Cisco 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

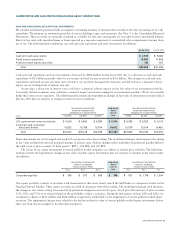

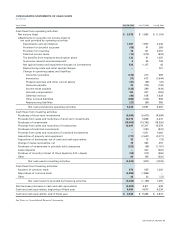

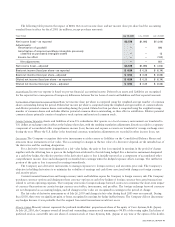

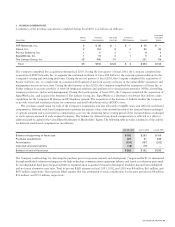

Common Stock Accumulated

and Other Total

Shares of Additional Retained Comprehensive Shareholders’

Common Stock Paid-In Capital Earnings Income (Loss) Equity

BALANCE AT JULY 29, 2000 7, 138$14,609 $ 8,358 $ 3,530 $ 26,497

Net loss — — (1,014) — (1,014)

Change in unrealized gains and losses on investments, net of tax — — — (3,812) (3,812)

Other — — — 7 7

Comprehensive loss (4,819)

Issuance of common stock 140 1,262 — — 1,262

Tax benefits from employee stock option plans — 1,755 — — 1,755

Purchase acquisitions 46 2,163 — — 2,163

Amortization of deferred stock-based compensation — 262 — — 262

BALANCE AT JULY 28, 2001 7,324 $20,051 $ 7,344 $ (275) $ 27,120

Net income — — 1,893 — 1,893

Change in unrealized gains and losses on investments, net of tax — — — 224 224

Other — — — 24 24

Comprehensive income 2,141

Issuance of common stock 76 655 — — 655

Repurchase of common stock (124) (350) (1,504) — (1,854)

Tax benefits from employee stock option plans — 61 — — 61

Purchase acquisitions 27 346 — — 346

Amortization of deferred stock-based compensation — 187 — — 187

BALANCE AT JULY 27, 2002 7,303 $20,950 $ 7,733 $ (27) $ 28,656

Net income ——3,578 — 3,578

Change in unrealized gains and losses on investments, net of tax ———352 352

Other ———2929

Comprehensive income 3,959

Issuance of common stock 68 578 — — 578

Repurchase of common stock (424) (1,232) (4,752) — (5,984)

Tax benefits from employee stock option plans —132 — — 132

Purchase acquisitions 51 557 — — 557

Amortization of deferred stock-based compensation —131 — — 131

BALANCE AT JULY 26, 2003 6,998 $21,116 $ 6,559 $ 354 $ 28,029

See Notes to Consolidated Financial Statements.

38 CISCO SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In millions)