Cisco 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

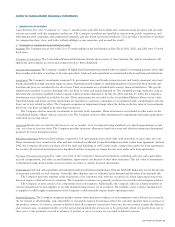

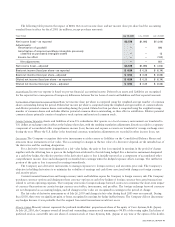

On August 19, 2002, we entered into a definitive agreement to acquire privately held Andiamo, which represents the exercise

of our rights under the call option. The acquisition of Andiamo is expected to close in the third quarter of fiscal 2004, but no later

than July 31, 2004. Under the terms of the agreement, our common stock and options will be exchanged for all outstanding shares

and options of Andiamo not owned by us at the closing of the acquisition. The amount of the purchase price for the remaining equity

interests in Andiamo not then held by us is not determinable at this time, but will be based primarily upon a formula-based valuation of

Andiamo to be determined by applying a multiple to the actual, annualized revenue generated from sales by us of products attributable

to Andiamo during a three-month period shortly preceding the closing. Under our agreements with Andiamo, we are the exclusive

manufacturer and distributor of all Andiamo products. The multiple will be equal to our average market capitalization during a

specified period divided by our annualized revenue for a three-month period prior to closing, subject to adjustment as follows: (i) if

the multiple so calculated is less than 10, then the multiple to be used for purposes of determining the transaction price shall be the

midpoint between 10 and the multiple so calculated; (ii) if the multiple so calculated is greater than 15, then the multiple to be used for

purposes of determining the transaction price shall be the midpoint between 15 and the multiple so calculated. There is no minimum

purchase price, and the maximum purchase price is limited to approximately $2.5 billion in shares of our common stock valued at

the time of closing. The acquisition has received the required approvals of the Board of Directors from both companies and is

subject to various closing conditions and approvals, including stockholder approval by Andiamo. As of July 26, 2003, we have invested

$84 million in the convertible debt and $76 million in the non-convertible debt. Substantially all of our investment in Andiamo has been

expensed as research and development costs, as if such expenses constituted our development costs.

We have evaluated our debt investment in Andiamo and have determined that Andiamo is a variable interest entity under FIN 46.

We have concluded that we are the primary beneficiary as defined by FIN 46, and as a result, we are required to consolidate Andiamo

beginning the first day of the first quarter of fiscal 2004.

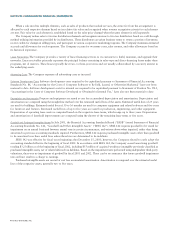

FIN 46 will require us to account for Andiamo as if we had consolidated it since our initial investment in April 2001. If we

consolidated Andiamo from the date of our initial investment, we would be required to account for the call option as a repurchase

right. Under Financial Accounting Standards Board Interpretation No. 44, “Accounting for Certain Transactions Involving Stock

Compensation,” and related interpretations, variable accounting is required for substantially all Andiamo employee stock and options

because the ending purchase price is primarily derived from a revenue-based formula. Therefore, beginning in the first quarter of fiscal 2004,

we will revalue the stock and options of Andiamo each quarter based on an independent valuation of Andiamo until the completion

of the acquisition, which is expected in the third quarter of fiscal 2004, but no later than July 31, 2004.

Effective July 27, 2003, the first day of fiscal 2004, we will record a non-cash cumulative charge of approximately $400 million

(representing the amount of variable compensation from April 2001 through July 2003). This will be reported as a separate line item

in the Consolidated Statements of Operations as a cumulative effect of a change in accounting principle, net of tax. The charge is

based on the value of the Andiamo employee stock and options and their expected vesting upon FIN 46 adoption pursuant to the

independent evaluation, and does not necessarily reflect the value of Andiamo as a whole nor indicate the expected valuation of Andiamo

upon acquisition. Subsequent to the adoption of FIN 46, changes to the value of Andiamo and continued vesting of the employee

stock and options will result in adjustments to the non-cash stock compensation charge and will be reflected as operating expenses.

These adjustments will be recorded commencing in the first quarter of fiscal 2004 and will continue until such time as the acquisition

of Andiamo is completed, which is expected to close in the third quarter of fiscal 2004, but no later than July 31, 2004. The value

of Andiamo computed under the negotiated formula is largely based on revenues derived from specific storage switch products.

The estimated range of the future non-cash variable stock compensation adjustments and the final purchase price of Andiamo are

subject to uncertainty. The valuation of Andiamo is subject to change based on the ability of Andiamo to meet its revenue projections,

the market for its products, its ability to develop relevant technology, as well as other factors, and will be based on a valuation performed

by an independent third party using a consistent methodology.

Excluding the non-cash stock compensation cumulative charge and any future non-cash variable stock compensation adjustments,

the impact of consolidating Andiamo will not materially affect our operating results or financial condition.

In the ordinary course of business, we have investments in other privately held companies and provide structured financing to

certain customers through our wholly owned subsidiary, Cisco Systems Capital Corporation, which may be considered variable

interest entities. We have evaluated our investments in these other privately held companies and structured financings and have

determined that there will be no material impact on our operating results or financial condition upon the adoption of FIN 46.

Under FIN 46, certain events can require a reassessment of our investments in privately held companies or structured financings

to determine if they are variable interest entities and which of the stakeholders will be the primary beneficiary. As a result of such events,

we may be required to make additional disclosures or consolidate these entities. We may not have the ability to influence these events.

2003 ANNUAL REPORT 31