Cisco 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

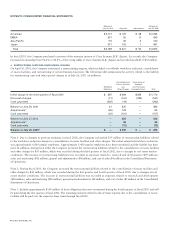

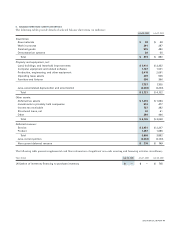

8. COMMITMENTS AND CONTINGENCIES

Leases

The Company leases office space in several U.S. locations, as well as locations elsewhere in the Americas International, EMEA, Asia Pacific,

and Japan. Rent expense totaled $196 million, $265 million, and $381 million in fiscal 2003, 2002, and 2001, respectively.

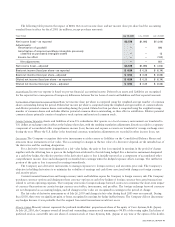

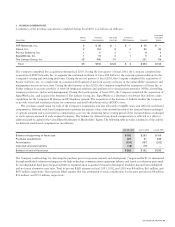

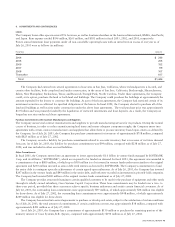

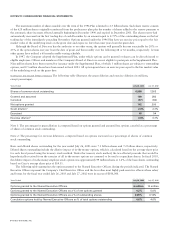

Future annual minimum lease payments under all non-cancelable operating leases with an initial term in excess of one year as of

July 26, 2003 were as follows (in millions):

Fiscal Year Amount

2004 $246

2005 205

2006 152

2007 119

2008 107

Thereafter 617

Total $1,446

The Company had entered into several agreements to lease sites in San Jose, California, where its headquarters is located, and

certain other facilities, both completed and under construction, in the areas of San Jose, California; Boxborough, Massachusetts;

Salem, New Hampshire; Richardson, Texas; and Research Triangle Park, North Carolina. Under these agreements, the Company

could, at its option, purchase the land or both land and buildings. The Company could purchase the buildings at approximately the

amount expended by the lessors to construct the buildings. As part of the lease agreements, the Company had restricted certain of its

investment securities as collateral for specified obligations of the lessors. In fiscal 2002, the Company elected to purchase all of the

land and buildings as well as sites under construction under the above lease agreements. The total purchase price was approximately

$1.9 billion and was primarily funded by the liquidation of restricted investments and lease deposits. As a result, the Company no

longer has any sites under such lease agreements.

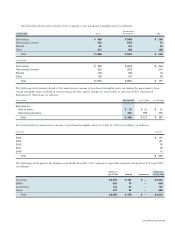

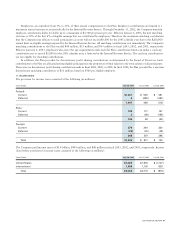

Purchase Commitments with Contract Manufacturers and Suppliers

The Company uses several contract manufacturers and suppliers to provide manufacturing services for its products. During the normal

course of business, in order to reduce manufacturing lead times and ensure adequate component supply, the Company enters into

agreements with certain contract manufacturers and suppliers that allow them to procure inventory based upon criteria as defined by

the Company. As of July 26, 2003, the Company has purchase commitments for inventory of approximately $718 million, compared

with $825 million as of July 27, 2002.

The Company records a liability for purchase commitments related to on-order inventory that is in excess of its future demand

forecasts. As of July 26, 2003, the liability for purchase commitments was $99 million, compared with $238 million as of July 27,

2002, and was included in other accrued liabilities.

Other Commitments

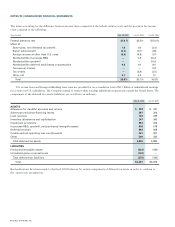

In fiscal 2001, the Company entered into an agreement to invest approximately $1.0 billion in venture funds managed by SOFTBANK

Corp. and its affiliates (“SOFTBANK”), which are required to be funded on demand. In fiscal 2003, this agreement was amended to

a commitment of up to $800 million, of which up to $550 million is to be invested in venture funds under terms similar to the original

agreement and $250 million invested as senior debt with entities as directed by SOFTBANK. The Company’s commitment to fund

the senior debt is contingent upon the achievement of certain agreed-upon milestones. As of July 26, 2003, the Company has invested

$247 million in the venture funds and $49 million in the senior debt, and both were recorded as investments in privately held companies.

The Company had invested $100 million of the original venture funds commitment as of July 27, 2002.

The Company provides structured financing to certain qualified customers to be used for the purchase of equipment and other needs

through its wholly owned subsidiary, Cisco Systems Capital Corporation. These loan commitments may be funded over a two- to

three-year period, provided that these customers achieve specific business milestones and satisfy certain financial covenants. As of

July 26, 2003, the outstanding loan commitments were approximately $97 million, of which approximately $38 million was eligible

for draw-down. As of July 27, 2002, the outstanding loan commitments were approximately $948 million, of which approximately

$209 million was eligible for draw-down.

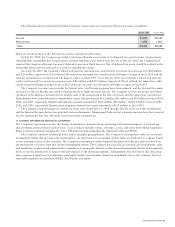

The Company has entered into several agreements to purchase or develop real estate, subject to the satisfaction of certain conditions.

As of July 26, 2003, the total amount of commitments, if certain conditions are met, was approximately $38 million, compared with

approximately $491 million as of July 27, 2002.

As of July 26, 2003, the Company has a commitment of approximately $130 million to purchase the remaining portion of the

minority interest of Cisco Systems, K.K. (Japan), compared with approximately $190 million as of July 27, 2002.

2003 ANNUAL REPORT 49