Cisco 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

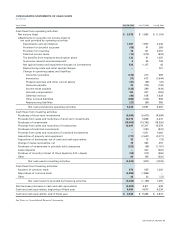

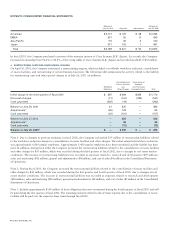

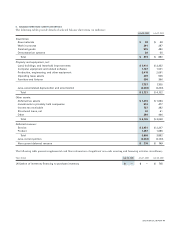

5. BALANCE SHEET AND CASH FLOW DETAILS

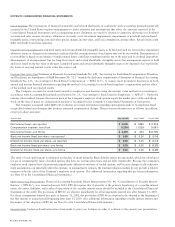

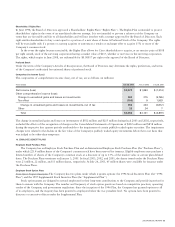

The following tables provide details of selected balance sheet items (in millions):

July 26, 2003 July 27, 2002

Inventories:

Raw materials $38 $38

Work in process 291 297

Finished goods 515 490

Demonstration systems 29 55

Total $873 $880

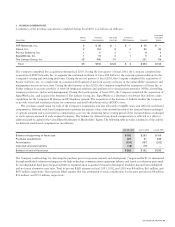

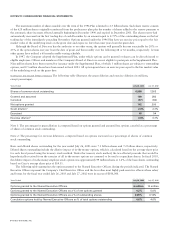

Property and equipment, net:

Land, buildings, and leasehold improvements $3,411 $3,352

Computer equipment and related software 1,147 1,021

Production, engineering, and other equipment 2,410 2,061

Operating lease assets 439 505

Furniture and fixtures 350 366

7,757 7, 305

Less, accumulated depreciation and amortization (4,036) (3,203)

Total $3,721 $4,102

Other assets:

Deferred tax assets $1,476 $1,663

Investments in privately held companies 516 477

Income tax receivable 727 392

Structured loans, net 42 61

Other 384 466

Total $3,145 $3,059

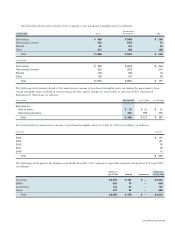

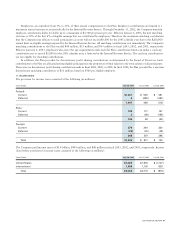

Deferred revenue:

Service $2,451 $2,207

Product 1,357 1,685

Total 3,808 3,892

Less, current portion (3,034) (3,143)

Non-current deferred revenue $774 $749

The following table presents supplemental cash flow information of significant non-cash investing and financing activities (in millions):

Years Ended July 26, 2003 July 27, 2002 July 28, 2001

Utilization of inventory financing to purchase inventory $— $— $765

2003 ANNUAL REPORT 47