Cisco 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 ANNUAL REPORT 3

“WE CONTINUED TO ACHIEVE SOME OF THE BEST RESULTS IN OUR COMPANY’S

HISTORY WHILE MAINTAINING A PASSIONATE FOCUS ON MEETING THE NEEDS

OF OUR CUSTOMERS, PARTNERS, INVESTORS, AND EMPLOYEES.”

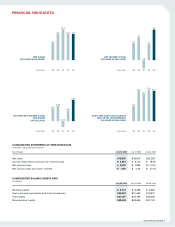

In fiscal 2003, we continued to be very active with our

share repurchase program. During fiscal 2003, we repur-

chased approximately $6 billion or 424 million shares of

our stock at an average price of $14.10. Our cumulative

purchases since the inception of the repurchase program

were approximately $7.8 billion, or 548 million shares at

an average price of $14.29, leaving a remaining approved

repurchase amount of approximately $5.2 billion at the

end of fiscal 2003.

Moving forward, we have articulated three long-term

financial priorities for Cisco. First, we must continue to

seek out profitable growth opportunities while supporting

Cisco’s current goal of 20 percent pro forma profit after

tax margins. Second, we must continue to improve our

productivity, as measured in terms of operating expense

as a percentage of revenue. And finally, we must maintain

our healthy and conservative balance sheet, including

strong liquidity, low days sales outstanding (DSO), and

inventory turns in line with our stated goals of 7 to 8 turns.

We continue to evaluate the most effective use of our

cash. Today, we believe the share repurchase program,

along with ongoing strategic investments and a strong

cash balance, are in the best interest of our shareholders.

As we enter into the next fiscal year, we are absolutely

focused on providing an attractive return on investment to

our shareholders, and we intend to do so while maintaining

the highest standards of integrity, including accurate,

timely, and transparent financial reporting.

MARKET PERFORMANCE AND GROWTH OPPORTUNITIES

In terms of Cisco’s business, we are focused on three broad

areas to drive growth: our core technologies, routing and

switching; the service provider market; and our Advanced

Technology markets. While we participate in four key

markets—enterprise, service provider, commercial, and

consumer—the service provider area provides the greatest

potential to utilize Cisco products and services. We believe

our core technologies and Advanced Technologies will also

drive growth through all of our key markets. We achieved

solid results in fiscal 2003 within these areas, and have

built a strong foundation for growth in fiscal 2004.

First, in routing and switching, we sustained our technology

leadership through performance enhancements and by

providing industry-leading solutions to our customers.

During the fiscal year, we introduced many new products

that combined significant performance enhancements with

price reductions, ensuring a balance of customer success,

Cisco’s profitability, and our leadership in the marketplace.

Second, we made important progress with our service

provider customer base in all of our key geographies,

despite a challenging capital spending environment. In

a market that has contracted, we executed well and are

pleased with our resource investment, expanding customer

partnerships, and key technology and architectural wins.

Our investments and commitments in the service provider

market over the last two to three years, and the results they

are yielding, continue to meet and exceed our expectations.