Cisco 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

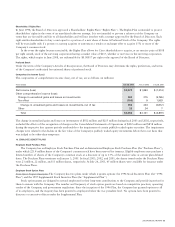

Employees can contribute from 1% to 25% of their annual compensation to the Plan. Employee contributions are limited to a

maximum annual amount as set periodically by the Internal Revenue Service. Through December 31, 2002, the Company matched

employee contributions dollar for dollar up to a maximum of $1,500 per person per year. Effective January 1, 2003, the new matching

structure is 50% of the first 6% of eligible earnings that are contributed by employees. Therefore, the maximum matching contribution

that the Company may allocate to each participant’s account will not exceed $6,000 for the 2003 calendar year due to the $200,000

annual limit on eligible earnings imposed by the Internal Revenue Service. All matching contributions vest immediately. The Company’s

matching contributions to the Plan totaled $40 million, $35 million, and $45 million in fiscal 2003, 2002, and 2001, respectively.

Effective January 1, 2003, employees who meet the age requirements and reach the Plan contribution limits can make a catch-up

contribution not to exceed $2,000 for the 2003 calendar year, a limit set by the Internal Revenue Service. The catch-up contributions

are not eligible for matching contributions.

In addition, the Plan provides for discretionary profit sharing contributions as determined by the Board of Directors. Such

contributions to the Plan are allocated among eligible participants in the proportion of their salaries to the total salaries of all participants.

There were no discretionary profit sharing contributions made in fiscal 2003, 2002, or 2001. In fiscal 2002, the Plan provided for a one-time

discretionary matching contribution of $11 million, based on $500 per eligible employee.

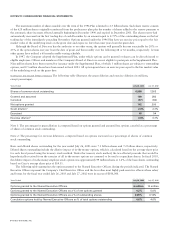

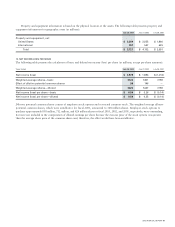

11. INCOME TAXES

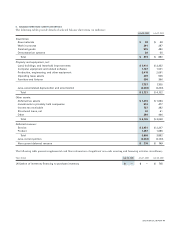

The provision for income taxes consisted of the following (in millions):

Years Ended July 26, 2003 July 27, 2002 July 28, 2001

Federal:

Current $1,041 $929 $ 581

Deferred 6(480) (697)

1,047 449 (116)

State:

Current 138 11 7 1 57

Deferred 2(68) (199)

140 49 (42)

Foreign:

Current 270 344 326

Deferred (22) (25) (28)

248 319 298

Total $1,435 $817 $140

The Company paid income taxes of $1.4 billion, $909 million, and $48 million in fiscal 2003, 2002, and 2001, respectively. Income

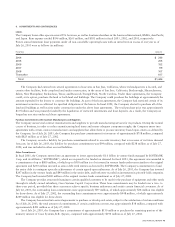

(loss) before provision for income taxes consisted of the following (in millions):

Years Ended July 26, 2003 July 27, 2002 July 28, 2001

United States $3,325 $1,550 $ (1,727)

International 1,688 1,160 853

Total $5,013 $2,710 $ (874)

2003 ANNUAL REPORT 57