Cisco 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

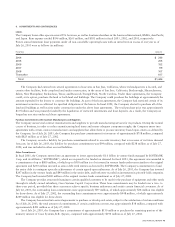

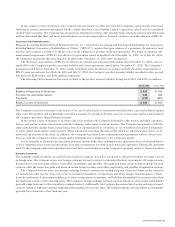

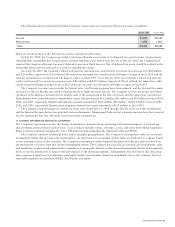

The Company also has certain other funding commitments related to its privately held investments that are based on the

achievement of certain agreed-upon milestones. The funding commitments were approximately $95 million as of July 26, 2003,

compared with approximately $152 million as of July 27, 2002.

Variable Interest Entities

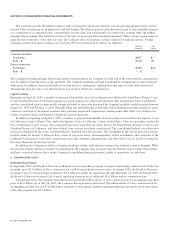

In April 2001, the Company entered into a commitment to provide convertible debt funding of approximately $84 million to Andiamo

Systems Inc. (“Andiamo”), a storage switch developer. This debt will be convertible into approximately 44% of the equity in

Andiamo, subject to certain terms and conditions. In connection with this investment, the Company obtained a call option that

provided the Company the right to purchase Andiamo. The purchase price under the call option is based on a valuation of

Andiamo using a negotiated formula as discussed below. The Company also entered into a commitment to provide non-convertible

debt funding to Andiamo of approximately $100 million through the close of the acquisition, subject to period funding.

On August 19, 2002, the Company entered into a definitive agreement to acquire privately held Andiamo, which represents the

exercise of its rights under the call option. The acquisition of Andiamo is expected to close in the third quarter of fiscal 2004, but no

later than July 31, 2004. Under the terms of the agreement, common stock and options of the Company will be exchanged for all

outstanding shares and options of Andiamo not owned by the Company at the closing of the acquisition. The amount of the purchase

price for the remaining equity interests in Andiamo not then held by the Company is not determinable at this time, but will be based

primarily upon a formula-based valuation of Andiamo to be determined by applying a multiple to the actual, annualized revenue

generated from sales by the Company of products attributable to Andiamo during a three-month period shortly preceding the closing.

Under its agreements with Andiamo, the Company is the exclusive manufacturer and distributor of all Andiamo products. The multiple

will be equal to the Company’s average market capitalization during a specified period divided by the Company’s annualized revenue

for a three-month period prior to closing, subject to adjustment as follows: (i) if the multiple so calculated is less than 10, then the

multiple to be used for purposes of determining the transaction price shall be the midpoint between 10 and the multiple so calculated;

(ii) if the multiple so calculated is greater than 15, then the multiple to be used for purposes of determining the transaction price shall

be the midpoint between 15 and the multiple so calculated. There is no minimum purchase price, and the maximum purchase price is

limited to approximately $2.5 billion in shares of the Company’s common stock valued at the time of closing. The acquisition has

received the required approvals of the Board of Directors from both companies and is subject to various closing conditions and

approvals, including stockholder approval by Andiamo. As of July 26, 2003, the Company has invested $84 million in the convertible

debt and $76 million in the non-convertible debt. Substantially all of the investment in Andiamo has been expensed as research and

development costs, as if such expenses constituted the development costs of the Company.

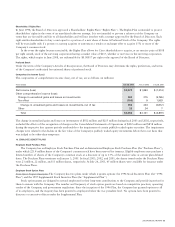

The Company has evaluated its debt investment in Andiamo and has determined that Andiamo is a variable interest entity under

FIN 46. The Company has concluded that it is the primary beneficiary as defined by FIN 46 and, as a result, the Company is required

to consolidate Andiamo beginning the first day of the first quarter of fiscal 2004.

FIN 46 will require the Company to account for Andiamo as if it had consolidated it since the Company’s initial investment in

April 2001. If the Company consolidated Andiamo from the date of its initial investment, the Company would be required to account

for the call option as a repurchase right. Under Financial Accounting Standards Board Interpretation No. 44, “Accounting for

Certain Transactions Involving Stock Compensation,” and related interpretations, variable accounting is required for substantially

all Andiamo employee stock and options because the ending purchase price is primarily derived from a revenue-based formula.

Therefore, beginning in the first quarter of fiscal 2004, the Company will revalue the stock and options of Andiamo each quarter

based on an independent valuation of Andiamo until the completion of the acquisition, which is expected in the third quarter of fiscal

2004, but no later than July 31, 2004.

Effective July 27, 2003, the first day of fiscal 2004, the Company will record a non-cash cumulative charge of approximately $400

million (representing the amount of variable compensation from April 2001 through July 2003). This will be reported as a separate line

item in the Consolidated Statements of Operations as a cumulative effect of a change in accounting principle, net of tax. The charge is

based on the value of the Andiamo employee stock and options and their expected vesting upon FIN 46 adoption pursuant to the

independent evaluation, and does not necessarily reflect the value of Andiamo as a whole nor indicate the expected valuation of

Andiamo upon acquisition. Subsequent to the adoption of FIN 46, changes to the value of Andiamo and the continued vesting of the

employee stock and options will result in adjustments to the non-cash stock compensation charge and will be reflected as operating

expenses. These adjustments will be recorded commencing in the first quarter of fiscal 2004 and will continue until such time as the

acquisition of Andiamo is completed, which is expected to close in the third quarter of fiscal 2004, but no later than July 31, 2004.

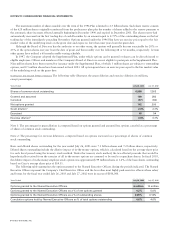

The value of Andiamo computed under the negotiated formula is largely based on revenues derived from specific storage switch

products.

Excluding the non-cash stock compensation cumulative charge and any future non-cash variable stock compensation adjustments,

the impact of consolidating Andiamo will not materially affect the Company’s operating results or financial condition.

50 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS