Cisco 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

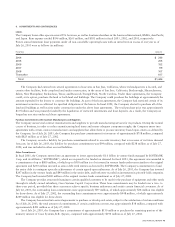

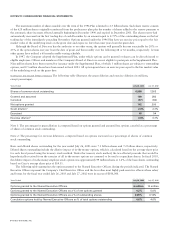

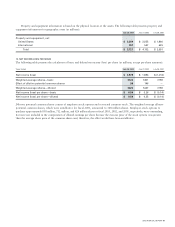

The items accounting for the difference between income taxes computed at the federal statutory rate and the provision for income

taxes consisted of the following:

Years Ended July 26, 2003 July 27, 2002 July 28, 2001

Federal statutory rate 35.0 % 35.0% (35.0)%

Effect of:

State taxes, net of federal tax benefit 1.8 1.8 (2.4)

Export sales benefit (0.2) (1.5) (1.8)

Foreign income at other than U.S. rates (8.9) (4.9) (1.7)

Nondeductible in-process R&D — 0.9 30.3

Nondeductible goodwill —— 20.9

Nondeductible deferred stock-based compensation 0.8 1.9 8.0

Tax-exempt interest —— (1.0)

Tax credits —(3.4) (2.5)

Other, net 0.1 0.3 1.2

Total 28.6% 30.1% 16.0%

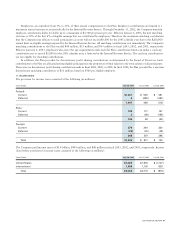

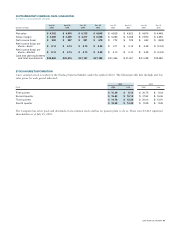

U.S. income taxes and foreign withholding taxes were not provided for on a cumulative total of $2.5 billion of undistributed earnings

for certain non-U.S. subsidiaries. The Company intends to reinvest these earnings indefinitely in operations outside the United States. The

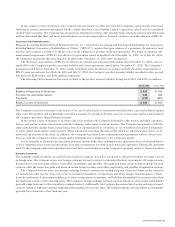

components of the deferred tax assets (liabilities) are as follows (in millions):

July 26, 2003 July 27, 2002

ASSETS

Allowance for doubtful accounts and returns $228 $247

Sales-type and direct-financing leases 297 306

Loan reserves 123 249

Inventory allowances and capitalization 247 340

Investment provisions 654 476

In-process R&D, goodwill, and purchased intangible assets 608 578

Deferred revenue 899 968

Credits and net operating loss carryforwards 261 391

Other 509 330

Total deferred tax assets 3,826 3,885

LIABILITIES

Purchased intangible assets (233) (192)

Unrealized gains on investments (142) —

Total deferred tax liabilities (375) (192)

Total $3,451 $3,693

Reclassifications have been made to the fiscal 2002 balances for certain components of deferred tax assets in order to conform to

the current year presentation.

58 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS