Cisco 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

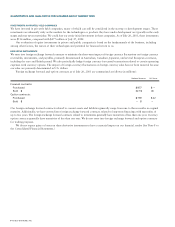

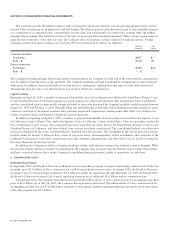

Use of Estimates The preparation of financial statements and related disclosures in conformity with accounting principles generally

accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the

Consolidated Financial Statements and accompanying notes. Estimates are used for revenue recognition, allowance for doubtful

accounts and sales returns, inventory allowances, warranty costs, investment impairments, impairments of goodwill and purchased

intangible assets, restructuring costs and other special charges, income taxes, and loss contingencies, among others. Actual results could

differ materially from these estimates.

Impairment of Long-Lived Assets Long-lived assets and certain identifiable intangible assets to be held and used are reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Determination of

recoverability is based on an estimate of undiscounted future cash flows resulting from the use of the asset and its eventual disposition.

Measurement of an impairment loss for long-lived assets and certain identifiable intangible assets that management expects to hold

and use is based on the fair value of the asset. Long-lived assets and certain identifiable intangible assets to be disposed of are reported at

the lower of carrying amount or fair value less costs to sell.

Employee Stock Option Plans Statement of Financial Accounting Standards No. 148, “Accounting for Stock-Based Compensation-Transition

and Disclosure, an Amendment of FASB Statement No. 123,” amends the disclosure requirements of Statement of Financial Accounting

Standards No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”), to require more prominent disclosures in both

annual and interim financial statements regarding the method of accounting for stock-based employee compensation and the effect

of the method used on reported results.

The Company accounts for stock-based awards to employees and directors using the intrinsic value method of accounting in

accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”). Under the

intrinsic value method, because the exercise price of the Company’s employee stock options equals the market price of the underlying

stock on the date of grant, no compensation expense is recognized in the Company’s Consolidated Statements of Operations.

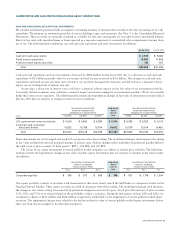

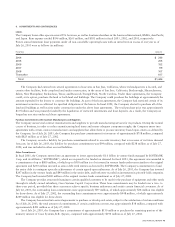

The Company is required under SFAS 123 to disclose pro forma information regarding option grants made to its employees based

on specified valuation techniques that produce estimated compensation charges. The pro forma information is as follows (in millions,

except per-share amounts):

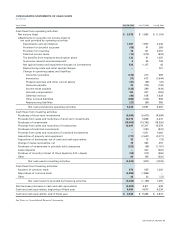

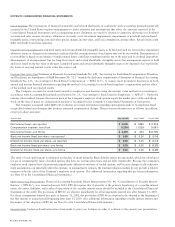

Years Ended July 26, 2003 July 27, 2002 July 28, 2001

Net income (loss)—as reported $3,578 $1,893 $ (1,014)

Compensation expense, net of tax (1,259) (1,520) (1,691)

Net income (loss)—pro forma $2,319 $373 $ (2,705)

Basic net income (loss) per share—as reported $0.50 $0.26 $ (0.14)

Diluted net income (loss) per share—as reported $0.50 $0.25 $ (0.14)

Basic net income (loss) per share—pro forma $0.33 $0.05 $ (0.38)

Diluted net income (loss) per share—pro forma $0.32 $0.05 $ (0.38)

The value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model, which was developed

for use in estimating the value of traded options that have no vesting restrictions and are fully transferable. Because the Company’s

employee stock options have characteristics significantly different from those of traded options, and because changes in the subjective

input assumptions can materially affect the estimate, in management’s opinion, the existing valuation models do not provide a reliable

measure of the fair value of the Company’s employee stock options. (For additional information regarding this pro forma information,

see Note 10 to the Consolidated Financial Statements.)

Recent Accounting Pronouncement Financial Accounting Standards Board Interpretation No. 46, “Consolidation of Variable Interest

Entities” (“FIN 46”), was issued in January 2003. FIN 46 requires that if an entity is the primary beneficiary of a variable interest

entity, the assets, liabilities, and results of operations of the variable interest entity should be included in the Consolidated Financial

Statements of the entity. The provisions of FIN 46 are effective immediately for all arrangements entered into after January 31, 2003.

For those arrangements entered into prior to January 31, 2003, the provisions of FIN 46 are required to be adopted at the beginning of

the first interim or annual period beginning after June 15, 2003. (For additional information regarding variable interest entities and

the impact of the adoption of FIN 46, see Note 8 to the Consolidated Financial Statements.)

Reclassifications Certain reclassifications have been made to prior year balances in order to conform to the current year presentation.

42 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS