Cisco 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

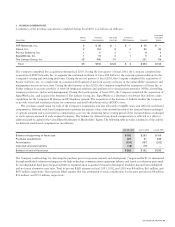

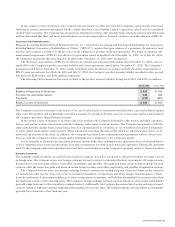

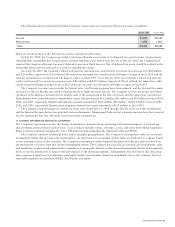

In the ordinary course of business, the Company has investments in other privately held companies and provides structured

financing to certain customers through its wholly owned subsidiary, Cisco Systems Capital Corporation, which may be considered

variable interest entities. The Company has evaluated its investments in these other privately held companies and structured financings

and has determined that there will be no material impact on its operating results or financial condition upon the adoption of FIN 46.

Guarantees and Product Warranties

Financial Accounting Standards Board Interpretation No. 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others” (“FIN 45”), requires that upon issuance of a guarantee, the guarantor must

disclose and recognize a liability for the fair value of the obligation it assumes under that guarantee. The initial recognition and

measurement requirement of FIN 45 was effective for guarantees issued or modified after December 31, 2002. As of July 26, 2003,

the Company’s guarantees that were issued or modified after December 31, 2002 were not material.

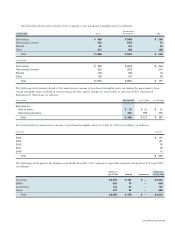

The disclosure requirements of FIN 45 are effective for interim and annual periods ending after December 15, 2002, and are

applicable to the Company’s product warranty liability and certain guarantees issued before December 31, 2002. The Company’s

guarantees issued before December 31, 2002, which would have been disclosed in accordance with the disclosure requirements of

FIN 45, were not material. As of July 26, 2003 and July 27, 2002, the Company’s product warranty liability recorded in other accrued

liabilities was $246 million and $242 million, respectively.

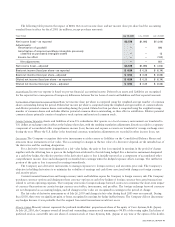

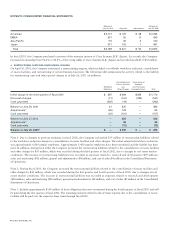

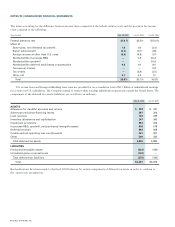

The following table summarizes the activity related to the product warranty liability during fiscal 2003 and 2002 (in millions):

July 26, 2003 July 27, 2002

Balance at beginning of fiscal year $242 $190

Provision for warranties issued 342 443

Payments (338) (391)

Balance at end of fiscal year $246 $242

The Company accrues for warranty costs as part of its cost of sales based on associated material product costs and technical support

labor costs. The products sold are generally covered by a warranty for periods of 90 days, one year, or five years, and for some products,

the Company provides a limited lifetime warranty.

In the normal course of business to facilitate sales of its products, the Company indemnifies other parties, including customers,

lessors, and parties to other transactions with the Company, with respect to certain matters. The Company has agreed to hold the

other party harmless against losses arising from a breach of representations or covenants, or out of intellectual property infringement

or other claims made against certain parties. These agreements may limit the time within which an indemnification claim can be

made and the amount of the claim. In addition, the Company has entered into indemnification agreements with its officers and

directors, and the Company’s bylaws contain similar indemnification obligations to the Company’s agents.

It is not possible to determine the maximum potential amount under these indemnification agreements due to the limited history

of prior indemnification claims and the unique facts and circumstances involved in each particular agreement. Historically, payments

made by the Company under these agreements have not had a material impact on the Company’s operating results or financial position.

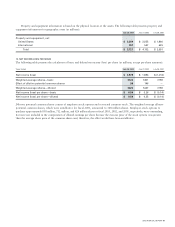

Derivative Instruments

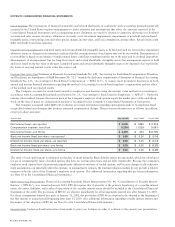

The Company conducts business on a global basis in several currencies. As such, it is exposed to adverse movements in foreign currency

exchange rates. The Company enters into foreign exchange forward contracts to minimize the short-term impact of foreign currency

fluctuations on certain foreign currency receivables, investments, and payables. The gains and losses on the foreign exchange forward

contracts offset the transaction gains and losses on certain foreign currency receivables, investments, and payables recognized in earnings.

The Company does not enter into foreign exchange forward contracts for trading purposes. Gains and losses on the contracts

are included in other income (loss), net, in the Consolidated Statements of Operations and offset foreign exchange gains or losses

from the revaluation of intercompany balances or other current assets, investments, and liabilities denominated in currencies other than

the functional currency of the reporting entity. The Company’s foreign exchange forward contracts related to current assets and liabilities

generally range from one to three months in original maturity. Additionally, the Company has entered into foreign exchange forward

contracts related to long-term customer financings with maturities of up to two years. The foreign exchange contracts related to investments

generally have maturities of less than one year.

2003 ANNUAL REPORT 51