Cisco 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

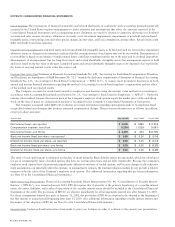

3. BUSINESS COMBINATIONS

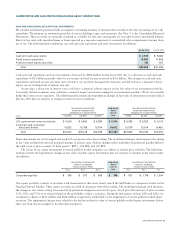

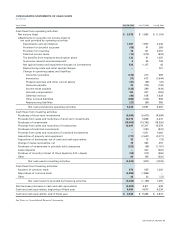

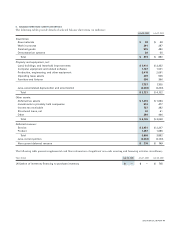

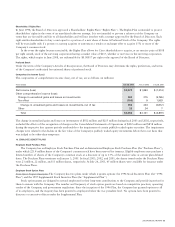

A summary of the purchase acquisitions completed during fiscal 2003 is as follows (in millions):

Purchased

Shares Purchase Assumed In-Process Intangible

Acquisition Issued Consideration Liabilities R&D Expense Goodwill Assets

AYR Networks, Inc. 9 $ 96 $ 1 $ — $ 59 $ —

Okena, Inc. 9 152 8 3 96 45

Psionic Software, Inc. 1 11 2 — 8 5

SignalWorks, Inc. 1 16 2 1 9 4

The Linksys Group, Inc. 29 480 111 — 221 114

Total 49 $755 $124 $ 4 $393 $ 168

The Company completed five acquisitions during fiscal 2003. During the first quarter of fiscal 2003, the Company completed the

acquisition of AYR Networks, Inc. to augment the continued evolution of Cisco IOS Software, the network systems software for the

Company’s routing and switching platforms. During the second quarter of fiscal 2003, the Company completed the acquisition of

Psionic Software, Inc. to complement its continued development of network security software in the vulnerability assessment and

management security services areas. During the third quarter of fiscal 2003, the Company completed the acquisition of Okena, Inc. to

further enhance its security portfolio of network-integrated solutions and appliances for virtual private networks (VPNs), firewalling,

intrusion protection, and security management. During the fourth quarter of fiscal 2003, the Company completed the acquisition of

SignalWorks, Inc. and acquired the business of The Linksys Group, Inc. SignalWorks is a developer of software that delivers audio

capabilities for the Company’s IP phones and IP telephony systems. The acquisition of the business of Linksys enables the Company

to provide wired and wireless products for consumers and small-office/home-office (SOHO) users.

The purchase consideration for each of the Company’s acquisitions was also allocated to tangible assets and deferred stock-based

compensation. Deferred stock-based compensation represents the intrinsic value of the unvested portion of the restricted shares exchanged

or options assumed and is amortized as compensation cost over the remaining future vesting period of the restricted shares exchanged

or stock options assumed of each acquired company. The balance for deferred stock-based compensation is reflected as a debit to

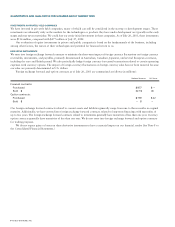

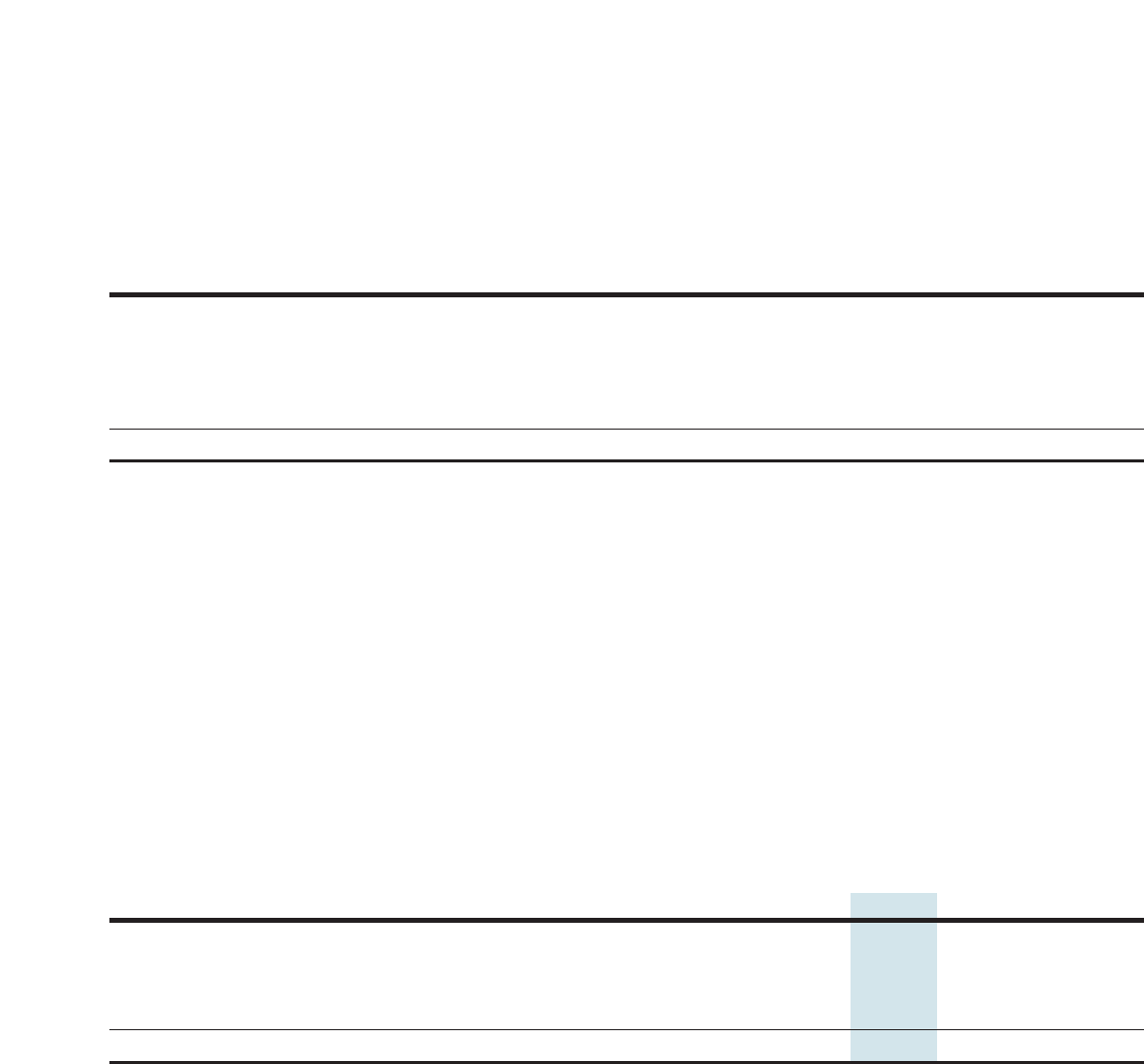

additional paid-in capital in the Consolidated Statements of Shareholders’ Equity. The following table provides a summary of the activity

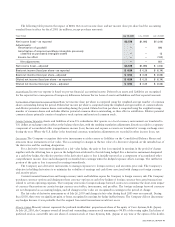

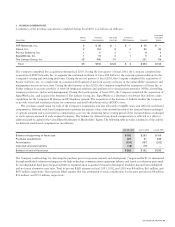

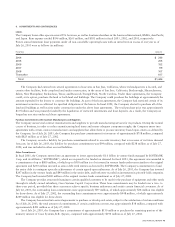

for deferred stock-based compensation (in millions):

July 26, 2003 July 27, 2002 July 28, 2001

Balance at beginning of fiscal year $182 $293 $ 109

Purchase acquisitions 227 91 446

Amortization (131) (187) (262)

Canceled unvested options (16) (15) —

Balance at end of fiscal year $262 $182 $293

The Company’s methodology for allocating the purchase price to in-process research and development (“in-process R&D”) is determined

through established valuation techniques in the high-technology communications equipment industry and based on valuations performed

by an independent third party. In-process R&D is expensed upon acquisition because technological feasibility has not been established

and no future alternative uses exist. Total in-process R&D expense in fiscal 2003, 2002, and 2001 was $4 million, $65 million, and

$855 million, respectively. The in-process R&D expense that was attributable to stock consideration for the same periods was $4 million,

$53 million, and $739 million, respectively.

2003 ANNUAL REPORT 43