Cisco 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

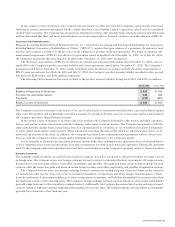

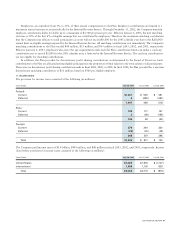

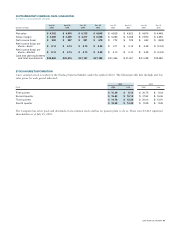

Property and equipment information is based on the physical location of the assets. The following table presents property and

equipment information for geographic areas (in millions):

July 26, 2003 July 27, 2002 July 28, 2001

Property and equipment, net:

United States $3,264 $3,555 $ 1,966

International 457 547 625

Total $3,721 $4,102 $ 2,591

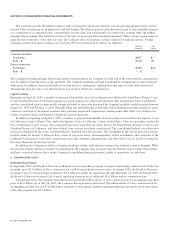

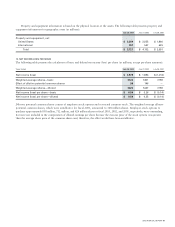

13. NET INCOME (LOSS) PER SHARE

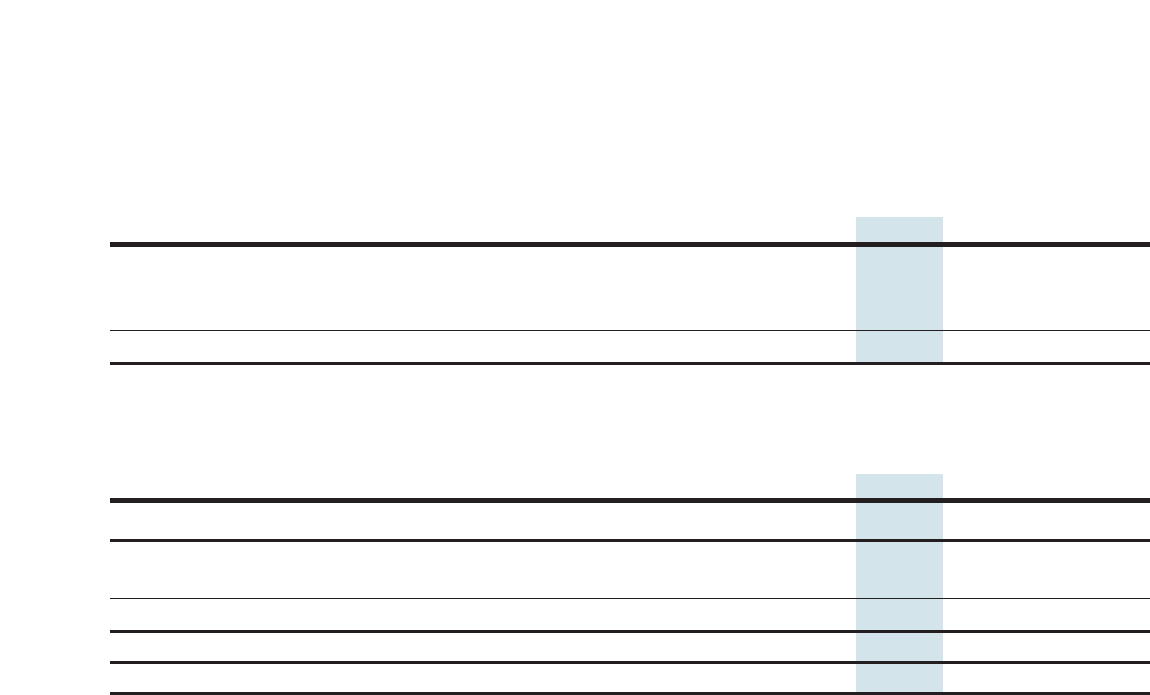

The following table presents the calculation of basic and diluted net income (loss) per share (in millions, except per-share amounts):

Years Ended July 26, 2003 July 27, 2002 July 28, 2001

Net income (loss) $3,578 $1,893 $ (1,014)

Weighted-average shares—basic 7,124 7,301 7,196

Effect of dilutive potential common shares 99 146 —

Weighted-average shares—diluted 7,223 7,447 7,196

Net income (loss) per share—basic $0.50 $0.26 $ (0.14)

Net income (loss) per share—diluted $0.50 $0.25 $ (0.14)

Dilutive potential common shares consist of employee stock options and restricted common stock. The weighted-average dilutive

potential common shares, which were antidilutive for fiscal 2001, amounted to 348 million shares. Employee stock options to

purchase approximately 838 million, 712 million, and 426 million shares in fiscal 2003, 2002, and 2001, respectively, were outstanding,

but were not included in the computation of diluted earnings per share because the exercise price of the stock options was greater

than the average share price of the common shares and, therefore, the effect would have been antidilutive.

2003 ANNUAL REPORT 61