collaboration technologies like WebEx and TelePresence, the company is committed to reducing emissions from employee travel... -

Page 7

... turn into interactive touch screens. And information analysis gives store managers keen insights into day-to-day business, so they can plan for staffing needs and streamline the supply chain. By catering to the shopper as an individual, the network is putting a smile on the face of retail. SMALL... -

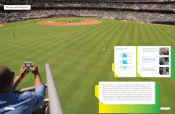

Page 8

... your handheld device to find your seat, download a program, order food and drinks without getting up, and purchase tickets for future games. View live-action and replay video on your handheld, or on high-definition screens throughout the facility. Get profiles of your favorite players and see what... -

Page 9

... market approach with the ability to tie together both technology and business architectures. Fourth, our cross-functional teamwork and prioritization of initiatives that drive execution across products, value-added services, customer segments, and geographic theaters. 12 Cisco Systems... -

Page 10

..., the commercial market remained very solid and well balanced globally. We are continuing to expand our product offerings, services, and distribution capabilities to this strategic market. These customers, which are typically small and medium-sized businesses, are increasingly embracing networking... -

Page 11

... greater scale for Scientific Atlanta products in international markets, and a stronger position for Cisco with service providers worldwide. We added approximately 11,600 employees on a net basis throughout the year. These additions drove sales in video, Emerging Markets, and market expansion in the... -

Page 12

... Financial Officer. Frank's experience directing global sales finance at Cisco is complemented by his prior background as CFO at two public companies within the technology industry. Our accomplishments and successes are built upon foundational relationships with our customers, our worldwide partners... -

Page 13

... Financial Statements, prepared in accordance with generally accepted accounting principles (GAAP), and has full responsibility for their integrity and accuracy. Management, with oversight by Cisco's Board of Directors, has established and maintains a strong ethical climate so that our affairs... -

Page 14

...and Shareholders of Cisco Systems, Inc.: We have completed integrated audits of Cisco Systems, Inc.'s consolidated financial statements and of its internal control over financial reporting as of July 28, 2007, in accordance with the standards of the Public Company Accounting Oversight Board (United... -

Page 15

...of tax, related to acquisitions and investments. There was no employee share-based compensation expense under Statement of Financial Accounting Standards No. 123, "Accounting for Stock-Based Compensation" ("SFAS 123"), prior to fiscal 2006 because the Company did not adopt the recognition provisions... -

Page 16

...or update any forward-looking statements for any reason. Overview We sell Internet Protocol (IP)-based networking and other products and services related to the communications and information technology industry. Our products and services are designed to address a wide range of customers' business... -

Page 17

..., and investments acquired. Days sales outstanding in accounts receivable (DSO) at the end of both fiscal 2007 and 2006 was 38 days. Our inventory balance was $1.3 billion at the end of fiscal 2007, compared with $1.4 billion at the end of fiscal 2006. Annualized inventory turns were 10.3 in... -

Page 18

... changing technology and customer requirements, we could be required to increase our inventory write downs and our liability for purchase commitments with contract manufacturers and suppliers, and our gross margin could be adversely affected. Inventory and supply chain management remain areas of... -

Page 19

... and recognition of compensation expense for all share-based payment awards made to our employees and directors including employee stock options and employee stock purchases related to the Employee Stock Purchase Plan ("employee stock purchase rights"), based on estimated fair values. Share-based... -

Page 20

...and extent to which the fair value has been less than our cost basis, the financial condition and near-term prospects of the investee, and our intent and ability to hold the investment for a period of time sufficient to allow for any anticipated recovery in market value. Our ongoing consideration of... -

Page 21

...on commercially reasonable terms and conditions, our business, operating results, and financial condition could be materially and adversely affected. Financial Data for Fiscal 2007, 2006, and 2005 Net Sales The following table presents the breakdown of net sales between product and service revenue... -

Page 22

... net sales for groups of similar products (in millions, except percentages): Years Ended July 28, 2007 July 29, 2006 Variance in Dollars Variance in Percent July 29, 2006 July 30, 2005 Variance in Dollars Variance in Percent Net product sales: Routers Switches Percentage of net product sales... -

Page 23

... no amortization of purchased intangible assets recorded to cost of sales in fiscal 2005. In addition, there was no employee share-based compensation expense in fiscal 2005 because we did not adopt the recognition provisions of SFAS 123. Research and Development, Sales and Marketing, and General and... -

Page 24

... to the February 2006 acquisition date, as summarized in the following table (in millions): Years Ended July 28, 2007 July 29, 2006 Scientific-Atlanta: United States and Canada European Markets Emerging Markets Asia Pacific Japan Total product sales Service Total $ 2,035 353 168 71 9 2,636... -

Page 25

... module and line card sales related to our routers and LAN modular switches as customers continued to emphasize network security, and also due to sales of our next-generation adaptive security appliance product, which integrates multiple technologies including virtual private network (VPN), firewall... -

Page 26

... mix of direct sales and indirect sales; variations in sales channels; and final acceptance criteria of the product, system, or solution as specified by the customer. In addition, sales to the service provider market have been characterized by larger and more uneven purchases, especially relating to... -

Page 27

...due to an increase in headcount-related expenses. Scientific-Atlanta contributed an additional $86 million of sales and marketing expenses for fiscal 2007 compared with fiscal 2006. Sales and marketing expenses for fiscal 2007 included employee share-based compensation expense which decreased by $35... -

Page 28

... Financial Statements and is not included in the above table. Share-based compensation expense included compensation expense for share-based payment awards granted prior to, but not yet vested, as of July 30, 2005 based on the grant date fair value using the Black-Scholes model, and compensation... -

Page 29

..., rapidly changing customer markets, uncertain standards for new products, and significant competitive threats. The nature of the efforts to develop these technologies into commercially viable products consists primarily of planning, designing, experimenting, and testing activities necessary to... -

Page 30

... base of equipment being serviced. Net Product Sales by Theater The increase in net product sales in the United States and Canada theater was due to an increase in net product sales in all of our customer markets, led by strength in the enterprise, service provider and commercial markets, and the... -

Page 31

... of home networking product sales during fiscal 2006, and the growth of our wireless and wired router businesses. Sales of video systems products of approximately $695 million in fiscal 2006 were related to Scientific-Atlanta. Application networking services and hosted small-business systems, which... -

Page 32

... and recognition of compensation expense for all share-based payment awards made to employees and directors including employee stock options and employee stock purchase rights based on estimated fair values. In fiscal 2006, employee share-based compensation expense was $1.0 billion and share-based... -

Page 33

..." ("SFAS 157"). SFAS 157 defines fair value, establishes a framework and gives guidance regarding the methods used for measuring fair value, and expands disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007... -

Page 34

... periods as a result of a number of factors, including fluctuations in our operating results, the rate at which products are shipped during the quarter (which we refer to as shipment linearity), accounts receivable collections, inventory and supply chain management, excess tax benefits from share... -

Page 35

... and retail partners and shipments to customers. Manufactured finished goods consist primarily of build-to-order and build-to-stock products. Service-related spares consist of reusable equipment related to our technical support and warranty activities. All inventories are accounted for at... -

Page 36

..., shipment linearity, accounts receivable collections, inventory management, excess tax benefits from share-based compensation, and the timing and amount of tax and other payments. As a result, the impact of contractual obligations on our liquidity and capital resources in future periods should be... -

Page 37

... to provide manufacturing services for our products. During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component supply, we enter into agreements with contract manufacturers and suppliers that either allow them to procure inventory based upon... -

Page 38

...and the tax benefit related to employee stock incentive plans are recorded as an increase to common stock and additional paid-in capital. As a result of future repurchases, we may report an accumulated deficit as a component in shareholders' equity. Liquidity and Capital Resource Requirements Based... -

Page 39

... the extent unhedged, reported as a separate component of accumulated other comprehensive income, net of tax. Fixed Income Securities At any time, a sharp rise in interest rates could have a material adverse impact on the fair value of our fixed income investment portfolio. Conversely, declines in... -

Page 40

... in total research and development, sales and marketing, and general and administrative expenses was not material in fiscal 2007. Foreign exchange forward and option contracts as of July 28, 2007 and July 29, 2006 are summarized as follows (in millions): July 28, 2007 Notional Amount Fair Value July... -

Page 41

... of interest rate swaps designated as fair value hedges of our investment portfolio. Under these interest rate swap contracts, we make fixed-rate interest payments and receive interest payments based on LIBOR. The effect of these swaps is to convert fixed-rate returns to floating-rate returns based... -

Page 42

... share-based compensation expense under Statement of Financial Accounting Standards No. 123 (revised 2004), "Share-Based Payment," ("SFAS 123(R)"). See Note 10 to the Consolidated Financial Statements for additional information. See Notes to Consolidated Financial Statements. 2007 Annual Report... -

Page 43

... Property and equipment, net Goodwill Purchased intangible assets, net Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Income taxes payable Accrued compensation Deferred revenue Other accrued liabilities Total current liabilities Long-term debt... -

Page 44

... taxes Tax benefits from employee stock option plans Excess tax benefits from share-based compensation In-process research and development Net gains and impairment charges on investments Other Change in operating assets and liabilities, net of effects of acquisitions: Accounts receivable Inventories... -

Page 45

... on investments, net of tax Other Comprehensive income Issuance of common stock Repurchase of common stock Tax benefits from employee stock incentive plans Purchase acquisitions Employee share-based compensation expense Share-based compensation expense related to acquisitions and investments BALANCE... -

Page 46

...'s customers are primarily in the enterprise, service provider, and commercial markets. The Company receives certain of its components from sole suppliers. Additionally, the Company relies on a limited number of contract manufacturers and suppliers to provide manufacturing services for its products... -

Page 47

... that stock inventory and typically sell to systems integrators, service providers, and other resellers. In addition, certain products are sold through retail partners. The Company refers to these sales through distributors and retail partners as its two-tier system of sales to the end customer... -

Page 48

... average share price for each fiscal period using the treasury stock method. Under the treasury stock method, the amount the employee must pay for exercising stock options, the amount of compensation cost for future service that the Company has not yet recognized, and the amount of tax benefits that... -

Page 49

... to employees and directors equaled the fair market value of the underlying stock at the date of grant. Share-based compensation expense recognized in the Company's Consolidated Statements of Operations for fiscal 2007 and 2006 included compensation expense for share-based payment awards granted... -

Page 50

... on items for which the fair value option has been elected in earnings at each subsequent reporting date. SFAS 159 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The Company is currently assessing the... -

Page 51

... develop networked entertainment products for the consumer. • The Company acquired Scientific-Atlanta, Inc. to create an end-to-end solution for carrier networks and the digital home and deliver large-scale video systems to extend Cisco's commitment to and leadership in the service provider market... -

Page 52

...scale video systems to extend Cisco's commitment to and leadership in the service provider market. Purchase Price Allocation Pursuant to the terms of the merger agreement, the Company paid a cash amount of $43.00 per share in exchange for each outstanding share of Scientific-Atlanta common stock and... -

Page 53

... pro forma financial information for fiscal 2006 also included incremental share-based compensation expense due to the acceleration of Scientific-Atlanta employee stock options prior to the acquisition date, investment banking fees, and other acquisition-related costs, recorded in Scientific-Atlanta... -

Page 54

... Life (in Years) OTHER WeightedAverage Useful Life (in Years) TOTAL Amount Amount Amount Amount FISCAL 2007 Arroyo Video Solutions, Inc. IronPort Systems, Inc. Reactivity, Inc. WebEx Communications, Inc. Other Total FISCAL 2006 KiSS Technology A/S Scientific-Atlanta, Inc. Sheer Networks, Inc... -

Page 55

Notes to Consolidated Financial Statements During the year ended July 29, 2006, the Company recorded an impairment charge of $69 million from a write down of purchased intangible assets related to certain technology and customer relationships due to a reduction in expected future cash flows, and the... -

Page 56

... as a reduction to additional paid-in capital. The following table presents the activity of deferred share-based compensation for the fiscal year ended July 30, 2005 (in millions): Amount Balance at July 31, 2004 Purchase acquisitions Amortization Canceled unvested options Balance at July 30, 2005... -

Page 57

... of sales Manufactured finished goods Total finished goods Service-related spares Demonstration systems Total Property and equipment, net: Land, buildings, and leasehold improvements Computer equipment and related software Production, engineering, and other equipment Operating lease assets Furniture... -

Page 58

... to Consolidated Financial Statements 5. Lease Receivables, Net Lease receivables represent sales-type and direct-financing leases resulting from the sale of the Company's and complementary third-party products and services. These lease arrangements typically have terms from two to three years and... -

Page 59

... fair value has been less than the cost basis, the financial condition and near-term prospects of the investee, and the Company's intent and ability to hold the investment for a period of time sufficient to allow for any anticipated recovery in market value. Substantially all of the Company's fixed... -

Page 60

... Leases The Company leases office space in several U.S. locations. Outside the United States, larger sites include Australia, Belgium, Canada, China, France, Germany, India, Israel, Italy, Japan, and the United Kingdom. Rent expense totaled $219 million, $181 million, and $179 million in fiscal... -

Page 61

...provide manufacturing services for its products. During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component supply, the Company enters into agreements with contract manufacturers and suppliers that either allow them to procure inventory based... -

Page 62

... year Provision for warranties issued Fair value of warranty liability acquired from Scientific-Atlanta Payments Balance at end of fiscal year $ 309 510 - (479) $ 340 $ 259 444 44 (438) $ 309 The Company accrues for warranty costs as part of its cost of sales based on associated material product... -

Page 63

...interest rate swaps designated as fair value hedges of its investment portfolio. Under these interest rate swap contracts, the Company makes fixed-rate interest payments and receives interest payments based on LIBOR. The effect of these swaps is to convert fixed-rate returns to floating-rate returns... -

Page 64

... then as an increase to accumulated deficit and (ii) a reduction of common stock and additional paid-in capital. Issuance of common stock and the tax benefit related to employee stock incentive plans are recorded as an increase to common stock and additional paid-in capital. 2007 Annual Report 67 -

Page 65

...the Cisco Systems, Inc. WebEx Acquisition Long-Term Incentive Plan (the "WebEx Acquisition Plan"). In addition, the Company has, in connection with the acquisitions of various companies, assumed the stock incentive plans of the acquired companies or issued replacement share-based awards. Share-based... -

Page 66

...exercise price equal to the fair market value of the underlying stock on the grant date. The Company no longer makes stock option grants or direct share issuances under the Supplemental Plan. Acquisition Plans In connection with the Company's acquisitions of Scientific-Atlanta and WebEx, the Company... -

Page 67

... Financial Statements General Share-Based Award Information A summary of share-based award activity is as follows (in millions, except per-share amounts): STOCK OPTIONS OUTSTANDING Share-Based Awards Available for Grant WeightedAverage Exercise Price per Share Number Outstanding BALANCE... -

Page 68

... directors including employee stock options and employee stock purchase rights, based on estimated fair values. Employee share-based compensation expense under SFAS 123(R) was as follows (in millions): Years Ended July 28, 2007 July 29, 2006 July 30, 2005 Cost of sales-product Cost of sales-service... -

Page 69

... forma information regarding option grants made to the Company's employees and directors and employee stock purchases is as follows (in millions, except per-share amounts): Year Ended July 30, 2005 Net income-as reported Share-based compensation expense Tax benefit Share-based compensation expense... -

Page 70

.../willing seller market transaction. Employee 401(k) Plans The Company sponsors the Cisco Systems, Inc. 401(k) Plan (the "Plan") to provide retirement benefits for its employees. As allowed under Section 401(k) of the Internal Revenue Code, the Plan provides for tax-deferred salary contributions for... -

Page 71

... July 29, 2006 measurement dates. The fair value determination of the liabilities reflects the Company's intent to integrate the Scientific-Atlanta employee benefit programs with those of the Company. As a result, no additional benefits will be accrued under the Pension Plans after February 2008. On... -

Page 72

... 2006 included a benefit of approximately $124 million from the favorable settlement of a tax audit in a foreign jurisdiction. During the fourth quarter of fiscal 2005, the Internal Revenue Service completed its examination of the Company's federal income tax returns for the fiscal years ended July... -

Page 73

... includes only the direct tax effects of employee stock incentive plans in calculating this increase to additional paid-in capital. The Company's federal income tax returns for fiscal years ended July 27, 2002 through July 31, 2004 are under examination and the Internal Revenue Service has proposed... -

Page 74

... Financial Statements 12. Segment Information and Major Customers The Company's operations involve the design, development, manufacturing, marketing, and technical support of networking and other products and services related to the communications and information technology industry. Cisco products... -

Page 75

... Financial Statements The Company refers to some of its products and technologies as advanced technologies. As of July 28, 2007, the Company had identified the following advanced technologies for particular focus: application networking services, home networking, hosted small-business systems... -

Page 76

...$ 6,550 $ 4,410 $ 1,261 $ 0.20 $ 0.20 $ 13,490 Stock Market Information Cisco common stock is traded on the NASDAQ Global Select Market under the symbol CSCO. The following table lists the high and low sales prices for each period indicated: 2007 Fiscal High Low High 2006 Low First quarter Second... -

Page 77

... stock trades on the NASDAQ Global Select Market under the ticker symbol CSCO. Investor Relations For further information about Cisco, additional copies of this report, Form 10-K, or other financial information without charge, contact: Investor Relations Cisco Systems, Inc. 170 West Tasman Drive San... -

Page 78

... employees. Learn more at www.cisco.com. WORLDWIDE OFFICES Americas Headquarters San Jose, California, USA Asia Pacific Headquarters Singapore Europe Headquarters Amsterdam, Netherlands Cisco has more than 200 offices worldwide. Addresses, phone numbers, and fax numbers are listed on the Cisco... -

Page 79

Printed on recycled paper. Lit# 932000707 • SKU# 1026-AR-07