Cisco 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

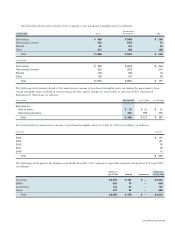

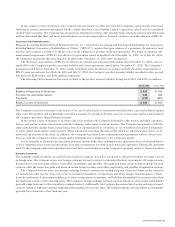

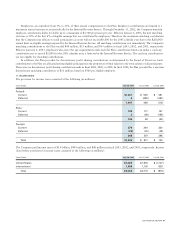

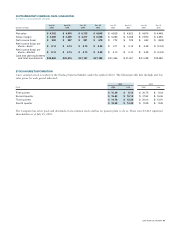

General Option Information A summary of option activity follows (in millions, except per-share amounts). The Company has, in connection

with the acquisitions of various companies, assumed the stock option plans of each acquired company. During fiscal 2003, a total of

approximately 4 million shares of the Company’s common stock has been reserved for issuance under the assumed plans and the

related options are included in the following table.

OPTIONS OUTSTANDING

Options Weighted-Average

Available Number Exercise Price

for Grant Outstanding per Share

BALANCE AT JULY 29, 2000 393 971 $ 24.19

Granted and assumed (320) 320 39.93

Exercised — (133) 7.43

Canceled 98 (98) 41.82

Additional shares reserved 351 — —

BALANCE AT JULY 28, 2001 522 1,060 29.41

Granted and assumed (282) 282 17.72

Exercised — (54) 6.99

Canceled 82 (82) 36.94

Additional shares reserved 342 — —

BALANCE AT JULY 27, 2002 664 1,206 27.17

Granted and assumed (199) 199 12.01

Exercised — (45) 7.14

Canceled 57 (57) 33.03

Additional shares reserved 4 — —

BALANCE AT JULY 26, 2003 526 1,303 $ 25.29

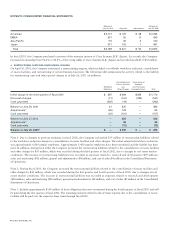

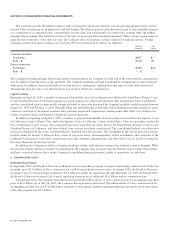

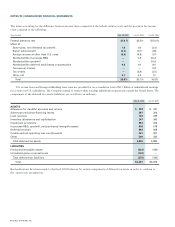

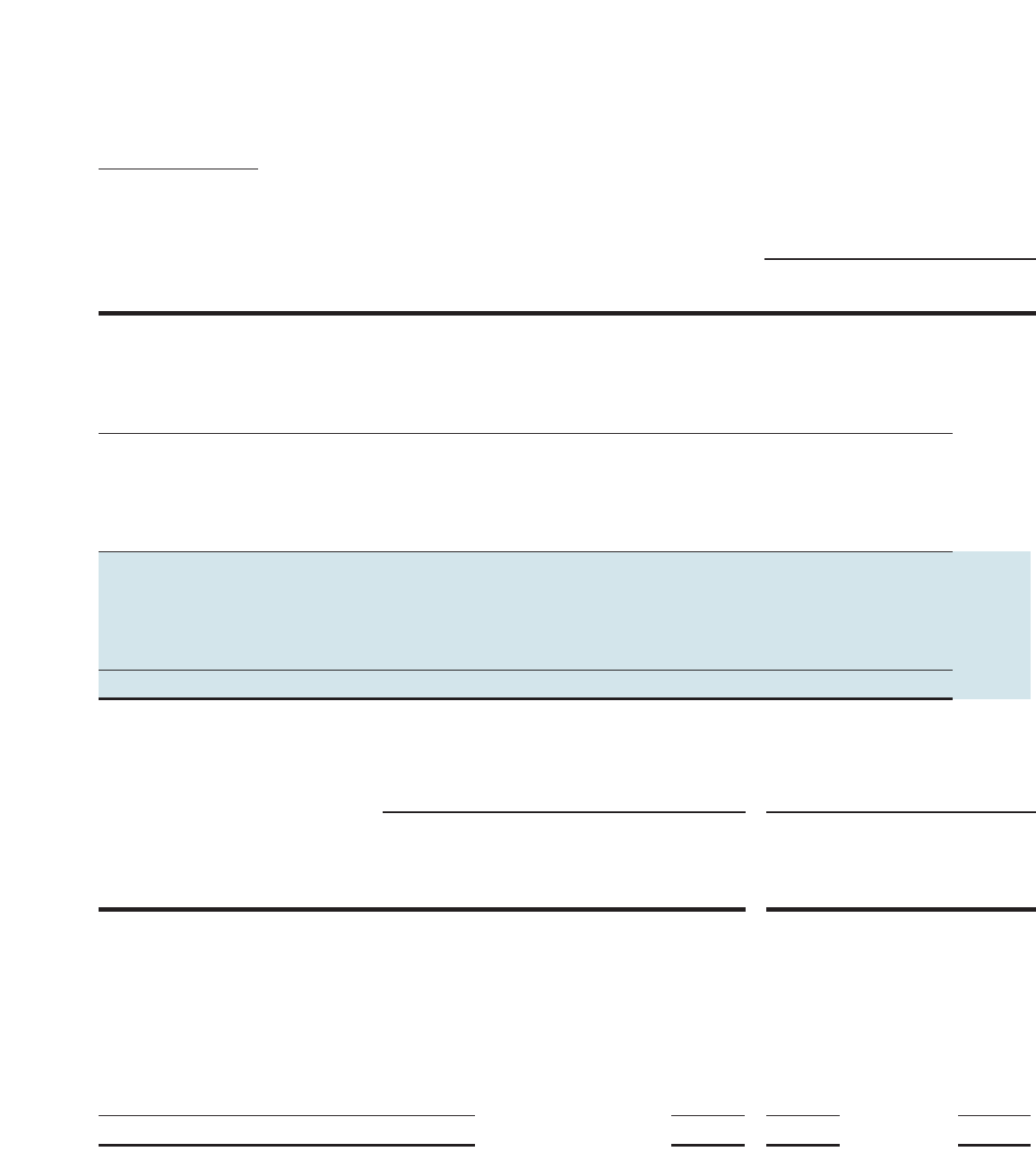

The following table summarizes significant ranges of outstanding and exercisable options as of July 26, 2003 (in millions, except

number of years and per-share amounts):

OPTIONS OUTSTANDING OPTIONS EXERCISABLE

Weighted-

Average Weighted- Weighted-

Remaining Average Average

Contractual Exercise Aggregate Exercise Aggregate

Range of Number Life Price Intrinsic Number Price Intrinsic

Exercise Prices Outstanding (In Years) per Share Value Exercisable per Share Value

$0.01 – 6.69 146 2.52 $ 4.62 $ 2,111 141 $ 4.81 $ 2,012

6.70 – 11.78 139 5.94 9.50 1,332 63 9.39 610

11.79 – 13.04 149 6.35 12.61 964 71 12.34 479

13.05 – 16.15 202 7.22 15.61 701 66 15.79 217

16.16 – 20.53 184 7.11 19.18 89 67 19.04 36

20.54 – 35.91 142 4.93 27.75 — 128 27.76 —

35.92 – 50.38 135 6.25 49.12 — 75 48.86 —

50.39 – 54.53 140 5.49 54.37 — 95 54.37 —

54.54 – 72.56 66 5.90 63.92 — 42 64.15 —

Total 1,303 5.84 $ 25.29 $5,197 748 $26.12 $3,354

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value based on Cisco’s closing stock price of

$19.08 as of July 25, 2003, that would have been received by the option holders had all option holders exercised their options as of

that date. The total number of in-the-money options exercisable as of July 26, 2003 was 382 million options. As of July 27, 2002,

634 million outstanding options were exercisable and the weighted average exercise price was $23.51.

2003 ANNUAL REPORT 55