Cisco 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

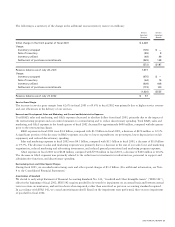

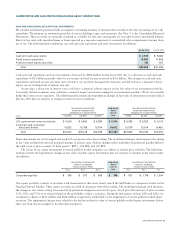

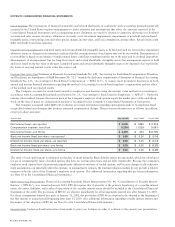

Stock Repurchase Program

In September 2001, the Board of Directors authorized a stock repurchase program to acquire outstanding common stock. Under the

program, up to $3.0 billion of our common stock could be repurchased over two years. In August 2002, the Board of Directors

increased our stock repurchase program by $5.0 billion available for repurchase through September 12, 2003. In March 2003, the

Board of Directors increased our stock repurchase program by an additional $5.0 billion with no termination date.

During fiscal 2003, we repurchased and retired 424 million shares of our common stock for an aggregate purchase price of

$6.0 billion. As of July 26, 2003, we have repurchased and retired 548 million shares of our common stock for an aggregate purchase

price of $7.8 billion since inception of the program, and the remaining authorized amount for stock repurchases under this program

was $5.2 billion.

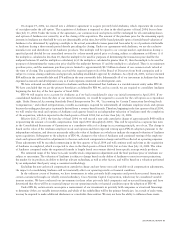

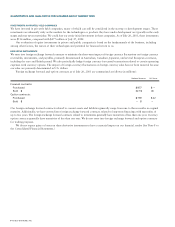

Liquidity and Capital Resource Requirements

Based on past performance and current expectations, we believe that our cash and cash equivalents, short-term investments, and cash

generated from operations will satisfy our working capital needs, capital expenditures, investment requirements, stock repurchases,

commitments (see Note 8 to the Consolidated Financial Statements), future customer financings, and other liquidity requirements

associated with our existing operations through at least the next 12 months. We believe that the most strategic uses of our cash resources

include repurchase of shares, strategic investments to gain access to new technologies, acquisitions, financing activities, and working

capital. There are no transactions, arrangements, and other relationships with unconsolidated entities or other persons that are

reasonably likely to materially affect liquidity or the availability of our requirements for capital resources.

32 CISCO SYSTEMS, INC.

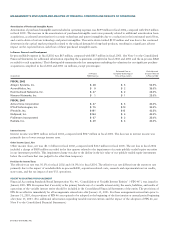

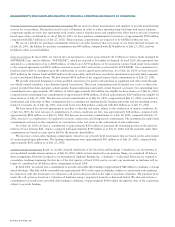

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS