Cisco 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Amortization of Purchased Intangible Assets

Amortization of purchased intangible assets included in operating expenses was $699 million in fiscal 2002, compared with $365 million

in fiscal 2001. The increase in the amortization of purchased intangible assets was primarily related to additional amortization from

acquisitions, accelerated amortization for certain technology and patent intangibles due to a reduction in their estimated useful lives,

and a write-down of certain technology and patent intangibles. This write-down totaled $159 million and was due to the continued

downturn in the optical market primarily related to the reduced demand for long-haul products, resulting in a significant adverse

impact on the expected future cash flows of these purchased intangible assets.

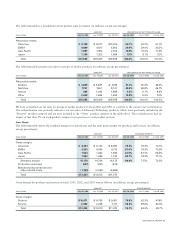

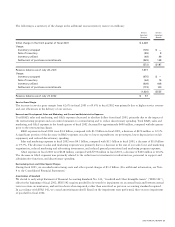

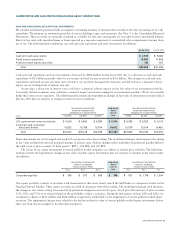

In-Process Research and Development

In-process R&D expense in fiscal 2002 was $65 million, compared with $855 million in fiscal 2001. (See Note 3 to the Consolidated

Financial Statements for additional information regarding the acquisitions completed in fiscal 2002 and 2001 and the in-process R&D

recorded for each acquisition.) The following table summarizes the key assumptions underlying the valuations for our significant purchase

acquisitions completed in fiscal 2002 and 2001 (in millions, except percentages):

Estimated Cost to Risk-Adjusted

In-Process Complete Technology at Discount Rate for

Acquisition R&D Expense Time of Acquisition In-Process R&D

FISCAL 2002

Allegro Systems, Inc. $ 28 $ 5 52.5%

AuroraNetics, Inc. $ 9 $ 2 35.0%

Hammerhead Networks, Inc. $ 27 $ 2 23.0%

Navarro Networks, Inc. $ 1 $ 1 23.0%

FISCAL 2001

Active Voice Corporation $ 37 $ 5 40.0%

IPCell Technologies, Inc. $ 75 $ 10 30.0%

IPmobile, Inc. $181 $15 42.5%

NuSpeed, Inc. $164 $ 6 40.0%

PixStream Incorporated $ 67 $ 2 35.0%

Radiata, Inc. $ 29 $ 3 30.0%

Interest Income

Interest income was $895 million in fiscal 2002, compared with $967 million in fiscal 2001. The decrease in interest income was

primarily due to lower average interest rates.

Other Income (Loss), Net

Other income (loss), net was ($1.1) billion in fiscal 2002, compared with $163 million in fiscal 2001. The net loss in fiscal 2002

included a charge of $858 million recorded in the first quarter related to the impairment of certain publicly traded equity securities

in our investment portfolio. This impairment charge was due to the decline in the fair value of our publicly traded equity investments

below the cost basis that was judged to be other-than-temporary.

Provision for Income Taxes

The effective tax rate was 30.1% for fiscal 2002 and (16.0%) for fiscal 2001. The effective tax rate differs from the statutory rate

primarily due to the impact of nondeductible in-process R&D, acquisition-related costs, research and experimentation tax credits,

state taxes, and the tax impact of non-U.S. operations.

RECENT ACCOUNTING PRONOUNCEMENT

Financial Accounting Standards Board Interpretation No. 46, “Consolidation of Variable Interest Entities” (“FIN 46”), was issued in

January 2003. FIN 46 requires that if an entity is the primary beneficiary of a variable interest entity, the assets, liabilities, and results of

operations of the variable interest entity should be included in the Consolidated Financial Statements of the entity. The provisions of

FIN 46 are effective immediately for all arrangements entered into after January 31, 2003. For those arrangements entered into prior to

January 31, 2003, the provisions of FIN 46 are required to be adopted at the beginning of the first interim or annual period beginning

after June 15, 2003. (For additional information regarding variable interest entities and the impact of the adoption of FIN 46, see

Note 8 to the Consolidated Financial Statements.)

28 CISCO SYSTEMS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS