Cisco 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

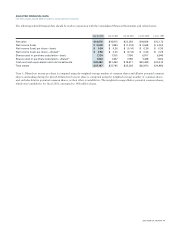

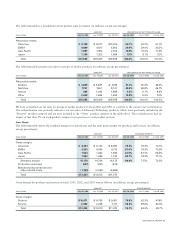

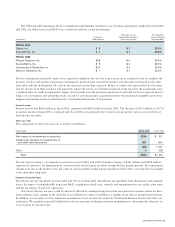

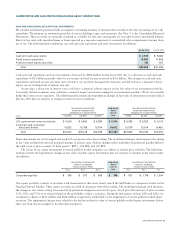

The following table summarizes the key assumptions underlying the valuation for our purchase acquisitions completed in fiscal 2003

and 2002, for which in-process R&D was recorded (in millions, except percentages):

Estimated Cost to Risk-Adjusted

In-Process Complete Technology at Discount Rate for

Acquisition R&D Expense Time of Acquisition In-Process R&D

FISCAL 2003

Okena, Inc. $3 $1 22.0%

SignalWorks, Inc. $1 $1 24.0%

FISCAL 2002

Allegro Systems, Inc. $28 $ 5 52.5%

AuroraNetics, Inc. $ 9 $ 2 35.0%

Hammerhead Networks, Inc. $27 $ 2 23.0%

Navarro Networks, Inc. $ 1 $ 1 23.0%

The key assumptions primarily consist of an expected completion date for the in-process projects; estimated costs to complete the

projects; revenue and expense projections, assuming the products have entered the market; and discount rates based on the risks

associated with the development life cycle of the in-process technology acquired. Failure to achieve the expected levels of revenue

and net income from these products will negatively impact the return on investment expected at the time that the acquisitions were

completed and may result in impairment charges. Actual results from the purchase acquisitions to date did not have a material adverse

impact on our business and operating results, except for certain purchase acquisitions where the purchased intangible assets were

impaired and written down as reflected in the Consolidated Statements of Operations.

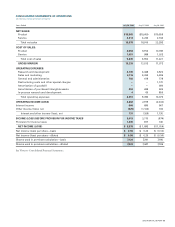

Interest Income

Interest income was $660 million in fiscal 2003, compared with $895 million in fiscal 2002. The decrease of $235 million or 26.3%

in interest income in fiscal 2003, compared with fiscal 2002, was primarily due to lower average interest rates on our portfolio of

fixed income securities.

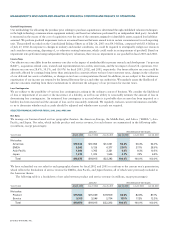

Other Loss, Net

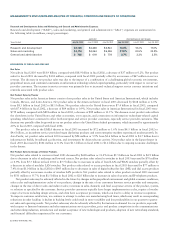

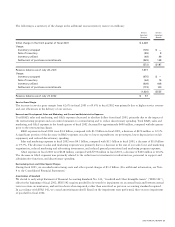

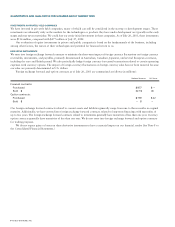

The components of other loss, net, are as follows (in millions):

Years Ended July 26, 2003 July 27, 2002

Net losses on investments in securities $239 $707

Impairment charges on investments in

privately held companies 281 420

520 1,127

Other 9(23)

Total $529 $1,104

The net losses relating to investments in securities in fiscal 2003 and 2002 included a charge of $412 million and $858 million,

respectively, related to the impairment of certain publicly traded equity securities during the first quarter periods. The impairment

charges were due to the decline in the fair value of certain publicly traded equity investments below their cost basis that was judged

to be other-than-temporary.

Provision for Income Taxes

The effective tax rate was 28.6% for fiscal 2003 and 30.1% for fiscal 2002. The effective tax rate differs from the statutory rate primarily

due to the impact of nondeductible in-process R&D, acquisition-related costs, research and experimentation tax credits, state taxes,

and the tax impact of non-U.S. operations.

Our future effective tax rates could be adversely affected by earnings being lower than anticipated in countries where we have

lower statutory rates, changes in the valuation of our deferred tax assets or liabilities, or changes in tax laws or interpretations thereof.

In addition, we are subject to the continuous examination of our income tax returns by the Internal Revenue Service and other tax

authorities. We regularly assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of

our provision for income taxes.

2003 ANNUAL REPORT 25