Cisco 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

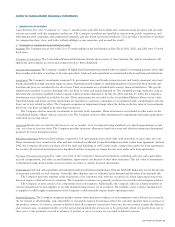

When a sale involves multiple elements, such as sales of products that include services, the entire fee from the arrangement is

allocated to each respective element based on its relative fair value and recognized when revenue recognition criteria for each element

are met. Fair value for each element is established based on the sales price charged when the same element is sold separately.

The Company makes sales to two-tier distribution channels and recognizes revenue to two-tier distributors based on a sell-through

method utilizing information provided by its distributors. These distributors are given business terms to return a portion of inventory,

receive credits for changes in selling prices, and participate in various cooperative marketing programs. The Company maintains estimated

accruals and allowances for such exposures. The Company accrues for warranty costs, sales returns, and other allowances based on

its historical experience.

Lease Receivables The Company provides a variety of lease financing services to its customers to build, maintain, and upgrade their

networks. Lease receivables primarily represent the principal balance remaining in sales-type and direct-financing leases under these

programs, net of reserves. These leases typically have two- to three-year terms and are usually collateralized by a security interest in

the underlying assets.

Advertising Costs The Company expenses all advertising costs as incurred.

Software Development Costs Software development costs required to be capitalized pursuant to Statement of Financial Accounting

Standards No. 86, “Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed,” have not been

material to date. Software development costs for internal use required to be capitalized pursuant to Statement of Position No. 98-1,

“Accounting for the Costs of Computer Software Developed or Obtained for Internal Use,” have also not been material to date.

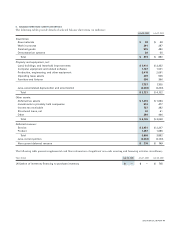

Depreciation and Amortization Property and equipment are stated at cost less accumulated depreciation and amortization. Depreciation and

amortization are computed using the straight-line method over the estimated useful lives of the assets. Estimated useful lives of 25 years

are used for buildings. Estimated useful lives of 30 to 36 months are used for computer equipment and related software and five years

for furniture and fixtures. Estimated useful lives of up to five years are used for production, engineering, and other equipment.

Depreciation of operating lease assets is computed based on the respective lease terms, which range up to three years. Depreciation

and amortization of leasehold improvements are computed using the shorter of the remaining lease terms or five years.

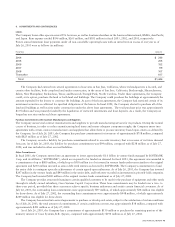

Goodwill and Purchased Intangible Assets In July 2001, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (“SFAS 142”). SFAS 142 requires goodwill to be tested for

impairment on an annual basis and between annual tests in certain circumstances, and written down when impaired, rather than being

amortized as previous accounting standards required. Furthermore, SFAS 142 requires purchased intangible assets other than goodwill

to be amortized over their useful lives unless these lives are determined to be indefinite.

SFAS 142 was effective for fiscal years beginning after December 15, 2001; however, the Company elected to early adopt the

accounting standard effective the beginning of fiscal 2002. In accordance with SFAS 142, the Company ceased amortizing goodwill

totaling $3.2 billion as of the beginning of fiscal 2002, including $55 million of acquired workforce intangible previously classified as

purchased intangible assets, net of related deferred tax liabilities. Based on the impairment tests performed using independent third-party

valuations, there was no impairment of goodwill in fiscal 2003 and 2002. There can be no assurance that future goodwill impairment

tests will not result in a charge to earnings.

Purchased intangible assets are carried at cost less accumulated amortization. Amortization is computed over the estimated useful

lives of the respective assets, generally two to five years.

40 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS