Cisco 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

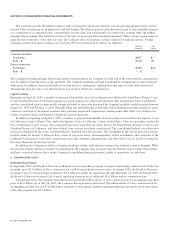

The Company periodically hedges foreign currency forecasted transactions related to certain operating expenses with currency

options. These transactions are designated as cash flow hedges. The effective portion of the derivative’s gain or loss is initially reported

as a component of accumulated other comprehensive income (loss) and subsequently reclassified into earnings when the hedged

exposure affects earnings. The ineffective portion of the gain or loss is reported in earnings immediately. These currency option contracts

generally have maturities of less than one year. The Company does not purchase currency options for trading purposes. Foreign

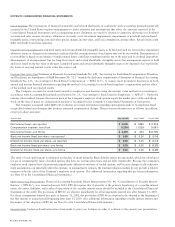

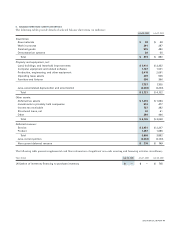

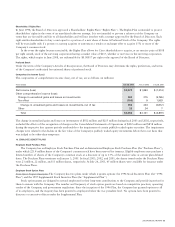

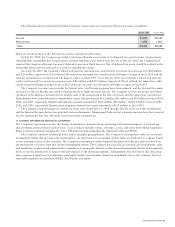

exchange forward and option contracts as of July 26, 2003 are summarized as follows (in millions):

Notional Fair

Amount Value

Forward contracts:

Purchased $877 $ —

Sold $ 527 $ (6)

Option contracts:

Purchased $759 $ 22

Sold $ —$ —

The Company’s foreign exchange forward and option contracts expose the Company to credit risk to the extent that the counterparties

may be unable to meet the terms of the agreement. The Company minimizes such risk by limiting its counterparties to major financial

institutions. In addition, the potential risk of loss with any one counterparty resulting from this type of credit risk is monitored.

Management does not expect any material losses as a result of default by counterparties.

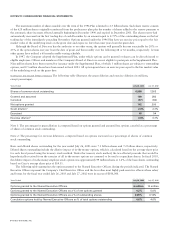

Legal Proceedings

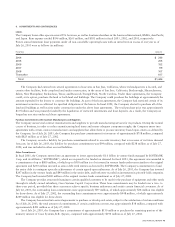

Beginning on April 20, 2001, a number of purported shareholder class action lawsuits were filed in the United States District Court

for the Northern District of California against Cisco and certain of its officers and directors. The lawsuits have been consolidated,

and the consolidated action is purportedly brought on behalf of those who purchased the Company’s publicly traded securities between

August 10, 1999 and February 6, 2001. Plaintiffs allege that defendants have made false and misleading statements, purport to assert

claims for violations of the federal securities laws, and seek unspecified compensatory damages and other relief. Cisco believes the

claims are without merit and intends to defend the actions vigorously.

In addition, beginning on April 23, 2001, a number of purported shareholder derivative lawsuits were filed in the Superior Court

of California, County of Santa Clara, and in the Superior Court of California, County of San Mateo. There is a procedure in place for

the coordination of such actions. Two purported derivative suits have also been filed in the United States District Court for the

Northern District of California, and those federal court actions have been consolidated. The consolidated federal court derivative

action was dismissed by the court, and plaintiffs have appealed from that decision. The complaints in the various derivative actions

include claims for breach of fiduciary duty, waste of corporate assets, mismanagement, unjust enrichment, and violations of the

California Corporations Code; seek compensatory and other damages, disgorgement, and other relief; and are based on essentially

the same allegations as the class actions.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business. While

the outcome of these matters is currently not determinable, the Company does not expect that the ultimate costs to resolve these matters

will have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows.

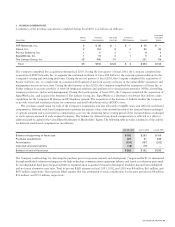

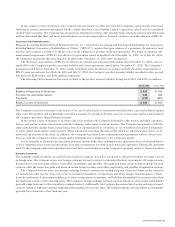

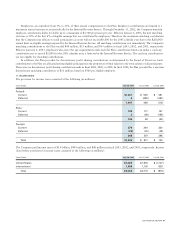

9. SHAREHOLDERS’ EQUITY

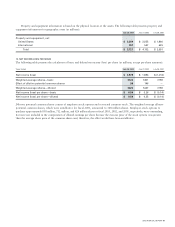

Stock Repurchase Program

In September 2001, the Board of Directors authorized a stock repurchase program to acquire outstanding common stock. Under the

program, up to $3.0 billion of Cisco common stock could be repurchased over two years. In August 2002, the Board of Directors

increased Cisco’s stock repurchase program by $5.0 billion available for repurchase through September 12, 2003. In March 2003,

the Board of Directors increased Cisco’s stock repurchase program by an additional $5.0 billion with no termination date.

During fiscal 2003, the Company repurchased and retired 424 million shares of Cisco common stock for an aggregate purchase

price of $6.0 billion. As of July 26, 2003, the Company has repurchased and retired 548 million shares of Cisco common stock for

an aggregate purchase price of $7.8 billion since inception of the program, and the remaining authorized amount for stock repurchases

under this program was $5.2 billion.

52 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS